REITs – Opportunities awaiting in India

01 Jul 2017

Considering the capital-intensive nature of the commercial real estate sector as an investment avenue and also the limited investment opportunities with regards to high-grade office assets, REITs (Real estate investments funds) will be a big boon for the Indian real estate industry. In simple terms, a REIT is an investment tool that owns and operates real estate assets and even allows individual investors to invest in and earn income through partial or equity level ownership of commercial real estate without actually having to buy those assets.

REITs are modelled after mutual funds, and provide their investors with all types of income streams – as well as the benefits of long-term capital appreciation. A REIT also trades on major stock exchanges and provides investors with a highly liquid stake in real assets typically offering high yields.

Over the last decade, globally, REITs have developed into a mature market force, providing easy access to high-quality assets along with stable return on investments. To illustrate – as of 2016, there were over 500 REITs operating across various countries, with total market capitalisation of more than US$ 900 billion.

Taking a closer look at REITs globally

- The US: The US Congress created the Real Estate Investment Trust (US-REIT) in 1960 to make large-scale, income-producing real estate investments accessible to smaller investors. Since then, US-REIT has dominated the market, and has a market capitalisation which grew from US$ 1.4943 billion in 1971 to US$ 1 trillion by 2016.

- Singapore: Since the launch of the first Singapore REIT in 2002, the REIT sector has become one of the biggest success stories of the Singapore Stock Exchange (SGX). Singapore REITs have since grown into a US$ 53 billion market. Currently, the total ‘REITable’ stock available in Singapore’s CBD is 2.687million sq m.

- Australia: The first REIT in Australia was the General Property Trust – a listed property trust started in 1971. A-REITs are the largest REIT market in Asia with a total market capitalisation of almost €72 billion, accounting for 9.36 per cent of the global REIT market capitalisation. The Sydney CBD market has 3.060 million sq m of REITable stock.

Given the currently sluggish demand for residential real estate in India, the office sector provides some relief for real estate developers, given the declining vacancy levels and improving rents. With declining vacancies, superior quality buildings in CBDs, SBDs and PBDs are likely to see maximum REITable assets.

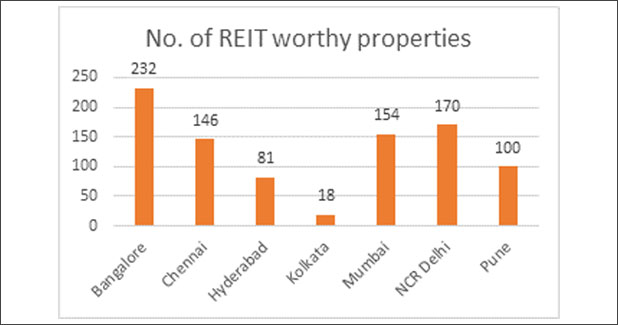

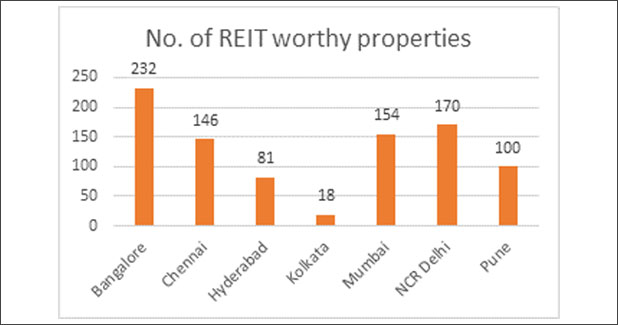

Close to 283 million sq ft of office space in India is REITable. Currently, there are 901 REIT-worthy properties in India.

There is no doubt that REITs will provide access to highly lucrative assets, such as large-scale commercial properties and high-quality retail assets, that may be otherwise out of reach for individual investors. Once the first REIT listings go live in India, we will definitely see significantly increased institutional and retail investor participation in this market.

About the Author:

Ramesh Nair is CEO & Country Head, JLL India.

Related Stories