- Home

- Infrastructure Energy

- POWER & RENEWABLE ENERGY

- Let´s clean UP the mess...

Let´s clean UP the mess...

- Arbitration

- Delayed Projects

- Stalled Projects

- Dispute

- Companies in DEBT

- Pending Clearences

While issues related to banking and financing, claims and contracts continue to discourage contractors, CW highlights problem areas and offers 16 concrete solutions that will help resolve issues and make the construction sector a success.

The Indian construction sector is in an imbroglio and the emergency alarm has been buzzing for a while now. But is anyone listening?The sector today is facing a severe financial crisis, which is fast becoming existential. The fact that this has happened in the middle of ambitious targets, and not owing to lack of projects on offer, clearly indicates that the fundamentals governing infrastructure projects have not been sound. Thus, a thorough review and corrective measures are urgently required.

Over the years, rapid urbanisation and strong population growth have rendered India´s current infrastructure inadequate. The result: A huge funding gap for infra finance today. Also, the country compares poorly on the infrastructure pillar, ranking only 87th out of 148 countries according to a recent report on Global ompetitiveness. To address this gap, the Twelfth Five-Year Plan has earmarked close to $1 trillion to be spent on infrastructure. ´However, the plan envisioned only half of this to come from the public sector,´ says DK Vyas, CEO, Srei BNP Paribas. ´The private sector thus has to play a pivotal role, but is plagued by its own share of challenges.´ Nonetheless, the present day is not completely gloomy. Green shoots are evident, signalled by an uptick in the macroeconomic environment and greater emphasis by the government on infrastructure development. New project announcements are gaining traction and, as reported, the total value of tenders has increased by 62 per cent year-on-year. The government is emphatic about reviving stalled projects, which have declined to 6.6 per cent of GDP in June 2015 compared to 8.4 per cent in March 2014.

All considered, the success of the sector is of paramount importance. It contributes about 8 per cent of the GDP, and is one of the largest generators of employment. Considering that 15 million jobs need to be created each year for the next 20 years, the construction sector will play a key role in this area. Also, its success is also vital for every programme announced by the government (see box on page XX). However, issues related to banking and financing, claims and contracts don´t seem to be getting resolved. While factors like locking funds, delaying judgments, delay in project completion owing to delay in deliverables from the project owner´s end, and others, have been discouraging contractors; there seems to be lack of trust between the government and industry stakeholders. There is a real mess hindering the success of the sector - it needs to be cleaned up.

Current affairs

At present, from an infrastructure perspective as well as projects from related sectors, there are a huge number of stalled projects. Several reasons have led to this situation.

Contracting companies are in deep financial trouble and are on the verge of closure; they have to borrow to pay interest. Land acquisition is another area that affects many of these projects. And subsequently, cumulative effects of multiple issues - financing, environment clearances and others - have stalled projects.

For his part, Siddharth Singh, Secretary-General, Construction Federation of India, holds the Government responsible for the current state of affairs. B Manohar, COO-Head Construction, Lanco Infratech, adds, ´There is a lack of government reforms in contracting methodology across various departments, and each department follows its own agenda.´ And A Ranga Raju, Managing Director, NCC Ltd, shares, ´In the recent past, many leading industry players suffered and are in recovery phase. More investment in the country´s infrastructure is definitely required.´ The industry also expresses that government spending is not happening at the desired level.

But there is no single solution as projects have been stalled for a while, says Arvind Mahajan, Head of Energy, Infrastructure, Healthcare & Government Practice, KPMG. ´Projects that have taken off four to five months ago have been facing issues for two to three years now,´ he points out. And there is a large basic stock of stalled projects that, if cleared, would add significant points to the GDP.

Claims and contracts

Today, contractors are plagued with several contract-related issues. One major issue is non-standardised contracts with various unfair clauses, which include, for example, unconditional bank guarantee encashment and interest on advance payments, provisions for both retention and performance bank guarantees, etc.

