- Home

- Real Estate

- Centres of opportunity

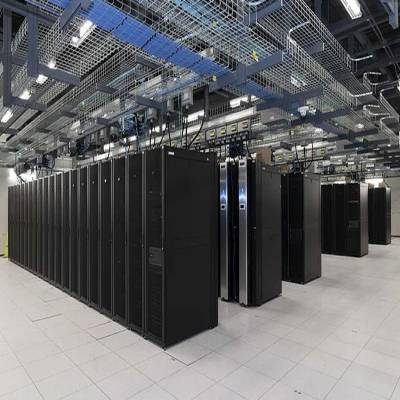

Centres of opportunity

Data centres can be over 40 times as energy-intensive as conventional office buildings

Did you know?

- Tata Communications plans to invest $200 million to double its data centre capacity in India from 5 lakh sq ft to 10 lakh sq ft over three years.

- IBM plans to open a new cloud services data centre in India this year.

- Netmagic Solutions is building a 1-million-sq-ft data centre in Bengaluru.

- A data centre under development for ESDS in Navi Mumbai with a floor space of 180,000 sq ft is likely to commence operation early next year.

- Reliance Jio Infocomm is setting up 14 data centres across India.

- Engineers India Ltd is constructing data centres in Delhi and Bengaluru for the Unique Identification Authority of India.

That´s not all. The Department of Electronics and Information Technology, Government of India, is planning to set up a national cloud-based network that connects all state data centres and make the network the backbone of the national e-governance plan. It has invited proposals from several IT companies to set up and maintain private clouds in each state.

Evidently, data centres, which entered India in the mid-1990s, are now ubiquitous. More important, they are crucial to the functioning of every sector - from IT, telecom and banking to finance, healthcare, education, entertainment, social media and government. While client-owned and operated captive data centres are more prevalent in India, hosted data centres or third-party service providers who provide infrastructure and maintenance to clients are also on the rise. According to estimates, there are around 50,000 in-house data centres and 99 hosted data centres in the country. Over 16 state goverments in India have fully functional data centres. And data centre space grew from about 3.4 million sq ft in 2009 to about 5.2 million sq ft in 2012.

¨The market is huge in terms of requirements with driving factors such as managing large data; multiple applications; statutory data retention policy; multiple locations connected with real-time applications; and data voice video over IP network, etc. As per the American IT research firm Gartner Inc, the Indian Data Center market would experience consistent growth through 2016 and is expected to reach $1.3 billion by then with a CAGR of 21.23 per cent,¨ states Anindya Sengupta, Managing Consultant-Consulting, PwC India. ¨Green data centres, cloud computing, nuclear-proof data centres, SAAS, data centre in a box (container) and data centre consolidation are the emerging trends in India.¨ Some key players among third-party service providers include Tata Communications, Netmagic Solutions, Reliance Data Centre, CtrlS Data Centres, Sify Technologies and Spectranet Solutions while IBM, HP, Wipro, HCL, TCL, Emerson, Schneider Electric and UTC are some major companies providing hardware equipment, software solutions and other services like power and security.

The opportunities

The emerging data centre market has no doubt opened up myriad opportunities for stakeholders, from software service providers and hardware equipment suppliers to architects, builders and vendors.

¨Data centres are opening up many opportunities for small and mid-size businesses (SMB) who can now compete with big players with minimum investments,¨ affirms Piyush Somani, Managing Director, ESDS Software Solution Pvt Ltd. ¨Some areas where SMBs can capitalise on are healthcare; online training providing virtual desktop infrastructure; back-office services by leveraging SaaS; video and teleconferencing services; software-testing services and document management services.¨

It has also opened up new doors for the construction industry. ¨There has been a huge business opportunity created with the emergence of the data centre industry, thereby providing ample scope for architects to design such facilities,¨ points out Ratan Batliboi, Chairman, Ratan J Batliboi Consultants Pvt Ltd. ¨Data centres are specialised buildings and, unlike other buildings, the services provided here are phenomenal in nature. Hence, they have to be designed with knowledge and understanding of each of these services and with utmost precision.¨

What´s more, data centres have changed market dynamics.

