- Home

- Real Estate

- Look out for the business in affordable housing and the opportunity for developers

Look out for the business in affordable housing and the opportunity for developers

<ul> <li>BDI Group's BDI Ananda, launched in August 2016, records sales of around 120 units on Day 1 and 1,500 units in around 12-15 days.</li> <li>At Happinest, Avadi, handovers of homes done within 22 months of launch; over 600 apartments (of 1,260 in two phases) already handed over.</li> <li>VBHC Value Homes has delivered 3,000-plus homes in the past six to seven years and in the process of delivering 1,000 more.</li> <li>Akshaya to launch three projects in the affordable housing segment in the current fiscal comprising 1,010 units in the Rs 10 lakh-25 lakh range.</li></ul><br /> The numbers say it all: 'Affordable' is the name of the game! <br /> Indeed, H1 2017 witnessed the resurrection of affordable housing across India with 71 per cent launches coming under the Rs 50-lakh price segment, up from 52 per cent during the same period last year, reveals the seventh edition of Knight Frank's flagship half-yearly report, India Real Estate. It further indicates that NCR, Kolkata, Pune and Ahmedabad have driven the revival of affordable housing projects with around 80 per cent of launches in these cities in the sub Rs 50-lakh segment. <br /> <br /> This trend is further confirmed by a joint CREDAI and CBRE report, Indian Real Estate in 2017 and Beyond, which points to the legislative measures taken to promote private-sector participation in this segment. These include awarding infrastructure status to affordable housing, 100 per cent deduction on profits for affordable housing projects, increasing the liveable area of units and relaxed completion timelines, among others. <p></p> <p>While some last-mile measures still remain to be undertaken, the government's quick response rate towards developer and customer needs has conveyed its intent to make affordable housing the growth catalyst of residential real estate in India. 'The Pradhan Mantri Awas Yojana (PMAY) is a critical component of inclusive urban development,' says <span style="font-weight: bold;">Dr Medithi Ravi Kanth, Chairman & Managing Director, HUDCO</span>. 'For the successful implementation of 'Housing for All', considerable attention has been devoted to the structure of the programme.' HUDCO has accorded a sanction of Rs 7,748.60 crore towards viability gap funding for the share of state governments and ULBs to construct 10.26 lakh houses; so far, Rs 820 crore has been disbursed to various state government agencies.</p> <p> <span style="font-weight: bold;">A sustainable business model</span><br /> Affordable housing certainly spells opportunity for developers to tap 'thanks to the favourable government incentives (PMAY and tax benefits under Section-80 IBA), which is a win-win situation for both developers and buyers,'says<span style="font-weight: bold;"> T Chitty Babu, Chairman and CEO, Akshaya. </span>The company plans to launch three affordable housing projects this year in the Rs 10 lakh-25 lakh range. </p> <p>Babu adds that with the government's ambitious vision and increasing interest in improving the lives of the BOP segment, 'we see the push towards affordable housing as a sustainable business model.'</p> <p>Meanwhile, <span style="font-weight: bold;">Ssumit Berry, Managing Director, BDI Group</span>, says, 'The demand for affordable housing has been constantly growing and developers in this domain will be able to sell their projects in the near future.' That said, it is hoped they don't confront the effects of inflation or other economic setbacks. In agreement is <span style="font-weight: bold;">Rohit Poddar, Managing Director, Poddar Housing and Development.</span> 'We have delivered over 5,000 apartments and are now ramping up our project rollouts,' he shares. Poddar Housing focuses on the EWS, LIG and MIG sectors. </p> <p>For VBHC Value Homes, the focus has always been on affordable housing. 