- Home

- Real Estate

- Real Estate - A Streak of Hope

Real Estate - A Streak of Hope

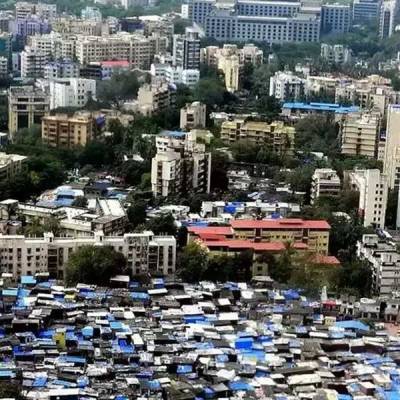

The dark clouds over real estate have begun to drift away to reveal a ray of light. For the past few years, real estate has been groaning under the burden of unsold stock, exorbitant prices and lack of financing. In a populous country like India, there is no dearth of housing demand; however, the quandary on the supply side has always plagued the market.

Better times

The current phase in real estate can be seen as a point of inflection where the slackness has made way for price correction, leading to a boost in sales and increased absorption. The prevailing price point and reduction in housing finance rates have also eased entry for fence-sitters. Also, softening of commodity prices has reduced input costs and motivated developers to abstain from resorting to high prices. Adding much-needed stimulus to the property market is the lucrative salary hike proposed by the Seventh Pay Scale Commission. The deep pockets of government employees may encourage them to enter property markets they had been shying away from. As a result of ever-expanding dimensions, the real estate sector is witnessing burgeoning rise in Tier-II and Tier-III cities. With improved quality of demographics and job opportunities, the performance of these cities holds great promise in times to come.

As for the commercial sector, it is now in the turnaround phase following a general uptick in business activity.

With a positive trend in absorption, this avenue can be considered as a promising asset class.

The challenges

Here are some of the inherent challenges the sector continues to face:

- Infrastructural roadblocks: One of the biggest challenges is lack of proper physical infrastructure. Creation of highways and external connectivity do not help residential realty in the immediate phase, but only logistics. It is a long-drawn process. Internal roads and layouts should be given more emphasis as they boost the residential sector.

- Lack of proper financing for developers: Developers still resort to sources with high cost of capital and seek compensation for the same by charging buyers a higher price. This kind of superficial price appreciation makes the market inefficient and speculative. This is a vicious cycle and needs to end to arrest unjustified real estate price rises.

- Lack of transparency: The absence of a proper regulator for pricing and practices in real estate has always been felt. If a market like real estate is left to fend for itself without proper accountability, it will be nothing more than a playground for developers and speculators.

Will policy changes help?

Though we expect certain actions from the government, we are not too hopeful of their impact. Some expected policy changes are:

- Regulatory Bill: We believe the Regulatory Bill will come into fruition by 2016. However, the delay with which it is happening cannot be ignored. The most important factor of any regulatory change is the right timing. The passing of this bill is overdue and it is likely that the government realises that establishing an effective regulatory mechanism is the need of the hour.

- Failure of FDI: Opening up FDI and relaxation of norms and the government´s aim to provide affordable housing for all do not go hand in hand. FDI in the past has proved to be counterproductive. It has only inflated prices and added inefficiencies in the market. At the end of the day, it is high cost capital that will motivate developers to quote higher prices from buyers. Rather than giving rise to speculative practices, the focus should be on the end-user´s interest. It is the government´s prerogative to provide housing for all and not the developer´s. After providing land bank to developers, the government cannot wash its own hands of the matter. Even if the interest rate comes down to 9 per cent, realty prices still have to undergo a correction of 27 per cent to be at the level of June 2009.

- Smart cities: Though the initiative is promising and praiseworthy, it is too futuristic and the immediate effects cannot be seen. What will augur well for real estate at present is a focus on introducing policy infrastructural changes in existing cities. Rather than smart cities, the focus should be on enhancing existing liveability.

- Cheap financing for developers: This should be provided with strict adherence to timelines. However, it should not be brokered by developers. Sitting on land banks and waiting for prices to increase will not solve the problem. Obtaining land at productive prices and passing on the benefits to the buyer is the key to bringing about efficient pricing.

In the past, many policy changes have been announced by the government. However, most of them have failed to bring about any substantial changes. There were talks of the Trans Harbour Link and Navi Mumbai International Airport on which realty players were banking. However, the extremely slow progress on these fronts validates the fact that these are more sweet talks than concrete steps.

Project watch

Looking ahead, we don´t really see the possibility of any major big-ticket projects in 2016 because the players in the luxury segment are now shifting their focus. There is already oversupply in the luxury segment and inventory overrun can be seen in the data. Developers in South Mumbai who used to offer three-to-four BHKs are now shifting to compact two-BHKs and comfortable one-BHKs. With the exception of Bengaluru and Pune, low sales velocity and marginal speculative appreciation characterise the luxury segment on a pan-India basis. Delay in construction, cash crunch, speculative prices, pressure from secondary market and overall subdued demand from housing can be identified as some of the factors at play for this.

