In her nearly two-hour-long speech, the world’s largest democracy’s first full-time woman Finance Minister, Nirmala Sitharaman, outlined that the Budget proposals rested on six pillars. These were health and wellbeing, physical and financial capital and infrastructure, inclusive development for an aspirational nation, the reinvigoration of human capital, encouraging innovation and R&D and minimising government and maximising governance.

She said the Budget proposals sought to consolidate the Central Government’s vision of an Aatmanirbhar Bharat by focusing on its sankalp (determination) of putting India first, doubling farm income, encouraging robust infrastructure creation and expansion of healthcare and good governance.

“Now, just as it had happened after the two World Wars, there are signs that the political, economic, and strategic relations in the post-COVID world are changing. This moment in history is the dawn of a new era; one in which India is well-poised to truly be the land of promise and hope,” she told the house.

“I want to confidently state that our Government is fully prepared to support and facilitate the economy’s reset. This Budget provides every opportunity for our economy to raise and capture the pace that it needs for sustainable growth,” she added.

At the base of Sitharaman’s proposals lie the creation as well as an overhaul of existing infrastructure from physical, administrative to digital to boost growth and create jobs. That is one of the reasons why the Budget speech largely avoided region or state-specific allocations. This is something that was first amplified by prime minister Narendra Modi in his speech while launching the Aatmanirbhar Bharat Abhiyan (self-reliant Indian programme) in May last year.

In a major announcement, the government has also tried to address the challenge of raising capital for physical infrastructure projects through the formation of a Development Finance Institution (DFI).

However, aatmanirbharta or self-reliance is not about a return to a protectionist era that started during the tenure of the country’s first prime minister, Jawaharlal Nehru. It is rather about reclaiming India’s historical position as the world’s manufacturing and services hub. According to the renowned economic historian Angus Maddison, India together with China used to lead the world in GDP numbers till the 1600s. In fact, despite the socio-political upheavals witnessed during much of its later medieval history, the country was the world leader in manufacturing, producing a quarter of the global industrial output until about the mid-18th century. However, colonisation and the resulting de-industrialisation led to the country’s share in the global industrial output decline to a measly 2 per cent by 1900.

However, contrary to popular belief, Roosevelt’s New Deal wasn’t a socialist programme, but a chain of evolving schemes, public work projects, financial reforms and regulations aimed at reviving the US economy. The effort eventually culminated in the US’ emergence as the world’s leading economic and military powerhouse in the post-World War-II world.

Prime minister Modi has tried something similar first with the three stimulus measures announced last year and Budget 2021-22.

Roosevelt is among the few foreign leaders that Modi most likely admires. His month-end Mann Ki Baat (roughly translating as ‘Matter of Contemplation’) radio programme is inspired by the American leaders’ ‘Fireside Chats’ to address the fears and concerns of fellow Americans. After all, Modi’s aatmanirbhar deal is also for what he often refers to as a “New India”.

Reacting to the finance minister’s proposals, an enthused Managing Director of the Mumbai-based wealth management firm, Emkay Global Financial Services, Krishna Kumar Karwa, told INFRASTRUCTURE TODAY, “Hats off to the finance minister for sticking to her promise of a Budget that will be remembered for 100 years. The revival in the economy seen in the last four-five months will be further enhanced with the various Budget proposals.”

Jagannarayan Padmanabhan, Director of Transport at CRISIL Infrastructure Advisory, observed, “The Central Government has directionally given the much-needed guidance for heavy lifting the infra spends, which could act as a cue for some of the state governments to follow. Policy announcements in the area of infra financing and aircraft leasing augur well for the development of institutional support in realising the projects as set out by the national infrastructure pipeline (NIP).”