'What has given us strength is lower margins, which is an outcome of anything that is mass produced, leading to higher volumes,' says <span style="font-weight: bold;">Rahul Sabharwal, COO, VBHC Value Homes.</span></p> <p>Mahindra Lifespace Developers forayed into the affordable housing segment with its brand 'Happinest' in 2014. 'Our ongoing affordable housing projects in Chennai (Happinest, Avadi) and Mumbai (Happinest, Boisar) were both launched in H2 2014,'says <span style="font-weight: bold;">Sriram Mahadevan, Business Head, Happinest. </span>An important growth area for Mahindra Lifespaces, Happinest leverages innovative technologies and value engineering approaches to ensure timely and cost-effective construction with zero compromise on quality. Mahadevan goes on to tell us how the company has focused on creating an ecosystem for access to home finance for Happinest customers; this includes partnerships with multiple NBFCs and banks that evaluate financial capability and accordingly approve home loans. </p> <p> <span style="font-weight: bold;">Is the money coming in?</span><br /> The current favourable environment has promoted the prospects of FDI in the sector. This apart, the industry has been witnessing increased participation from corporates and various financial institutions as well. </p> <p>'Enhanced legal clarity and accountability have greatly contributed to building stronger investor confidence as they are sure of better returns in an environment with better compliance,' points out Babu. He further states that with affordable housing getting infrastructure status, the segment is seeing a boost in investment from countries such as Japan and China. </p> <p>Berry believes affordable housing has stood the test of time, even as costlier luxury homes projects are confronting a hard time in the present situation. 'Developers who have tasted success by proving much-needed affordable housing are hence urged to cater even more to this segment,' he says. </p> <p>'The mortgage companies have always been gung-ho about this,' says Sabharwal. As far as funds and other investments are concerned, he opines that the interest levels in affordable housing are large. </p> <p>'This interest is expected to increase because of the impetus on affordable housing given by the government, much happening at the developer level, and RERA bringing in transparency and a level playing field for all developers.' </p> <p>With this, in the coming 12-18 months, a huge amount of lending activity is expected in the affordable zone. </p> <p> <span style="font-weight: bold;">Loan disbursements</span><br /> Affordable housing as a segment has witnessed tremendous traction over the past year, which is reflected on the portfolio of several lending companies. <span style="font-weight: bold;">Rajesh Krishnan, Founder and CEO, Brick Eagle,</span> describes the current scenario as a lenders' market. 'We can pick and choose projects,' he says. 'India needs $20 million of project finance every year and you do not have many institutions to cater to this demand.'</p> <p>In the view of <span style="font-weight: bold;">Manish Jaiswal, Managing Director & CEO, Magma Housing Finance & SME Business, PMAY </span>is the largest successful government subsidy scheme and is driving structural reforms in the EWS, LIG and MIG sectors of the economy despite archaic land laws, issues of land aggregation and lack of single-window approvals from multiple approval authorities. Speaking on his company, he adds, 'We are resetting our business model and aligning towards affordable housing and seeing green shoots already!' </p> <p>Comparing the projected number on a year-to-year or quarter-to-quarter basis, Indiabulls Housing Finance has witnessed almost 52 per cent growth in the affordable segment. <span style="font-weight: bold;">Sachin Chaudhary, COO, Indiabulls Housing Finance</span>, says, 'In the affordable space, we keep loans of up to Rs 50 lakh for a property valued at around Rs 65 lakh.' And <span style="font-weight: bold;">Khushru Jijina, Managing Director, Piramal Finance</span>, says, 'Aided by the government's push as well as further reductions in home loan rates, buyers are now increasingly transacting after waiting on the sidelines in the residential market.' This has also reflected in the company's portfolio. 