´In India, the formulation of construction contracts is pathetic and mostly one-sided,´ says N Kalyanaraman, Joint CEO-Realty and Social Infra, Feedback Infra. ´They are client-oriented, often too heavy on the constructors. It is not uncommon that the contracts are improperly drafted with vague provisions, sometimes even conflicting conditions. This leads to claims and counter claims from either side.´

Further, in the current scenario, there are severe delays in claims settlement or payment across different government employers. According to a recent survey, claims awarded by arbitrators are normally challenged in court by the employer (~6.5 years to settle; 85 per cent of claims raised currently pending (as per analysis from data received from top six EPC companies, for claims related to WIP projects, or projects completed in last three years). What´s more, reports suggest that the government owes Rs 1 lakh crore to the industry by way of various claims. Even if this is overstated and we discount 50 per cent, there is still Rs 50,000 crore of contractor money stuck. A robust system needs to be built to clear that. Here Gurjeet Singh Johar, Chairman, C&C Constructions Ltd, says,´Today, we have claims as old as 14-15 years. How do you survive in a situation like that?´ EPC companies today have a multitude of disputes, most of which consume the time and money of all parties to the contract. Atul Punj, Chairman, Punj Lloyd Group, and Chairman, CII National Committee on Construction, offers four points for quick government action, as these can get the economy moving and take India many notches up in ´ease of doing business´:

- Often, the contracts themselves are not equitable, and are one-sided favouring the owner. The first need is for contracts to be designed in a manner that works for both the owner and contractor.

- There have been instances where bank guarantees given by contractors in the prevailing banking system have been unfairly en-cashed by the owner. There is an urgent need to adopt global best practices like uniform rules for demand guarantees (URDG) to check the abuse of unconditional bank guarantees.

- In the EPC sector, there often exist disputes between owners and contractors over claims, which are resolved only after the expensive and time-consuming process of arbitration or court litigation. The Indian Arbitration Act needs to be amended to put a cap on time for giving the award, a cap on fees, and introduction of strict conditions to go for appeal in court. At present, thousands of crores are stuck in arbitration or courts.

- As a consequence of the issues mentioned above, contractors suffer from serious liquidity crises. As a discrete sector, construction needs to have a one-time debt realignment to be extended to it by the RBI.

To this, Johar adds, ´The most primary requirement is liquidity of equity in the system, which can be achieved by settling claims. What is due to us should be paid because that´s the only way we can survive.´ Supporting this is Praveen Sood, Group CFO, Hindustan Construction Company Ltd: ´If required, a bank guarantee will be given; so one en-cashes the guarantee and takes the money out in case final order is different. This is where we are putting all our efforts.´

Now, through the Arbitration Act, the government is trying to introduce a timeframe within which the case has to be closed with the arbitrator being made accountable if the case is not settled within a given time.

Question of capital

Money, as always, remains a problem. The infrastructure sector has a major volume of jobs and crores worth of government-based projects. Thus, banks can lend them money in the form of funds and non-funds. ´But they have looked at funds from the interest angle,´ says Manohar. ´Initially, banks encouraged contractors to spend money on contracts. But as contractors did not get the desired returns, not even for the interest rate required, banks are now afraid to give loans to the contractor, and that is why the industry is struggling.´ (Read ´Lenders´ Block´ on page XX) Johar suggests raising equity, though this could be expensive. Meanwhile, Sood avers, ´First, we need to start behaving like a contractor. Aggressively bidding to bag a contract, and putting its own money to complete the contract, as client don´t pay on time, needs to come to an end. The government must follow the contract, and everything including land as per the contract should be provided.

Also, whenever debt is due, pursue it hard contractually and legally.´ Getting working capital could be a major task for the industry. As Raju says, ´Many players are resolving issues resulting from exposure to high leverage.´ However, he believes financial institutions are playing a decisive role in controlling overexposure to financial risk in the market.´

On the other hand, Sood maintains that the construction industry does not require working capital as long as it behaves like contractors. ´Contractors do not put money into the project, but works around the client´s money,´ he reasons. ´On bagging a contract, we would get at least 5 per cent to 10 per cent advance money by giving guarantees. All payments are received normally on a monthly basis to us. So, if one works in a proper manner, working capital is not required.´

However, the problem started when projects started witnessing delays. Land acquisition has been a major problem. The contractor would be fully mobilised, yet the work would come to a halt. To get the work going, the contractor would have to put in his own money - and that´s where the problem starts.