Anuj Kumar Garg, Vice President Customer Engagement & Distribution at the real estate firm Viridian RED, remarked, “With the aim of drawing more investment, the Budget proposed additional tax incentives for the companies relocating foreign funds to the GIFT city which is a laudable decision in the making of GIFT City a global financial hub. Also, the debt financing of InvITs and REITs is an appreciative move as it will enable the real estate and infrastructure sector to attract more investments. From the employment generation to push real estate demand, these initiatives are likely to bring the economic multiplier effect which is a need of the hour.”

Santosh Agarwal, CFO & Executive Director at the Gurugram-based real estate player AlphaCorp, said, “Seeing affordable housing as the fastest growing sector, the government has announced the extension of one year till March 31, 2022 on the additional deduction of Rs 150,000 on the sanctioned loans. This will increase and provide a much-needed impetus to the housing demand and encourage prospective buyers to avail more benefits and invest in real estate.”

There is also a provision of Rs 350 billion for the Covid-19 vaccine in BE 2021-22. The launch of two more ‘Made in India vaccines’ shortly, is expected to provide further thrust to the country’s vaccine diplomacy globally.

The Finance Minister announced the launch of Jal Jeevan Mission (Urban) in all 4,378 urban local bodies with 2.86 crore household tap connections as well as liquid waste management in 500 Atal Mission for Urban Rejuvenation and Urban Transportation (AMRUT) cities. The schemes will be implemented over five years, with an outlay of Rs 2.87 trillion. Moreover, the Urban Swachh Bharat Mission will be implemented with a total financial allocation of Rs 14 trillion over five years from 2021-26.

“The increase in healthcare budget from Rs 945 billion to Rs 2.23 trillion is driven in large part by budgetary allocations for Covid vaccinations – Rs 350 billion, accounting for 27 per cent of the increase – and an increase in water & sanitation costs – Rs 745 billion, accounting for 58 per cent of the increase,” observed director, White Oak Capital, Manoj Garg from Mumbai.

George Rajkumar, Country President, Grundfos India, declared, “The move to include liquid waste management backed by the budget allocation of Rs 1.41 trillion for Urban Swachh Bharat Mission 2.0 is a great step forward to holistically look at sustainable water and waste water management in India. We hope that this allocation will encourage public and private players to develop innovative solutions for JJM.”

Also, to tackle the burgeoning problem of air pollution, the government has proposed an allocation of Rs 22.17 billion for 42 urban centres with a million-plus population. A voluntary vehicle scrapping policy to phase out old and unfit vehicles was also announced.

The finance minister emphasised that to make the country a USD 5 trillion economy by FY2025-26, the manufacturing sector had to grow in double digits on a sustained basis, with Indian companies becoming an integral part of global supply chains, possessing core competence and cutting-edge technologies. The Central Government had committed nearly Rs 1.97 trillion over the next five years under the Productivity Linked Scheme (PLI) for 13 sectors.

To enable the textile industry to become globally competitive, attract large investments and boost employment generation, a scheme of Mega Investment Textiles Parks (MITRA) will be launched in addition to the PLI scheme. The Government proposes to establish seven textile parks in three years.

This is an important area as the country is currently ranked the third-largest exporter of garments behind China and Bangladesh. In the last few years, it has also been facing stiff competition from Vietnam. The Budget proposals, therefore, focus not just on readymade garments but also on high-value industrial textiles.

Acknowledging that infrastructure creation required long-term debt financing, Sitharaman announced a professionally managed DFI to act as a provider, enabler and catalyst for infrastructure financing. The Government had provided a sum of Rs 200 billion to capitalise on this institution, with a targeted lending portfolio of at least Rs 5 trillion in three years.

Since monetising operational public infrastructure assets is a very important financing option for new infrastructure construction, a National Monetisation Pipeline of potential brownfield infrastructure assets is in the works. An asset monetisation dashboard will also be created for tracking the progress and to provide visibility of such projects to potential investors.

The Budget document also mentioned more economic corridors, a ‘future-ready’ railway system under the Indian Railways’ National Rail Plan for India: 2030 and deployment of the MetroLite and MetroNeo technologies to provide urban rail transit at a significantly reduced cost in Tier-2 cities and peripheral areas of Tier-1 cities.