¨In the pre-data centre era, software service providers had to get software installed at different client locations, which was time consuming,¨ says Somani. ¨Clients had to invest in hardware required for installation and execution of application software, apart from investing upfront on the platform required for the software to run. Clients generally either purchased or rented software through an ASP (application service provider). With the move to the data centre world, clients can now leverage the infrastructure, platform and software on a rented model. Cloud computing has fuelled SaaS, wherein applications are hosted and managed in a service provider´s data centre paid for on a subscription basis and accessed via a browser over an Internet connection.

As businesses see many potential benefits from the SaaS model, software as a service market has almost touched $20 billion.¨ ESDS currently has a data centre in Nashik, the first green data centre in Maharashtra, and an upcoming one in Navi Mumbai.

The design

Maximising real-estate resources is one of the most critical aspects of data centre design. As business environments constantly evolve, data centre planning needs to keep pace. However, construction as such is not a big issue, say industry experts. ¨Data centres need special expertise in design and administration,¨ says Sengupta. ¨However, construction is not a primary concern because given a design and BOM (bill of material), any construction company can build a data centre.¨

PS Badrinarayan, Senior Associate, Shirish Patel & Associates Consultants Pvt Ltd (SPA), concurs, saying, ¨As such there are no special factors in the structural design, construction or use of materials. Only the live loads as given by the owner will be higher than normally considered for commercial buildings. We have considered live loads varying from 1,200-1,500 kg per sq m for server loads and up to 2,000-2,500 kg per sq m in certain areas for UPS systems or other equipment. (Live loads for commercial buildings are normally 400 kg per sq m). Further, the owner may specify higher importance factor for seismic loads; normally, buildings are designed for an importance factor of 1.0, but data centres may be designed for 1.5 or 2.0 as per the owner´s specs. In one of the data centres we designed, owing to an adjacent firing range that sometimes caused ground vibrations during test firing, we provided a full height RCC wall on the building perimeter to prevent transfer of any minor vibrations to the server floor.¨ SPA has provided the structural design for two Internet data centres for Tata Communications in Mumbai and Pune.

¨The structural cost of a data centre would be higher than normal commercial buildings owing to higher live loads and seismic factors,¨ adds Badrinarayan. The cost of setting up a data centre is between Rs 20,000 and Rs 25,000 per sq ft if it is developed in-house. By outsourcing, a company can save over 30 per cent costs (capex and opex).

Construction aside, from the architectural angle, several aspects have to be taken into consideration, as Batliboi points out. Important factors to be considered include the structure of the building and space planning, which is intended for modularity and allows for better disaster management and servicing safety of the server farms. In addition, utilities also have to be designed in a modular manner, thereby saving on capital investment. From the perspective of the environment, the architect must propose the best design and orientation to help reduce heat gain, increase self-shading, optimise natural light and encourage the use of alternate energy to cater to general lighting.¨

The concerns

While data centres are essential for the operation of the digital economy, there has been mounting concern on the large amounts of energy they consume owing to the high power requirements of equipment and cooling infrastructure needed to support it. There are some energy-efficient practices that data centres can put into place to reduce power consumption. ¨Increased utilisation of blade chassis instead of rack servers can help as blade servers consume less power,¨ shares Somani. ¨Average power utilisation of any rack or blade server is always close to 35 per cent if it is not virtualised. Therefore, virtualisation of servers is a key measure to reduce power consumption. ESDS promotes offering of virtualised resources to its customers through eNlight cloud, which has a feature to auto-shutdown cloud nodes if they are not in use. ESDS will shortly offer servers based on the ARM processor that consumes very little power.¨ ESDS data centres are built on the green data centre concept where necessary provisions are made to reduce the sensible heat load by using dual walls with 4-ft cavity, vermiculite material, and so on.