'Disbursements to the affordable housing category have increased by 60 per cent YoY,' he adds.</p> <p> <span style="font-weight: bold;">Believing there </span><br /> is a market for everyone, especially in Tier-III and Tier-IV cities, <span style="font-weight: bold;">Sanjay Shukla, Managing Director and CEO, Centrum Housing Finance,</span> says, 'The market is not driven by investors because investors do not exist in the market.' Recently established, Centrum Finance started business in February this year. Shukla adds, 'We are seeing good momentum, especially in Tier-III and Tier-IV cities of Madhya Pradesh, Gujarat and Maharashtra.' </p> <p>Banks have an important role to ensure the success of PMAY, and the Credit Linked Subsidy Scheme (CLSS) in particular. 'As one of the central nodal agencies for the CLSS component of the affordable housing mission, HUDCO has executed an MoU with 62 banks or prime lending institutions (PLIs) for EWS and LIG, and with 46 banks or PLIs for MIG-I and MIG-II. These include PSUs, private-sector banks, grameen banks and cooperative banks,'says Kanth. The corporation has received and disbursed a subsidy claim amount of Rs 16.55 crore from (EWS and LIG) beneficiaries.</p> <p>'Rural fund allocation under PMAY has been raised from Rs 15,000 crore to Rs 23,000 crore, with the target to build 10 million homes by 2017-18,' says Jijina. Of HUDCO's total sanctioned amount this year, 'Rs 5,367 crore has been for the housing sector, for facilitating housing for over 8.25 lakh households,' says Dr Kanth. </p> <p>(Read about HUDCO's complete lending operations on page 86.) Urbanisation has been a key driver over the past 10 years - it has grown to 30 per cent and is expected to increase to 40 per cent by 2030. Currently, the potential market size for affordable housing in urban India is forecasted to grow 1.5x-2x. Jijina sees much of this growth centered around Tier-I cities that have a considerable mass of urban poor as well as Tier-II and Tier-III cities where lower income groups have aspirations and access to credit. 'We have a complete suite of products that cater to the affordable segment, right from equity to senior secured debt and construction finance,' he says. </p> <p>'We engage with the builder and approve their projects,' says Chaudhary. 'Also, wherever there is a requirement or if we find a viable project, we also participate as a construction finance company. </p> <p>But this depends on the stage of construction and requirement of the developer.'</p> <p>The real need for funding is at the pre-launch stage, according to Krishnan. 'Once a project is launched, customers typically come and book housing units,' he elaborates. 'This means cash flows are established at that stage and banks and NBFCs are willing to lend to these projects.' The pre-launch stage involves acquiring land, seeking approvals, preparing the site and initiating marketing activities. Citing that this is why developers struggle to get money, he adds, 'We want to invest money at the pre-launch stage. So this is pretty much effectively equity money, which is required to catalyse a project. So to take it to the launch stage, banks and NBFCs are willing to give money.' </p> <p> <span style="font-weight: bold;">Business ahead!</span><br /> With affordable housing evidently a key priority for the government, the surge in this segment is here to stay.</p> <p>About 80 million households in India are estimated to be living in substandard conditions or slums. 'As the Indian middle class expands and credit penetration increases, the demand for affordable housing is likely to grow further,' says Jijina. 