- Home

- Infrastructure Transport

- ROADS & HIGHWAYS

- We have tripled our total income compared to the previous year

We have tripled our total income compared to the previous year

Highlight one major challenge faced in FY2017-18 and how the company approached it.

For the Delhi-Meerut Expressway (Delhi section), we faced an ambitious challenge of completing the project in less than 500 days, as against the schedule of 900 days. Welspun Enterprises, along with its contractors and close synchronisation with various stakeholders, exhibited exemplary teamwork and commitment to ensure that the project was not only completed in 500 days but exceeded expectations.

What decision do you consider the biggest contributor to the company's growth in FY17-18?

Our operational efficiency has been the biggest contributor to our revenue and profitability growth in FY17-18. For the Delhi-Meerut Expressway, as against the scheduled timeline of 30 months, we completed the project in 19 months, which helped in recognition of revenue and profits on an accelerated basis. During the year, we also grew our order substantially from Rs 5.4 billion to Rs 60 billion. This has been possible due to our strong balance sheet. We started the year with more than Rs 10 billion, which helped in acquiring projects through a bid or buy strategy.

Please share a decision you avoided, which could have otherwise impacted the company's top-line and bottom-line.

Very early, we decided that we will stick to only differentiated HAM projects as a developer and that too, through an asset-light model with minimal investment in machinery and working capital. This would deliver higher returns on capital employed with much lesser risk, compared to traditional models. We sub-contract the construction to the best-suited contractors while focussing only on project management, ensuring timely completion. This has resulted in a strong balance sheet with ample cash, which provides the equity required for growing our HAM portfolio and helps us achieve quick financial closure.

| Total | Total Income | EBITDA | Reported PAT |

|---|---|---|---|

| Income | 10.92 | 1.66 | 1.09 |

| Growth over FY 2017 (in%) |

181 | 145 | 154 |

Are there any special announcements or events to look forward to in FY18-19?

Our roads portfolio, consisting of NHAI HAM projects, is around Rs 70 billion, which translates to a current EPC order book of Rs 60 billion. We were recently awarded the Sattanathapuram-Nagapattinam four-lane project in Tamil Nadu with a project cost of over Rs 20 billion. We are also developing the Aunta-Simaria (six-lane Ganga Bridge) HAM project in Bihar with a project cost of Rs 11.61 billion and have achieved financial closure for the same. We have become the sponsor for three NHAI HAM projects. Our target is to double our revenue every year for the next two years to reach a figure of above Rs 40 billion in FY19-20.

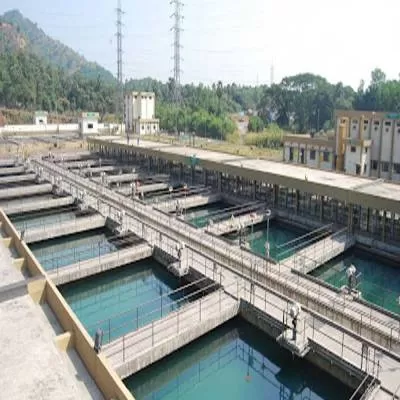

We are exploring diversification into the water sector.

Inputs from Seraphina D'souza

To share your views, write in at feedback@ConstructionWorld.in

Established in its current form in May 2015, Welspun Enterprises (WEL) operates PPPs in sectors like roads, water and urban infrastructure. The company has interests in oil and gas exploration with strategic equity investments. Sandeep Garg, Managing Director and CEO, Welspun Enterprises, shares more... Highlight one major challenge faced in FY2017-18 and how the company approached it. For the Delhi-Meerut Expressway (Delhi section), we faced an ambitious challenge of completing the project in less than 500 days, as against the schedule of 900 days. Welspun Enterprises, along with its contractors and close synchronisation with various stakeholders, exhibited exemplary teamwork and commitment to ensure that the project was not only completed in 500 days but exceeded expectations. What decision do you consider the biggest contributor to the company's growth in FY17-18? Our operational efficiency has been the biggest contributor to our revenue and profitability growth in FY17-18. For the Delhi-Meerut Expressway, as against the scheduled timeline of 30 months, we completed the project in 19 months, which helped in recognition of revenue and profits on an accelerated basis. During the year, we also grew our order substantially from Rs 5.4 billion to Rs 60 billion. This has been possible due to our strong balance sheet. We started the year with more than Rs 10 billion, which helped in acquiring projects through a bid or buy strategy. Please share a decision you avoided, which could have otherwise impacted the company's top-line and bottom-line. Very early, we decided that we will stick to only differentiated HAM projects as a developer and that too, through an asset-light model with minimal investment in machinery and working capital. This would deliver higher returns on capital employed with much lesser risk, compared to traditional models. We sub-contract the construction to the best-suited contractors while focussing only on project management, ensuring timely completion. This has resulted in a strong balance sheet with ample cash, which provides the equity required for growing our HAM portfolio and helps us achieve quick financial closure. .tg {border-collapse:collapse;border-spacing:0;} .tg td{font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;border-color:black;} .tg th{font-family:Arial, sans-serif;font-size:14px;font-weight:normal;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;border-color:black;} .tg .tg-8m2u{font-weight:bold;border-color:inherit} .tg .tg-qcuy{font-weight:bold;background-color:#f8a102;border-color:inherit;vertical-align:top} .tg .tg-v3tf{font-weight:bold;background-color:#f8a102;border-color:inherit} .tg .tg-p8bj{font-weight:bold;border-color:inherit;vertical-align:top} Total Total Income EBITDA Reported PAT Income 10.92 1.66 1.09 Growth over FY 2017 (in%) 181 145 154 Are there any special announcements or events to look forward to in FY18-19? Our roads portfolio, consisting of NHAI HAM projects, is around Rs 70 billion, which translates to a current EPC order book of Rs 60 billion. We were recently awarded the Sattanathapuram-Nagapattinam four-lane project in Tamil Nadu with a project cost of over Rs 20 billion. We are also developing the Aunta-Simaria (six-lane Ganga Bridge) HAM project in Bihar with a project cost of Rs 11.61 billion and have achieved financial closure for the same. We have become the sponsor for three NHAI HAM projects. Our target is to double our revenue every year for the next two years to reach a figure of above Rs 40 billion in FY19-20. We are exploring diversification into the water sector. Inputs from Seraphina D'souza To share your views, write in at feedback@ConstructionWorld.in