Another major concern is loss of data or interference with data availability owing to accidents, fire or natural disasters.

¨Fire is one of the most serious risks facing data centres,¨ asserts Amit Maheshwari, Director-Marketing and Strategy, UTC Climate, Controls & Security India. ¨Critical facilities are highly susceptible to fires caused by overheated electronic components, faulty wiring, power surges, lightning strikes, arsonists and even terrorists. Hence, data centres must have the highest level of fire protection, ideally incorporated into the overall security solution.¨ A leading company providing heating, air-conditioning and refrigeration systems, building controls, automation and fire and security solutions, UTC CCS has been involved with several international and Indian data centres.

Security is another concern, as Somani explains. ¨Security is one of the major concerns when using a third-party infrastructure provider. Despite the cloud provider´s best efforts, connectivity and outages are still a possibility. For certain kind of software, like the ones related to finance, compliance is a very big concern. For businesses that use SaaS from multiple SaaS providers or want the SaaS application to be integrated with one of their in-house hosted applications, the challenge is overwhelming and in many cases is not even a possibility.¨

Last, data centres must be built with considerable redundancy for network access, storage capacity and emergency power systems. This results in additional cost and complicates management. Moreover, high real-estate costs also compel data centre owners to locate them in inexpensive areas, thereby increasing the network delay to the final user and complexity associated with providing support and maintenance.

The challenges

What´s more, the challenges before data centre developers and managers are manifold, ranging from energy supplies and management of costs to keeping the facility cool, adopting sustainable practices and facing competition from within the country and outside. ¨The major challenges faced in these projects both in India and internationally are availability of power, fluctuating loads within the data centres and ambient conditions within the data centres,¨ says Maheshwari. Lack of quality real-estate supply, persistent power outages, poor connectivity and outdated policies are areas the Government needs to look into to create the right environment for data centre development. These are the factors that have reportedly resulted in India losing out business to countries like Singapore, Hong Kong and Taiwan.

In fact, India has been ranked the second most risk-prone location for hosting data centre operations, according to the annual Datacenter Risk Index 2013 survey released by international consultants Cushman & Wakefield in association with hurleypalmerflatt and Source8. India ranked high on parameters such as Cost of Labour (rank 4) and Sustainability (6), and moderately on the parameters of Political Stability (13) and International Bandwidth (16). However, the country scored low on key factors such as Energy Cost (25), Ease of Doing Business (30), Natural Disasters (28), Energy Security (28), Corporation Tax (28) and Education Level (28). However Arvind Nandan, Executive Director, Consultancy Services, Cushman & Wakefield, says it´s not all bad news. ¨Although the country ranks low compared to others included in the index, India presents some marked advantages, such as labour cost, high degree of operational sustainability and political stability. India has also scored high on international bandwidth, which is crucial for data centre operations in any location. Data centres that value these aspects above others will definitely find the country a viable location.¨

Clearly, there are several challenges ahead - some technological, others organisational - and overcoming them may not be easy. Yet, industry pundits predict significant growth with increased adoption of third-party data centre services. In their view, cheaper bandwidth and heightened interest in implementation of technologies, like cloud computing and grid computing, will combine to propel India as a future hot spot for data centres.

Quick Bytes

- On the rise: Hosted data centres or third-party service providers.

- Government to set up a national cloud-based network as the backbone of the ational e-governance plan.

- Cost: `20,000 to `25,000 per sq ft, if developed in-house.

- Emerging trends: Green data centres, cloud computing, SAAS, etc.

No. of data centres in India

Currently, there are 99 data centres in India

India Data Centre market is expexcted to reach 1.3 billion by 2016.

The biggest data centre in the world is the Lakeside Technology Centre in Chicago (1.1 million sq ft, or 11 million sq ft) and the next biggest is the QTS Metro Data Centre in Atlanta (9.7 lakh sq ft).