“It is evident that the Budget plans to give a big boost to both manufacturing and infrastructure with some path-breaking steps like the creation of DFI to fund the ambitious NIP, setting up of National Asset Monetisation Pipeline that will free up idle resources including surplus land with PSUs, and monetisation of various assets of railways like dedicated freight corridors, power transmission lines, roads, and oil & gas pipelines for fund mobilisation,” said managing director, Dalmia Bharat Group, Puneet Dalmia.

“We welcome the proposals of the continued development of economic corridors. These road and highway projects will boost the economy by creating thousands of jobs that are much needed during these times and attracting greater investment along the corridors because of the improved infrastructure. Additionally, the soon to be tabled bill on DFI is a much-awaited step which will provide funding to construction in the infrastructure sector,” remarked Kshitish Nadgauda, Managing Director Asia at the US-based engineering consultancy, Louis Berger.

Robust power infrastructure is yet another important prerequisite for a rapidly industrialising nation. Sitharaman expressed her concern over the viability of distribution companies. She proposed the launch of a revamped reforms-based result-linked power distribution sector scheme with an outlay of Rs 3.05 trillion over five years. The scheme will assist distribution companies in infrastructure creation including pre-paid smart metering and feeder separation, upgrading of systems, etc., to improve efficiency.

Welcoming the announcement, Tata Power’s President Transmission & Distribution, Sanjay Banga, said, “We also welcome the scheduled discussion on the Electricity Amendment Act 2021 during the ongoing Budget session as when implemented in its true letter and spirit, the Act will provide the much-needed independence to the regulatory mechanism for an effective and timely decision making. It will also pave the way for speedier implementation of the National Tariff Policy, a must for the tariff rationalisation across all segments of consumers. This is very crucial for overall industrial development for the realisation of Aatmanirbhar Bharat.”

Anil Chaudhry, CEO, Schneider Electric India, maintained, “The proposal to offer more choice to consumers by introducing competition in the power distribution space by kick-starting Rs 3 trillion reforms-based result-linked power distribution sector scheme for state power distribution companies is likely to address the long hanging transmission & distribution (T&D) issues and give relief to the power producers, thereby ensuring health for the entire value chain. It is also good to see the government government’s focus towards ensuring smart metering, which will help cut the commercial losses in power distribution.”

Importantly, the finance minister stated the Government had approved the policy for strategic disinvestment of public sector enterprises under the Aatmanirbhar Package. The policy provides a clear roadmap for disinvestment in all non-strategic and strategic sectors. The Government had kept four areas that were strategic where bare minimum Central Public Sector Enterprises (CPSEs) will be maintained and the rest privatised. Those in the non-strategic sectors, will be either privatised or closed. She said that to fast forward the disinvestment policy, the government think-tank NITI Aayog will work out the next list of CPSEs that would be taken up for strategic disinvestment. The government had estimated Rs 1.75 trillion as receipts from disinvestment in BE 2020-21.

In an important announcement to boost value addition in agriculture and allied products and their exports, the scope of ‘Operation Green Scheme’ that is presently applicable to tomatoes, onions, and potatoes, will be enlarged to include 22 perishable products.

Given the role played by the National Agricultural Markets or e-NAMs in improving transparency and competitiveness, 1,000 more mandis will be integrated with them. The Agriculture Infrastructure Funds would be made available to Agricultural Produce Market Committees (APMCs) for augmenting their infrastructure facilities.

Also, for the first time globally, social security benefits will be extended to gig and platform workers. Minimum wages will apply to all categories of workers, and they will all be covered by the Employees State Insurance Corporation (ESIC). Women will be allowed to work in all categories and also in the night-shifts with adequate protection. At the same time, the compliance burden on employers will be reduced with a single registration, licensing and online returns.