Securing loans

Securing loans at lower interest rates would certainly ease the financial pressure. ´Lower interest rates are always welcome because infrastructure projects are so capital-intensive in nature,´ says Raju. RBI has already taken policy initiatives to lower interest rates and this will help the construction industry. However, Sood says, ´As long as a project is happening in time, an interest of 10-12 per cent can be serviced. But when the project gets stalled, 10 per cent becomes a big deal.´ He suggests interest rates should come down by a straight 2 per cent. ´In big economies like China, the US and Europe, funding is made available to infrastructure projects at a rate of not more than 2 per cent and that too for more than 15 to 20 years. In India, we still apply commercial rate, commercial norms, etc, and get funding at 10-12 per cent for not more than 10 to 12 years.´

Raju adds, ´Commercial banks in India generally do not fund projects beyond a 10-year tenure, which needs to be extended up to 15 years in deserving cases.´ Now, the government has approved some takeout schemes by which the loan can be for a longer period. ´In take off funding, after five years, you approach a new banker to take over,´ explains Sood. ´You also have the 5/25 scheme, according to which the loan for an infrastructure project can be refinanced and can be extended for typically 20-25 years.´

The report card

While money, contracts and clearances continue to bedevil the industry, let´s see which sectors are stalled and which ones continue to show potential. Today, sectors in a limbo include hydropower, which has come to a halt in the past five years with no capacity addition. While there is much talk of smart cities, at present, there is not much construction or any other activity on the ground. Airports too have been stalled; but there is hope on the horizon with the new aviation policies. Also, in the past 10 years, no large projects have come up in the metal or steel segment or engineering manufacturing, either from the government or the private sector.

However, amid the dark clouds, the road sector shines through like a silver lining. Here, the authorities are trying a new business model called the hybrid model to offload some risk (like traffic risk and resulting cash-flow stress) from developers and contractors. Recently, the highways sector received a big regulatory boost with the Ministry of Road Transport and Highways clearing amendments to the model concession agreement (MCA) for awarding projects on a BOT basis. These measures will help restore the confidence of developers as well as financiers and other entities. And this is the kind of momentum required across sectors.

´We are seeing good traction in both oil and gas and infrastructure space,´ says Punj, spelling out the positives.

´Public-sector units are planning expansion of refineries and new pipelines. In the infrastructure space, the government has already unfolded its plans for 20,000 km of the National Highways Development Programme (NHDP), its flagship road-building programme, which envisages the development of existing National Highways into world-class roads in different phases with a total investment of $45 billion over the next three years. Moreover, the government is also trying to ease business by providing fiscal incentives and right of way (RoW) for project land is being made available to concessionaires free from all encumbrances, while the National Highways Authority of India (NHAI) is providing capital grant up to 40 per cent of project cost to enhance viability on a case-to-case basis.´ A senior NHAI spokesperson says, ´In the past two to three years, kilometres awarded have been about 1,116 km or 1,350 km and some 3,056 km. At present, we have awarded around 2,330 km. So, the capacity available in the market for project execution is quite good. And, the road sector is highly labour intensive. So the government should accept EPC as the ideal mode of award. Otherwise, at the look of it, the Central Government has been talking about having many road projects.´

Raju tells us that recent announcements on smart cities and water supply projects across the country are ´welcomed by the industry,´ while Kalyanaraman says, ´The sectors that are in momentum, though slowing down recently, are housing, commercial and core infrastructure, particularly highways.´ And in Mahajan´s view, the railways hold a lot of promise. ´Railway Minister Suresh Prabhu is doing a fair amount of activity to push on the railways front,´ he says. ´There is a lot expected, especially in station development.´

United we stand

All considered, a united approach is the best way ahead for all stakeholders to convert this positive momentum into actual gains. It took about 15 years for the software market to grow and become a success in India, with NASSCOM playing a key role in uniting the sector. Can the construction industry take a cue from this? For his part, Johar says the industry being united is a far cry because the environment or the situation of every company is different, and now it´s a question of survival. However, Mahajan believes various parties will have to unite to resolve issues. While this might not be a workable solution for all projects, he believes that a mechanism needs to be created for the top 50-100 stalled projects, ´where bankers, promoters and the government come together to view them.´

Moving ahead, bodies like Project Monitoring Group (PMG) and the Construction Federation of India (CFI) can also play a key role in resolution.