- Data Centres

- Construction

- Tata Communications

- IBM

- ESDS

- Reliance

- Jio Infocomm

- Electronics

- Information Technology

- IP Network

- Gartner Inc

- Indian Data Center

- CAGR

- Anindya Sengupt

- PwC India

- SAAS

- Green Data Centres

- CtrlS Data Centres

- Sify Technologies

- Spectranet Solutions

- Wipro

- HCL

- TCL

- Emerson

- Schneider Electric

- UTC

- SMB

- Piyush Somani

- ESDS Software Solution Pvt Ltd

- Ratan Bat

The large-scale movement towards digital information has fuelled the growth of data centres in India, which in turn has opened new opportunities for the construction industry. Data centres can be over 40 times as energy-intensive as conventional office buildings Did you know? Tata Communications plans to invest $200 million to double its data centre capacity in India from 5 lakh sq ft to 10 lakh sq ft over three years. IBM plans to open a new cloud services data centre in India this year. Netmagic Solutions is building a 1-million-sq-ft data centre in Bengaluru. A data centre under development for ESDS in Navi Mumbai with a floor space of 180,000 sq ft is likely to commence operation early next year. Reliance Jio Infocomm is setting up 14 data centres across India. Engineers India Ltd is constructing data centres in Delhi and Bengaluru for the Unique Identification Authority of India. That´s not all. The Department of Electronics and Information Technology, Government of India, is planning to set up a national cloud-based network that connects all state data centres and make the network the backbone of the national e-governance plan. It has invited proposals from several IT companies to set up and maintain private clouds in each state. Evidently, data centres, which entered India in the mid-1990s, are now ubiquitous. More important, they are crucial to the functioning of every sector - from IT, telecom and banking to finance, healthcare, education, entertainment, social media and government. While client-owned and operated captive data centres are more prevalent in India, hosted data centres or third-party service providers who provide infrastructure and maintenance to clients are also on the rise. According to estimates, there are around 50,000 in-house data centres and 99 hosted data centres in the country. Over 16 state goverments in India have fully functional data centres. And data centre space grew from about 3.4 million sq ft in 2009 to about 5.2 million sq ft in 2012. ¨The market is huge in terms of requirements with driving factors such as managing large data; multiple applications; statutory data retention policy; multiple locations connected with real-time applications; and data voice video over IP network, etc. As per the American IT research firm Gartner Inc, the Indian Data Center market would experience consistent growth through 2016 and is expected to reach $1.3 billion by then with a CAGR of 21.23 per cent,¨ states Anindya Sengupta, Managing Consultant-Consulting, PwC India. ¨Green data centres, cloud computing, nuclear-proof data centres, SAAS, data centre in a box (container) and data centre consolidation are the emerging trends in India.¨ Some key players among third-party service providers include Tata Communications, Netmagic Solutions, Reliance Data Centre, CtrlS Data Centres, Sify Technologies and Spectranet Solutions while IBM, HP, Wipro, HCL, TCL, Emerson, Schneider Electric and UTC are some major companies providing hardware equipment, software solutions and other services like power and security. The opportunities The emerging data centre market has no doubt opened up myriad opportunities for stakeholders, from software service providers and hardware equipment suppliers to architects, builders and vendors. ¨Data centres are opening up many opportunities for small and mid-size businesses (SMB) who can now compete with big players with minimum investments,¨ affirms Piyush Somani, Managing Director, ESDS Software Solution Pvt Ltd. ¨Some areas where SMBs can capitalise on are healthcare; online training providing virtual desktop infrastructure; back-office services by leveraging SaaS; video and teleconferencing services; software-testing services and document management services.¨ It has also opened up new doors for the construction industry. ¨There has been a huge business opportunity created with the emergence of the data centre industry, thereby providing ample scope for architects to design such facilities,¨ points out Ratan Batliboi, Chairman, Ratan J Batliboi Consultants Pvt Ltd. ¨Data centres are specialised buildings and, unlike other buildings, the services provided here are phenomenal in nature. Hence, they have to be designed with knowledge and understanding of each of these services and with utmost precision.