'We remain positively inclined towards expanding our presence in the affordable category, both through our proprietary lending platform as well as our housing finance company.'</p> <p>Equally bullish, Jaiswal sees a deep opportunity even in rural and sub-urban markets apart from catering to the urban poor. And Chaudhary emphasises, 'At present, 50-55 per cent of our business is happening in the affordable segment alone, which is again growing by around 50-52 per cent. With this, we can safely assume that by year-end, around 70-75 per cent of the business will come from the affordable segment alone.'</p> <p> Indeed, a confluence of factors is working for this segment - it's a business that is attracting funds, a new strategic model for the private sector, and a vision to give every Indian a home to call their own.</p> <p></p> <p> <span style="font-weight: bold;">Lending Agencies</span><br /> </p> <p><span style="font-weight: bold;">Akshaya </span><br /> </p> <ul> <li>Piramal Finance </li> <li>JM Finance</li> <li>ICICI Prudential</li></ul> <p><span style="font-weight: bold;">BDI Group</span><br /> </p> <ul> <li>HDFC</li> <li>PNB Housing</li> <li>Axis Bank</li> <li>Yes Bank</li> <li>Mfin</li> <li>Raas Housing Finance, etc</li></ul> <p><span style="font-weight: bold;">VBHC Value Homes</span><br /> </p> <ul> <li>Central Bank</li> <li>Kotak</li> <li>HDFC, etc.</li></ul><br /> <span style="font-weight: bold;">HUDCO's Current Lending Operations for Affordable Homes</span><br /> HUDCO's current lending operations for affordable homes <span style="font-weight: bold;">Dr Medithi Ravi Kanth, Chairman & Managing Director, HUDCO, </span>speaks about the major projects sanctioned by HUDCO: <br /> <ul> <li>A loan amount of Rs 1,000 crore to meet the state government's share for supporting 1 lakh EWS houses in various urban areas of Uttar Pradesh under PMAY (Urban) as part of the affordable housing under partnership component; this scheme will be implemented by the Uttar Pradesh Housing Development Board. </li> <li> <p>A loan of Rs 3,000 crore for meeting the state government's share for supporting 6.25 lakh EWS-SC/ST/OBC households in the rural areas of Uttar Pradesh under PMAY (Gramin); here, beneficiaries availing the funds will construct the houses on their own. This scheme will be implemented by the Uttar Pradesh Rural Housing Board. </p></li> <li> <p>The Uttar Pradesh Government has also been sanctioned a loan assistance of Rs 1,000 crore to take up 1 lakh EWS houses under PMAY (Urban) as part of the beneficiary-led construction component; under this, beneficiaries will receive the grant and construct houses on their own. This scheme is being implemented by the Uttar Pradesh State Urban Development Agency. </p></li> <li> <p>A loan assistance of Rs 216 crore has been sanctioned for resettlement and rehabilitation of 400 project-affected families at the Heavy Engineering Corporation site. <br /> </p></li> <li> <p>The loan has been sanctioned to the Planning & Finance Department of the Jharkhand Government.</p></li></ul> <p>In addition, Dr Kanth lists a few major proposals already received and under appraisal in the housing sector: <br /> </p> <ul> <li>The Andhra Pradesh Government has approached HUDCO for a loan assistance of Rs 506 crore to take up 55,000 EWS houses under the NTR Rural Housing Programme. </li> <li>The Andhra Pradesh Government has also approached HUDCO for another loan assistance of Rs 3,680 crore to take up 400,000 EWS houses under the NTR Rural Housing Programme.