´PMG does not clear any projects,´ says Dr VP Joy, Joint Secretary, Cabinet Secretariat and Head, Project Monitoring Group (PMG). ´It has been facilitating the resolution of issues by various ministries or state governments. So far, for central ministries, out of 668 projects considered by PMG, 313 projects have been fully resolved and in 83 projects, no further action or intervention is required from PMG. Thus, at present, 275 projects with 533 issues are under the consideration of PMG. Most of the resolved projects belong to sectors like power, steel, roads, railways, coal and civil aviation, and most have a significant construction component.´

Sood weighs in here, saying, ´Any advisory body will not serve the purpose unless it is given complete authority.´

And Punj adds, ´Today, the industry stands together on platforms such as the CII National Committee on Construction, through which it collectively seeks support from the government.´

Going forward, Mahajan is positive, provided the sector moves in the right direction and the right framework is in place. ´Five to 10 years down the line, the hope is to have a world-class construction and infrastructure industry,´ he envisions. Johar is quick to add a disclaimer: ´Provided there is enough business, and no money held up!´

Given the mammoth construction opportunity in the country - and all problems being addressed - what then is the execution strength that India needs? Well, a guesstimate would be 25-30 contracting companies of the size of L&T. That said, read on for our proposed 16 action points for the government to pave the way ahead.

Quick Bytes

Construction sector contributes to 8% of India´s GDP.

Stalled projects: Declined to 6.6% of GDP in June 2015 compared to 8.4% in March 2014.

Major issues are related to banking and financing, claimsand contracts.

Quality infrastructure is critical for the competitiveness of govt programmes.

Lenders´ Block

Banks and financing institutions have been exercising caution in financing owing to their experiences over the past few years. In the recent past, it has been challenging for developers to achieve financial closure and contractors have been struggling with funding their working capital requirements.

´The rising proportion of non-performing assets (NPAs) (as reported, upwards of 4.5 per cent of their total advances) has led to higher provisioning and reduced capital availability for almost all banks, particularly the PSU banks,´ says Mukund Gajanan Sapre, Executive Director, IL&FS Transportation Networks Ltd. ´In the case of PPPs, where the toll model is being adopted, banks have shown less interest compared to annuity or assured revenue models.´

Financiers have been getting increasingly averse to fund projects owing to sectoral caps being achieved and overall exposure limit restraint to individual group companies. Banks are also avoiding further lending of the sanctioned debt till assurances are given on the project work front availability (which is in the obligation of the project proponent) and till the borrowing company details its cash generation plan to fund the loan's interest and principal repayment.

DK Vyas, CEO, Srei BNP Paribas, agrees that ´availability and ease of funding´ are the biggest challenges faced by the industry. He adds that it has also been tough for the traditional banking segment to lend to this industry ´on account of asset liability mismatches as infrastructure development involves long gestation periods.´ All considered, the past couple of years have been testing for the industry, leading to deteriorating asset quality and rising stressed assets, further impeding the growth of finance to this segment.

Current approach towards lending

Banking and NBFC segments are still burdened with the stressed asset of this sector. Vyas says, ´The infrastructure sector contributed to about 30 per cent of the total stressed advanced of all scheduled commercial banks as on December 2014. To add to this, the credit quality of the companies in this sector has also taken a beating in the past couple of years and there is visible stress on the balance sheets in terms of high leverages.´

However, Sapre says, ´Issues in the earlier concessions and contracts that were hindering the flow of funds to the sector have now been addressed.´ He adds that the advent of new concession models such as hybrid annuity, where the revenue risk lies with the client, will find better acceptance among the lenders. It accounts for interest fluctuation and accords due recognition to the bidder's total project cost assessment while funding 40 per cent of the project cost over the construction period; this reduces the extensive dependence on banks and financial institutions. Adding to the factors that have seen more willingness by the banks, he says, ´The plug-´n´-play model is being adopted by clients in projects recently bid out where almost 100 per cent work front will be provided.´

As soon as these innovations and improvements are brought to the fore by project proponents, banks and financial institutes are likely to shed their cautious approach.

Restructuring and refinancing

Last year, RBI allowed lenders to restructure existing loans above Rs 500 crore to infrastructure and core industries´ projects. Also, banks and financial institutions were given an option to periodically refinance such loans.

