MoD Spends Over 50% of FY26 Defence Capital Outlay by September

The Ministry of Defence (MoD) has utilised more than 50 per cent of its capital outlay for FY 2025–26 by the end of September. The capital expenditure stands at Rs 922,114.4 million (51.23 per cent) out of the total allocation of Rs 18 billion. In the previous fiscal, MoD had fully utilised its capital budget of Rs 1,597,684 million. This strong expenditure pace will ensure timely delivery of major platforms such as aircraft, ships, submarines, and weapon systems vital for the modernisation of the Armed Forces. Most of the spending has been on aircraft and aero engines, followed by land sys..

Amit Shah Launches Rs 40, 000 Bn Investment Projects in Rajasthan

Union Home Minister and Minister of Cooperation Amit Shah inaugurated investment projects worth Rs 40,000 billion and a state-level exhibition on India’s new criminal laws in Jaipur. He also launched several development projects of the Rajasthan government in the presence of Chief Minister Bhajan Lal Sharma and senior officials. Shah described the three new criminal laws as the biggest reform of the 21st century, aimed at shifting focus from punishment to justice. He said that in Rajasthan, the conviction rate has risen from 42 to 60 per cent and is expected to touch 90 per cent once the la..

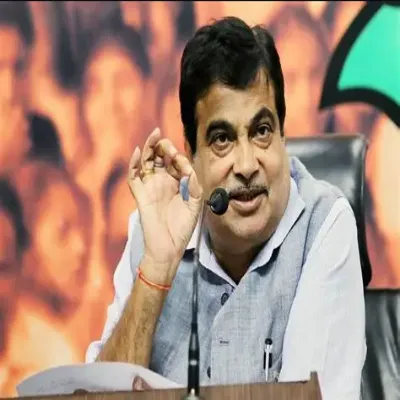

Gadkari Unveils Rs 200 Bn Highway Projects in Puducherry

Union Minister for Road Transport & Highways Nitin Gadkari inaugurated and laid the foundation stones for three National Highway projects worth over Rs 2,000 crore in Puducherry, along with Lt. Governor K. Kailashnathan and Chief Minister N. Rangaswamy. The projects include a 4-km elevated corridor between Indira Gandhi Square and Rajiv Gandhi Square on NH-32, improvements to the 14-km ECR Road on NH-332A, and the inauguration of the 38-km four-lane Puducherry–Poondiyankuppam section of NH-32. These works will reduce travel time across Puducherry’s urban stretch from 35 minutes to 10 minu..