¨ What´s more, data centres have changed market dynamics. ¨In the pre-data centre era, software service providers had to get software installed at different client locations, which was time consuming,¨ says Somani. ¨Clients had to invest in hardware required for installation and execution of application software, apart from investing upfront on the platform required for the software to run. Clients generally either purchased or rented software through an ASP (application service provider). With the move to the data centre world, clients can now leverage the infrastructure, platform and software on a rented model. Cloud computing has fuelled SaaS, wherein applications are hosted and managed in a service provider´s data centre paid for on a subscription basis and accessed via a browser over an Internet connection. As businesses see many potential benefits from the SaaS model, software as a service market has almost touched $20 billion.¨ ESDS currently has a data centre in Nashik, the first green data centre in Maharashtra, and an upcoming one in Navi Mumbai. The design Maximising real-estate resources is one of the most critical aspects of data centre design. As business environments constantly evolve, data centre planning needs to keep pace. However, construction as such is not a big issue, say industry experts. ¨Data centres need special expertise in design and administration,¨ says Sengupta. ¨However, construction is not a primary concern because given a design and BOM (bill of material), any construction company can build a data centre.¨ PS Badrinarayan, Senior Associate, Shirish Patel & Associates Consultants Pvt Ltd (SPA), concurs, saying, ¨As such there are no special factors in the structural design, construction or use of materials. Only the live loads as given by the owner will be higher than normally considered for commercial buildings. We have considered live loads varying from 1,200-1,500 kg per sq m for server loads and up to 2,000-2,500 kg per sq m in certain areas for UPS systems or other equipment. (Live loads for commercial buildings are normally 400 kg per sq m). Further, the owner may specify higher importance factor for seismic loads; normally, buildings are designed for an importance factor of 1.0, but data centres may be designed for 1.5 or 2.0 as per the owner´s specs. In one of the data centres we designed, owing to an adjacent firing range that sometimes caused ground vibrations during test firing, we provided a full height RCC wall on the building perimeter to prevent transfer of any minor vibrations to the server floor.¨ SPA has provided the structural design for two Internet data centres for Tata Communications in Mumbai and Pune. ¨The structural cost of a data centre would be higher than normal commercial buildings owing to higher live loads and seismic factors,¨ adds Badrinarayan. The cost of setting up a data centre is between Rs 20,000 and Rs 25,000 per sq ft if it is developed in-house. By outsourcing, a company can save over 30 per cent costs (capex and opex). Construction aside, from the architectural angle, several aspects have to be taken into consideration, as Batliboi points out. Important factors to be considered include the structure of the building and space planning, which is intended for modularity and allows for better disaster management and servicing safety of the server farms. In addition, utilities also have to be designed in a modular manner, thereby saving on capital investment. From the perspective of the environment, the architect must propose the best design and orientation to help reduce heat gain, increase self-shading, optimise natural light and encourage the use of alternate energy to cater to general lighting.¨ The concerns While data centres are essential for the operation of the digital economy, there has been mounting concern on the large amounts of energy they consume owing to the high power requirements of equipment and cooling infrastructure needed to support it. There are some energy-efficient practices that data centres can put into place to reduce power consumption. ¨Increased utilisation of blade chassis instead of rack servers can help as blade servers consume less power,¨ shares Somani. ¨Average power utilisation of any rack or blade server is always close to 35 per cent if it is not virtualised. Therefore, virtualisation of servers is a key measure to reduce power consumption. ESDS promotes offering of virtualised resources to its customers through eNlight cloud, which has a feature to auto-shutdown cloud nodes if they are not in use. ESDS will shortly offer servers based on the ARM processor that consumes very little power.