The finance minister said that the outlay for the National Research Foundation (NRF), first announced in her Budget speech of July 2019, will be Rs 500 billion over five years. This will work towards strengthening the overall research ecosystem of the country, with a focus on identified national-priority thrust areas.

The finance minister also announced a new initiative, the National Language Translation Mission (NTLM). This will enable the wealth of governance-and-policy-related knowledge on the internet available in major Indian languages.

Sitharaman informed that as part of the Gaganyaan mission activities, four Indian astronauts were being trained on generic space flight aspects, in Russia. The first unmanned launch was slated for December 2021. India has already emerged as the leading low-cost hub for the launch of satellites into space. The successful launch of a human space flight in the next couple of years will help firmly entrench the country as a major force in the global space race in the 21st century.

“The finance minister’s focus on healthcare, infrastructure, power and the financial sector will have a positive, broad-based impact on the economy. By increasing Capex spending significantly without hiking taxes, and instead focusing on expanding economic activity, the finance minister has set the groundwork for a sharp and sustained economic recovery over the next several years,” averred Chairman & Managing Director at the country’s leading renewable energy independent power producer, ReNew Power, Sumant Sinha.

Moreover, the emphasis on self-reliance is also about preparing the world’s largest democracy to compete with China as the world’s manufacturing hub in a post-Covid-19 environment. Other than the deployment of more troops along the Sino-India border in Ladakh, Sikkim and Arunachal Pradesh, Budget 2021-22 is an important part of New Delhi’s economic arsenal against an increasingly belligerent Beijing.

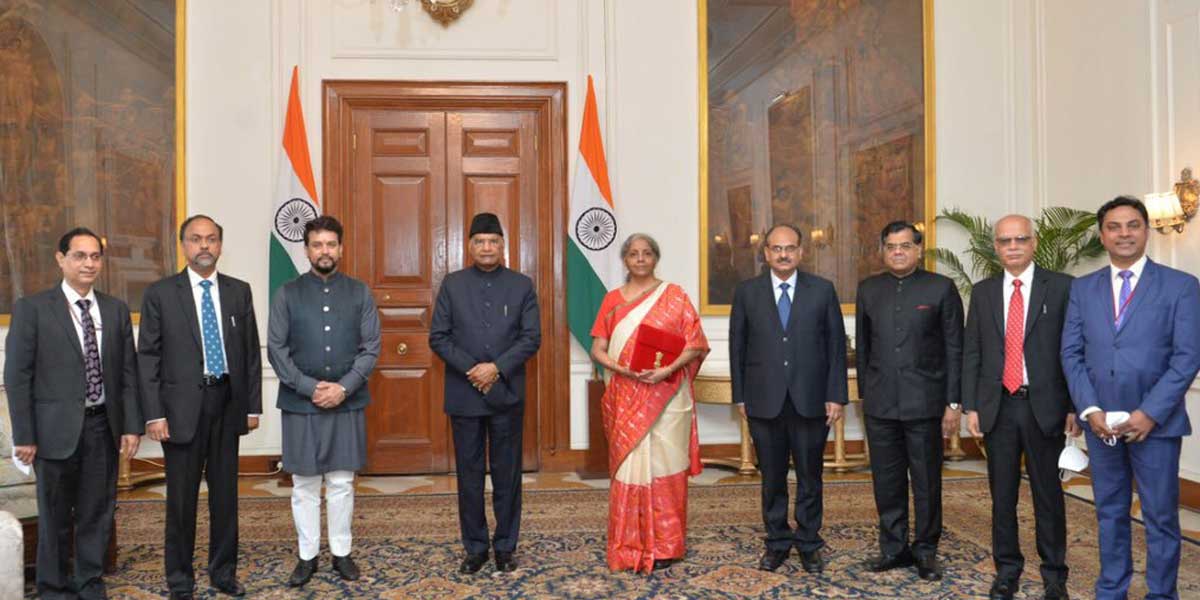

- Union Budget: Manish Pant