In

a webinar hosted by Construction

World and FIRST Construction Council yesterday, experts churned the

Union Budget 2021-22 to decode what it means in funding and implementation of

projects.

_________

Construction World and FIRST Construction Council organised a webinar

with prominent analysts and industry captains on February 2, the day after

Finance Minister Nirmala Sitharaman’s Union Budget 2021-22 speech.

The speakers were:

·

Deepto

Roy, Partner, Shardul Amarchand Mangaldas & Co

·

Dip

Kishore Sen, Director, L&T

·

Hemal

Mehta, Partner, Deloitte India

·

Pradeep

Singh, former Vice Chairman & MD, IDFC Projects

·

Sandeep

Singh, MD, Tata Hitachi

·

Sumit

Banerjee, former MD & CEO, ACC Ltd

The 90-minute session was moderated

by Construction World’s

Editor-in-Chief Pratap Padode.

Budgets over the years have

emphasised on infrastructure, but this budget hit the bull’s eye by

specifically allocating funds for infrastructure. Governments have dabbled in

public-private partnerships (PPP) in infrastructure projects, and experimented

with different methods of the workings of PPP. Arbitration mechanisms take

forever, and often, government-related issues such as land acquisition are

tricky for the private contractors and partners.

But as the industry finds itself in

the throes of a post-pandemic pain, these finance-, execution-, and related

issues take an even more significant role. Did the Union Budget 2021-22 make a

difference to how projects will be implemented? What were some of the hits and

more importantly, some misses? What are some loopholes and potential pitfalls?

In this article, we report on what experts on our panel said about project execution.

Project acceleration

Order

book positions seem to be in a promising mode as the companies are expecting a

huge amount of order to swell up their books post-pandemic. Which sectors do

the experts see most promising from the contractor’s perspective?

DK

Sen, Director, L&T, says order books are growing in

infrastructure--railway, roads, aviation, and metro. But it would be a

combination of industries, Sen said, thanks to the new economic corridors that the FM announced:

“The corridors will be the engines

of growth not just in terms of logistics itself, but in terms of other commercial

and residential opportunities. These are long corridors that connect important

cities and pass through underdeveloped, and that should lead to development

along the corridor.” The government has announced several corridors such as

Delhi-Dehradun, Kanpur-Lucknow, Chennai-Salem, Raipur-Visakhapatnam. All these

corridors are about 500-600 km long and will connect several major cities.

The

government’s announcement of new Dedicated Freight Corridors (DFCs) and

high-speed rail is welcome. It seems that the authorities are fully

prepared--tender papers are ready, and since it is all JICA-funded, this looks

good, Sen said. “Whether they will be able to get the money from the market

through monetisation is doubtful. Yet, emerging from a pandemic year, investment

of Rs 5 lakh crore is a very good move. It’s a tall order, but the FM’s

attitude is one of confidence.”

Sen added, “Apart from this they

also have ambitious high-speed rail where they have just awarded two packages.

And now there are a whole load of packages because the whole outlay is about Rs

100,000 crore out of which only about Rs 35,000 crore have been awarded. There

will be huge scope in that and the way the government is going the high-speed

rail authority is very is fully prepared as they have been working on this

project for a long time.”

As Deepto

Roy, Partner, Shardul Amarchand Mangaldas & Co, a

law firm, said in

the webinar, the government seems to have realised that one of the key drivers

of this government’s new slogan Atmanirbharta—or

self-reliance—is world-class infrastructure, and is identifying sectors to make

significant capital allocations.

Roy said, “Previous budgets used to

talk in more hypothetical terms. But this budget identifies certain sectors,

and a roadmap has been laid down for each of those sectors.”

The emphasis was given to

transportation, in particular, roads, railways, and urban infra. All this specific identification and funds

allocation according to Roy, “gives the impression that the government intends

to do much in a very short while.”

He goes on to add that a fair

amount of emphasis has been laid on the power

sector reform, particularly on the distribution side. The government has

identified discoms as a piece of the “electricity puzzle”, which needs urgent

intervention especially in modernising distribution infrastructure on the

energy side.

Revenue mobilisation strategy

The government is deploying a

strategy to eliminate the problem of infrastructure financing faced by the

Indian infrastructure sector. REITs (Real Estate Investment Trusts) and InVits

(Infrastructure Investment Trusts) will now be open to debt financing by foreign

players. to set up a development financial institution (DFI). The FM sees this

opening up to be a major enabler in financing real estate and infrastructure

projects to accelerate growth in these sectors. But will they?

Pratap

Padode, Editor-in-Chief, Construction

World, pointed out, “Private

capital was shy even before pandemic. Public spending needs to be high and the stage

needs to be set. Yet with asset monetisation, InvITS, REITS and other

processes, is the stage set for private monetisation to come back? This is an

operation clean up but why does the situation reach this point? Is it because

of the risk associated with projects?”

Sandeep

Singh, MD, Tata Hitachi, said

the production-linked incentives, or PLIs, which the government has recently

announced for a few industries, are already in place. “States will do very well

with their own incentives--especially states like Tamil Nadu and Karnataka,

which have been aggressive in rolling out the carpet for investment.”