´While the move to restructure loans is welcome, we need to take care of the growing menace of stressed assets, especially infrastructure assets,´ says Vyas. In stressed infrastructure assets, promoters run out of resources, are unable to manage the risks or are unable to come up with the right capital structure. In such cases, ´a change in management or partner should be the ideal approach to revive an infrastructure project,´ he suggests.

Also, as reported, many companies are lining up to avail the 5/25 scheme extended by RBI. To this, Sapre says, ´The model provides restructuring of principal and does not cater to the interest burden.´ Hence, despite the option, overall enthusiasm from developers and banks is not visible.

Further, the Government is considering the option of allowing banks to take over projects from the borrowers and try to turn them around. ´Attempting a turnaround of such stalled projects is always a better alternative than one-time selling of NPAs to asset reconstruction companies at sharp discounts,´ believes Vyas. ´With some smart restructuring and re-engineering, both financial and technical, such projects can be resurrected and generate steady revenue over the years.´

Hence, the focus should be on how quickly the asset or project can be revived. ´However,´ Vyas says, ´àwhile banks are good at lending, expecting them to take over management of stressed infrastructure projects and then revive them may be expecting too much from them.´ Here, he sees a huge untapped opportunity for investors with the right expertise to step in and take control of such assets.

Addressing fund needs

Recently, Economic Affairs Secretary Shaktikanta Das announced that RBI will draft a paper on liberalising certain external commercial borrowing (ECB) norms. The liberalised ECB norms are expected to put pressure on banks to cut interest rates. Vyas terms this move a ´masterstroke´. He avers, ´With ECB to be allowed for purchasing or financing domestically produced infrastructure equipment, purchase of domestically produced second-hand capital goods for providing loan finance and financing infrastructure SPVs, infrastructure finance will certainly get a shot in the arm.´

At present, RBI is in the process of collecting industry feedback on these guidelines. Once notified, asset finance companies (AFCs) and infrastructure finance companies (IFCs) will emerge as important players. Vyas adds, ´NBFCs will serve as a crucial conduit of credit to the vast number of contractors in the construction and transportation sectors.´

Also, issues such as land acquisition, clearances and other approvals, if sorted out, can lead to lenders gaining more confidence in the bankability of projects. Hence, Sapre points out to the need for ´timely and sincere fulfilment of project obligations´ to increase the chances of lending. He adds, ´Time-bound addressing of disputes and claims of developers and contractors will also lead to adequate fund availability.´ Additionally, in the proposed hybrid annuity model for PPP roads, the successful bidder's project cost is considered to override the authority project cost, which aptly addresses the termination issue and project cost related issues that bankers earlier had.

Sapre believes this provision, if included in other PPP projects too, will aid in resuming the fund flow to the sector.

Major Contributor to Government Programmes

The construction sector directly contributes to 8 per cent (approximately `4 trillion*) of India´s GDP. Further, the sector generates growth in other sectors through 1.8-2x multiplier effect: backward-construction materials (steel, cement, etc); forward-manufacturing, real estate, etc. What´s more, the sector is among India´s largest direct employers (approx 10 per cent of the total workforce, 46 million people), and generates indirect employment in other sectors.

That said, while the construction sector is an essential part of the economy, it will also contribute to the success of every government programme.

Make in India: Almost all sectors rely on good infrastructure (high-quality transport network, uninterrupted power, industrial clusters, etc) and quality infrastructure is critical for the competitiveness of the Make in India sectors.

Almost all sectors chosen in the Make in India programme rely on availability of good quality infrastructure as a key enabler:

- High quality transportation network (roads, railways and ports)

- Uninterrupted power supply; Industrial parks or clusters

- Easy access to raw materials.

POOR INFRASTRUCTURE QUALITY IS A BIG DISADVANTAGE

| Country | Infra quality score (Higher is better) | Manufacturing cost index (Lower is better) |

|---|---|---|

| Mexico | 4.2 | 91 |

| Indonesia | 4.4 | 83 |

| Brazil | 4.0 | 123 |

| China | 4.7 | 96 |

| India | 3.6 | 87 |

In addition, the industry is a large consumer of domestically manufactured products - over Rs.700,000 crore.

All sectors except Tourism & Hospitality and IT & BPM

Source: World Economic Forum competitiveness report 2014-15; Consulting report on manufacturing competitiveness (August 2014).

