BMC Gets CRZ Nod For Rs 40 Million Gorai Bridge Rebuild

The Brihanmumbai Municipal Corporation (BMC) has secured Coastal Regulation Zone (CRZ) clearance for the reconstruction of the Poisar River bridge in Gorai, located in Mumbai’s western suburbs. However, the proposed demolition of the existing 100-metre bridge has sparked opposition from local residents, who claim it serves as the only direct access route between the Lower and Upper Koliwada areas. The three-decade-old bridge, situated within the CRZ buffer zone, was recently declared structurally unsafe following a civic audit. The BMC has sanctioned its reconstruction at an estimated cost ..

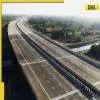

NHAI Completes Rs 15.9 Billion Four-Lane Stretch On ECR

The National Highways Authority of India (NHAI) has completed the four-laning of the 38 km Puducherry–Poondiyankuppam stretch, ending near Cuddalore, in a development that will cut travel time by up to two hours, according to a report by The New Indian Express. The upgraded section, built at a cost of Rs 15.9 billion under the Bharatmala Pariyojana Phase I, marks a major milestone in the ongoing East Coast Road (ECR) widening programme. The project promises a smoother, faster drive for motorists travelling towards Cuddalore, Chidambaram, Sirkazhi, and Nagapattinam. With this completion, 22..

Encroachments Delay Rs 1 Billion Ghatkopar Bridge Project

The construction of a new cable-stayed rail overbridge at Ghatkopar and the widening of the Andheri–Ghatkopar Link Road (AGLR) have been delayed due to the presence of nearly 250 encroached structures on both sides of the road. In response, Municipal Commissioner Bhushan Gagrani has directed officials to carry out a structural audit of the existing bridge over the railway line and enforce temporary restrictions on heavy vehicles to ensure public safety. The bridge, which starts at the Golibar Road junction near LBS Marg and extends up to the Eastern Express Highway (EEH), serves as a critic..