¨ ESDS data centres are built on the green data centre concept where necessary provisions are made to reduce the sensible heat load by using dual walls with 4-ft cavity, vermiculite material, and so on. Another major concern is loss of data or interference with data availability owing to accidents, fire or natural disasters. ¨Fire is one of the most serious risks facing data centres,¨ asserts Amit Maheshwari, Director-Marketing and Strategy, UTC Climate, Controls & Security India. ¨Critical facilities are highly susceptible to fires caused by overheated electronic components, faulty wiring, power surges, lightning strikes, arsonists and even terrorists. Hence, data centres must have the highest level of fire protection, ideally incorporated into the overall security solution.¨ A leading company providing heating, air-conditioning and refrigeration systems, building controls, automation and fire and security solutions, UTC CCS has been involved with several international and Indian data centres. Security is another concern, as Somani explains. ¨Security is one of the major concerns when using a third-party infrastructure provider. Despite the cloud provider´s best efforts, connectivity and outages are still a possibility. For certain kind of software, like the ones related to finance, compliance is a very big concern. For businesses that use SaaS from multiple SaaS providers or want the SaaS application to be integrated with one of their in-house hosted applications, the challenge is overwhelming and in many cases is not even a possibility.¨ Last, data centres must be built with considerable redundancy for network access, storage capacity and emergency power systems. This results in additional cost and complicates management. Moreover, high real-estate costs also compel data centre owners to locate them in inexpensive areas, thereby increasing the network delay to the final user and complexity associated with providing support and maintenance. The challenges What´s more, the challenges before data centre developers and managers are manifold, ranging from energy supplies and management of costs to keeping the facility cool, adopting sustainable practices and facing competition from within the country and outside. ¨The major challenges faced in these projects both in India and internationally are availability of power, fluctuating loads within the data centres and ambient conditions within the data centres,¨ says Maheshwari. Lack of quality real-estate supply, persistent power outages, poor connectivity and outdated policies are areas the Government needs to look into to create the right environment for data centre development. These are the factors that have reportedly resulted in India losing out business to countries like Singapore, Hong Kong and Taiwan. In fact, India has been ranked the second most risk-prone location for hosting data centre operations, according to the annual Datacenter Risk Index 2013 survey released by international consultants Cushman & Wakefield in association with hurleypalmerflatt and Source8. India ranked high on parameters such as Cost of Labour (rank 4) and Sustainability (6), and moderately on the parameters of Political Stability (13) and International Bandwidth (16). However, the country scored low on key factors such as Energy Cost (25), Ease of Doing Business (30), Natural Disasters (28), Energy Security (28), Corporation Tax (28) and Education Level (28). However Arvind Nandan, Executive Director, Consultancy Services, Cushman & Wakefield, says it´s not all bad news. ¨Although the country ranks low compared to others included in the index, India presents some marked advantages, such as labour cost, high degree of operational sustainability and political stability. India has also scored high on international bandwidth, which is crucial for data centre operations in any location. Data centres that value these aspects above others will definitely find the country a viable location.¨ Clearly, there are several challenges ahead - some technological, others organisational - and overcoming them may not be easy. Yet, industry pundits predict significant growth with increased adoption of third-party data centre services. In their view, cheaper bandwidth and heightened interest in implementation of technologies, like cloud computing and grid computing, will combine to propel India as a future hot spot for data centres. Quick Bytes On the rise: Hosted data centres or third-party service providers. Government to set up a national cloud-based network as the backbone of the ational e-governance plan. Cost: `20,000 to `25,000 per sq ft, if developed in-house. Emerging trends: Green data centres, cloud computing, SAAS, etc. No. of data centres in India Currently, there are 99 data centres in India India Data Centre market is expexcted to reach 1.3 billion by 2016. The biggest data centre in the world is the Lakeside Technology Centre in Chicago (1.1 million sq ft, or 11 million sq ft) and the next biggest is the QTS Metro Data Centre in Atlanta (9.7 lakh sq ft).