Hemal

Mehta, Partner, Deloitte India, said

he believed PLIs are “good for new manufacturing units, not so much with

existing ones.”

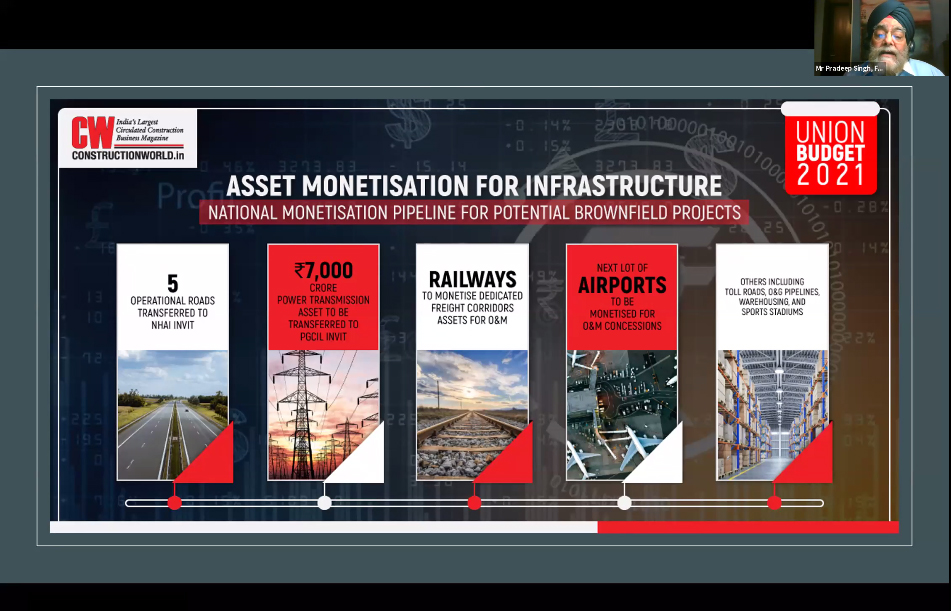

Pradeep Singh, Former Vice

Chairman & MD, IDFC Projects, said, “Revenue mobilisation strategy is good news

and bad news. It relies on monetisation of government assets including

infrastructure projects, especially brownfield

projects.”

Roy believes that the

“‘InVitisation’ risk could be hedged by investing and exiting later, with a

professional O&M coming in.”

“This Budget is a mixed bag,” Singh

went on to say. “The government’s commitment to monetisation of assets,

especially brownfield, is a renewed and bold move especially in the face of

criticism that the government leans towards the corporate sector. “Disinvestment, which is on the same

continuum disinvestment in public sector undertakings, including significant

land holdings, has been again identified very clearly as an intervention.” A

special purpose vehicle (SPV) is proposed to be set up to be able to mastermind

that transaction.

Bringing in the private sector into

infrastructure is welcome, Singh said, but the experience has been mixed—with a

rise in NPAs and even failures among

players.

The PPP strategy as previously

envisaged, too, Singh believes, seems to be getting lost, perhaps because of

that mixed experience:

He further added, “So the

government seems to be pragmatically accepting that the development and

execution risks associated with infrastructure projects are just simply too

high for the private sector. Bringing in the private sector to brownfield

projects, which are projects developed by the government executed by the

government to monetise those projects to recycle the capital, but in the

process, bring private sector efficiencies and management for the operation and

management and maintenance of those very projects, and take some residual

commercial risks of the future revenue generation and the management of costs

of all those projects. So in that sense, it's good news that the government

being pragmatic.”

But the flip side to this is that

in the process, the government seems to be no longer focusing on addressing the

fundamental challenges that lead to these failures of PPP in its full form,

where the commercial projects are developed and financed by commercial capital.

The good things about the PPP strategy seem to be getting lost. Many of these

underlying challenges are in the domain of public policy. Singh adds, “The

government should also bite the bullet and start addressing those challenges,

rather than just throwing away the baby with the bathwater and focusing on

brownfield monetisation, which by itself is welcome."

Mediation, not arbitration?

India ranks 163rd in the

enforcement of contracts in ease of doing business, although India’s rank in

ease of doing business is 63rd, where does the problem lie? How effective is

arbitration as a choice of dispute resolution?

Enforcing a contract is nothing but

a resolution of disputes in one way or the other. And India does have a strong

legal framework in place but the problem is with the execution of the rule of

law.

For dispute resolution, the government has taken a few positive steps like making mediation mandatory. But according to Banerjee, “there remain few flaws in that law, which doesn't make it mandatory. And people are bypassing it by taking injunctions etc,” Every commercial dispute should go through mediation, not arbitration because Banerjee feels that arbitration doesn't solve anything as arbitration can also be long-winded and ultimately land up through the whole court route into the Supreme Court. It adds more years to the resolution process. He added, “Mediation is the one which in western countries have become fashionable. And so in India, also we have to make it fashionable.”