</li></ul> <span style="font-weight: bold;">More Policy Measures from National Housing Bank</span><br /> NHB has signed several MoUs with primary lending institutions under PMAY-CLSS for EWS and LIG. These include 77 housing finance companies, 19 public-sector banks, 13 private-sector banks, and several other regional rural banks, cooperative banks, small finance companies and NBFC-MFI, as on August 31, 2017. <span style="font-weight: bold;">Sriram Kalyanaraman, Managing Director, National Housing Bank (NHB),</span> says, 'I am seeing a high level of interest for affordable housing primarily driven by the government's initiative in affordable housing underlined by its policy measures; state governments also making affordable housing a goal; and the boost given by the four verticals of PMAY.' He adds that NHB is working with the Centre and state governments to take more policy measures to facilitate more supply into the affordable housing segment. <p></p> <p>NHB does not lend to the builders directly. It is constrained on how it can finance the housing finance companies or banks who have lend to builders. 'We have a Rs 50,000-crore portfolio where we refinance the banks and HFCs,' says Kalyanaraman.</p> <p>What's more, the housing ministry has asked NHB to promote CLSS. As Kalyanaraman says, 'NHB has already crossed the Rs 1,000-crore subsidy mark with 48,000 households getting benefitted under the EWS and LIG segments, and we expect this will double this year.'</p> <p> Eight Models for Affordable Housing on Public Land under the PPP Model<br /> Following detailed internal deliberations and seeking comments from all stakeholders including state governments and the private sector, Hardeep Singh Puri, Union Minister of State with Independent Charge, Ministry of Housing and Urban Affairs, Government of India, announced eight models for affordable housing on public land under the PPP model at a recent NAREDCO event in Mumbai:</p> <p><span style="font-weight: bold;">1. The government, land-based subsidised housing:</span> Government land will be offered to private builders for building a specified number of affordable houses based on the lower cost of construction. Builders will design, finance, construct and hand over the houses to the government, who will pay the builder. The government will then transfer these houses to the beneficiaries.</p> <p><span style="font-weight: bold;">2. Mixed development cross-subsidised housing:</span> Government land will be given based on the number of affordable housing units that will be developed. This will be cross-subsidised from the revenues of high-end house constructions and commercial development.</p> <p><span style="font-weight: bold;">3. Annuity-based subsidised housing: </span>This model allows builders to invest against deferred annuity payments by the government. Land is allotted based on cost of construction.</p> <p><span style="font-weight: bold;">4. Annuity-cum-capital grant-based subsidised housing</span>. Under this hybrid model, besides annuity payment, builders would be given a share of the project cost by the government as upfront payment. Land allocation will be based on the unit cost of construction.</p> <p><span style="font-weight: bold;">5. Direct relationship ownership housing:</span> Promoters will directly deal with buyers and recover the cost. Land allocation will be based on the unit cost of construction. </p> <p><span style="font-weight: bold;">6. Direct relationship rental housing:</span> The difference here is that developers will recover cost through rental payments. </p> <p><span style="font-weight: bold;">7. Private land-based subsidised housing with interest subsidy for EWS, LIG and MIGs: </span>Government support in the form of interest subsidy under the CLSS component of PMAY (Urban) will be extended to affordable housing units taken up even on private land. Interest subsidy is 6.50 per cent for EWS and LIG and 4 per cent for MIG if annual income is between Rs 6 lakh and Rs 12 lakh, and 3 per cent if it is between Rs 12 lakh and Rs 18 lakh.</p> <p><span style="font-weight: bold;">8. Affordable housing in partnership with private sector for EWS:</span> Government support worth Rs 1.5 lakh for each affordable housing unit to be built on private lands would be allowed under this model.</p> <p> <span style="font-weight: bold;">- SHRIYAL SETHUMADHAVAN & SERAPHINA D'SOUZA</span></p> <p> To share your views on the business in the affordable housing segment in India, write in at feedback@ConstructionWorld.in</p>