About the Author:

Pankaj Kapoor, Founder and Managing Director, Liases Foras, is a well-known name in the real estate industry with over 15 years of experience, particularly in the field of valuation, risk assessment and forecast of the price behaviour.

Pankaj Kapoor examines the much needed stimulus to the Indian real estate market and the burgeoning rise in Tier-II and Tier-III cities. The dark clouds over real estate have begun to drift away to reveal a ray of light. For the past few years, real estate has been groaning under the burden of unsold stock, exorbitant prices and lack of financing. In a populous country like India, there is no dearth of housing demand; however, the quandary on the supply side has always plagued the market. Better times The current phase in real estate can be seen as a point of inflection where the slackness has made way for price correction, leading to a boost in sales and increased absorption. The prevailing price point and reduction in housing finance rates have also eased entry for fence-sitters. Also, softening of commodity prices has reduced input costs and motivated developers to abstain from resorting to high prices. Adding much-needed stimulus to the property market is the lucrative salary hike proposed by the Seventh Pay Scale Commission. The deep pockets of government employees may encourage them to enter property markets they had been shying away from. As a result of ever-expanding dimensions, the real estate sector is witnessing burgeoning rise in Tier-II and Tier-III cities. With improved quality of demographics and job opportunities, the performance of these cities holds great promise in times to come. As for the commercial sector, it is now in the turnaround phase following a general uptick in business activity. With a positive trend in absorption, this avenue can be considered as a promising asset class. The challenges Here are some of the inherent challenges the sector continues to face: Infrastructural roadblocks: One of the biggest challenges is lack of proper physical infrastructure. Creation of highways and external connectivity do not help residential realty in the immediate phase, but only logistics. It is a long-drawn process. Internal roads and layouts should be given more emphasis as they boost the residential sector. Lack of proper financing for developers: Developers still resort to sources with high cost of capital and seek compensation for the same by charging buyers a higher price. This kind of superficial price appreciation makes the market inefficient and speculative. This is a vicious cycle and needs to end to arrest unjustified real estate price rises. Lack of transparency: The absence of a proper regulator for pricing and practices in real estate has always been felt. If a market like real estate is left to fend for itself without proper accountability, it will be nothing more than a playground for developers and speculators. Will policy changes help? Though we expect certain actions from the government, we are not too hopeful of their impact. Some expected policy changes are: Regulatory Bill: We believe the Regulatory Bill will come into fruition by 2016. However, the delay with which it is happening cannot be ignored. The most important factor of any regulatory change is the right timing. The passing of this bill is overdue and it is likely that the government realises that establishing an effective regulatory mechanism is the need of the hour. Failure of FDI: Opening up FDI and relaxation of norms and the government´s aim to provide affordable housing for all do not go hand in hand. FDI in the past has proved to be counterproductive. It has only inflated prices and added inefficiencies in the market. At the end of the day, it is high cost capital that will motivate developers to quote higher prices from buyers. Rather than giving rise to speculative practices, the focus should be on the end-user´s interest. It is the government´s prerogative to provide housing for all and not the developer´s. After providing land bank to developers, the government cannot wash its own hands of the matter. Even if the interest rate comes down to 9 per cent, realty prices still have to undergo a correction of 27 per cent to be at the level of June 2009. Smart cities: Though the initiative is promising and praiseworthy, it is too futuristic and the immediate effects cannot be seen. What will augur well for real estate at present is a focus on introducing policy infrastructural changes in existing cities. Rather than smart cities, the focus should be on enhancing existing liveability. Cheap financing for developers: This should be provided with strict adherence to timelines. However, it should not be brokered by developers. Sitting on land banks and waiting for prices to increase will not solve the problem. Obtaining land at productive prices and passing on the benefits to the buyer is the key to bringing about efficient pricing. In the past, many policy changes have been announced by the government. However, most of them have failed to bring about any substantial changes. There were talks of the Trans Harbour Link and Navi Mumbai International Airport on which realty players were banking. However, the extremely slow progress on these fronts validates the fact that these are more sweet talks than concrete steps. Project watch Looking ahead, we don´t really see the possibility of any major big-ticket projects in 2016 because the players in the luxury segment are now shifting their focus. There is already oversupply in the luxury segment and inventory overrun can be seen in the data. Developers in South Mumbai who used to offer three-to-four BHKs are now shifting to compact two-BHKs and comfortable one-BHKs. With the exception of Bengaluru and Pune, low sales velocity and marginal speculative appreciation characterise the luxury segment on a pan-India basis. Delay in construction, cash crunch, speculative prices, pressure from secondary market and overall subdued demand from housing can be identified as some of the factors at play for this. About the Author: Pankaj Kapoor, Founder and Managing Director, Liases Foras, is a well-known name in the real estate industry with over 15 years of experience, particularly in the field of valuation, risk assessment and forecast of the price behaviour.