Della, Hiranandani & Krisala unveil Rs 11 billion themed township in Pune

In a first-of-its-kind initiative, Della Resorts & Adventure has partnered with Hiranandani Communities and Krisala Developers to develop a Rs 11 billion racecourse-themed township in North Hinjewadi, Pune. Based on Della’s proprietary CDDMO™ model, the hospitality-led, design-driven project aims to deliver up to 9 per cent returns—significantly higher than the typical 3 per cent in residential real estate.Spanning 40 acres within a 105-acre master plan, the mega township will feature an 8-acre racecourse and international polo club, 128 private villa plots, 112 resort residences, a ..

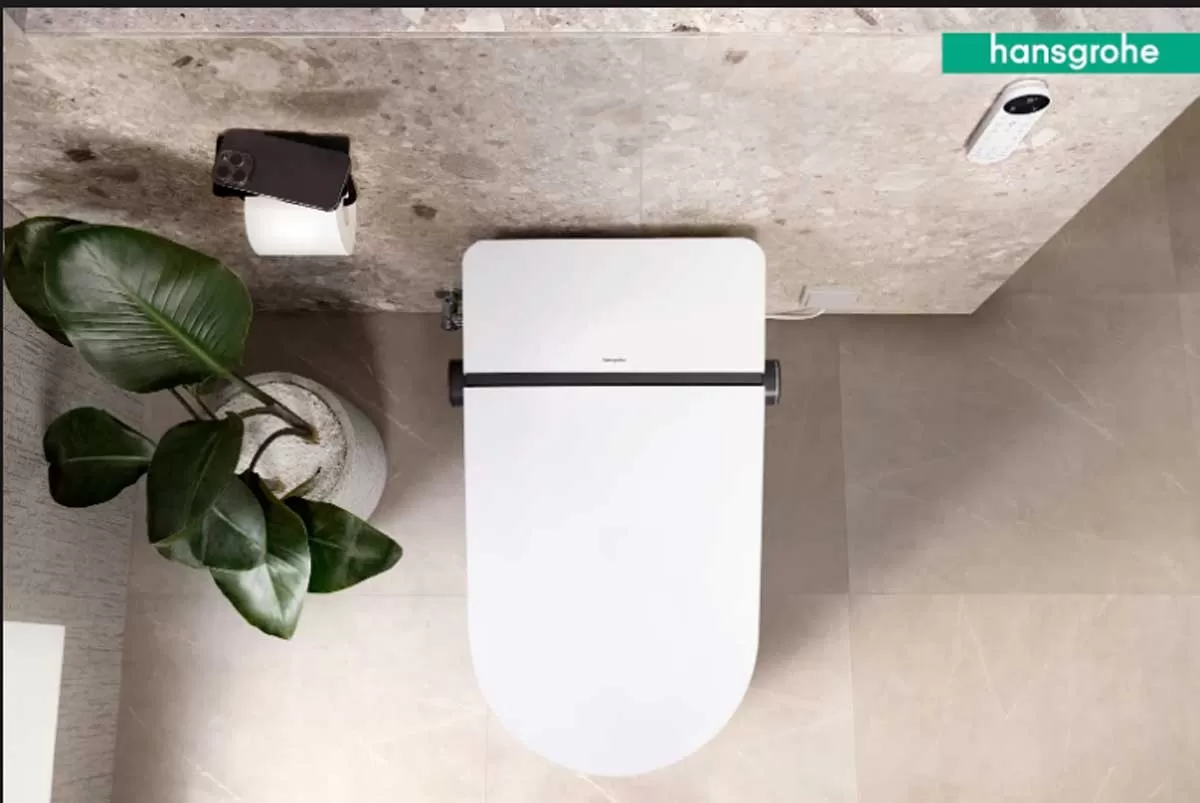

Hansgrohe unveils LavaPura Element S e-toilets in India

Hansgrohe India has launched its latest innovation, the LavaPura Element S e-toilet series, introducing a new standard in hygiene-focused, smart bathroom solutions tailored for Indian homes and high-end hospitality spaces.Blending German engineering with minimalist aesthetics, the LavaPura Element S combines intuitive features with advanced hygiene technology. The series is designed for easy installation and optimal performance under Indian conditions, reinforcing the brand’s focus on functional elegance and modern convenience.“With evolving consumer preferences, smart bathrooms are no lon..

HCC Net Profit Stands at Rs 2.28 Billion for Q4 FY25

Hindustan Construction Company (HCC) reported a standalone net profit of Rs 2.28 billion in Q4 FY25, a sharp increase from Rs 388 million in Q4 FY24. Standalone revenue for the quarter stood at Rs 13.30 billion, compared to Rs 14.28 billion in Q4 FY24. For the full fiscal year, the company reported a standalone net profit of Rs 849 million, down from Rs 1.79 billion in FY24. Standalone revenue for FY25 was Rs 48.01 billion, compared to Rs 50.43 billion in the previous year.Consolidated revenue for Q4 FY25 stood at Rs 13.74 billion, and for FY25 at Rs 56.03 billion, down from Rs 17.73 billion i..

Latest Updates

Advertisement

Recommended for you

Advertisement

Subscribe to Our Newsletter

Get daily newsletters around different themes from Construction world.

Advertisement

Advertisement

Advertisement

subscribe to the newsletter

Don't miss out on valuable insights and opportunities

to connect with like minded professionals