Digital India and Smart Cities: Development of supporting infrastructure (100 smart cities, seven greenfield electronics manufacturing clusters, etc)

Swachh Bharat Abhiyan: Waste management and public health facilities to be built across the country as part of the Clean India Initiative.

à and various other initiatives such as growth of SMEs and strengthening India´s infrastructure (power, freight, etc).

*Real GDP at factor cost (2004-2005 prices) as of 2014

16 Action Points for the Government

CW proposes 16 recommendations as voiced by the construction and infrastructure sector for the government:

1. Infrastructure should be included in the priority sector with prescription of funding limits for the sector.

2. Considering that the average time for dispute resolution is seven years, the Arbitration and Conciliation Act must be amended to put a cap on the time, fees and appeals process, which will free up a huge chunk of money stuck in disputes with the owner, in arbitration, and in the courts. Pending the amendments, owners should release payments due to contractors against bank guarantees (BGs) for all cases in courts. The government or Central Vigilance Commission (CVC) should encourage this process. If there is a dispute, a timeframe should be designed and it should be settled within that timeframe.

3. Disputes arising during the course of project activities should be settled through effective dispute resolution boards set up for each project in a time-bound manner. As noted by a World Bank study, arbitration had upheld DRB recommendations in 92 per cent of cases in India and the same was confirmed in 90 per cent of the cases by the courts.

4. In case a matter has to be taken to arbitration or the courts, a provision must be made that the party will implement the award and pay the awarded sum to the other party before the arbitrators can hear the appeal.

5. Employers should be mandated to settle claims awarded by arbitrators on a fast track. At present, there is no deterrent for the authorities from entering into arbitration instead of taking the onus and settling disputes at their end itself. This should be introduced and may see fewer cases going into arbitration and litigation.

6. NHAI, NHPC, NTPC and other government implementing agencies should pay the backlog they owe to the infrastructure industry at various levels. NHAI itself owes about Rs 30,000 to Rs 35,000 crore to construction companies. NHPC owes about Rs 10,000-15,000 crore. This amounts to almost Rs 50,000 crore in construction deficit from two agencies alone.

7. A credible mechanism is required (for instance, by entering into a supplementary agreement detailing new terms at the time of extension of time) to deal with delays not attributable to contractors that will be fair to both parties, which will determine the additional cost during the approval of extension of time itself.

8. The contract document needs to be fair. One-sided documents may appear to aggressively protect public interests but actually give rise to endless disputes and delays, which actually result in far greater national losses. Globally accepted templates for fair contract documents for awarding large infrastructure projects are available through FIDIC. A standard bidding document on a similar basis should be adopted by the Government of India. This step alone could eliminate a large number of problems.

9. Contract terms should be standardised along the lines of INCOTERMS, which specify each clause with a clear-cut legal definition acceptable internationally by all courts and tribunals.

10. Funds of infrastructure companies are locked and have remained unpaid owing to litigations forced upon the contractor by employers. Owing to this, many infrastructure companies have incurred losses and are left with no alternative for survival, but to apply for corporate debt restructuring (CDR). Certain employees are now issuing tenders that contain clauses of restriction against bidder/s who had applied or entered CDR in the past two financial years from participating in the bid. In the interest of public work, healthy competition and giving impetus to infrastructure companies in CDR, such onerous restrictive clauses should be omitted in future tenders.

11. The banking sector should adopt uniform rules of demand guarantees (URDG) to prevent unfair encashment of BGs.

12. The release of retention monies with BGs as security could help mitigate the liquidity crunch faced by the industry.

13. The new external commercial borrowings (ECB) guidelines should be quickly notified and a formal mechanism established to revive stressed assets in the infrastructure sector. That would automatically address the woes of the players in the construction sector.

14. The cost-escalation formula has to be very clear. It has to depend on the market radar, not the RBI index.

15. The regulatory regime over extraction of minerals - earth, sand, stone; the most basic elements for any construction - should be simplified. The approval of building plans should be taken as state approval for obtaining all materials required for the structure without any further approvals by any other authority.

16. Problems plaguing the construction and infrastructure sector must be addressed on a war footing by bringing all stakeholders together. The government should start by focusing on, say, the largest 100 projects.

Shriyal Sethumadhavan

To share your views on this article, write in at feedback@ConstructionWorld.in

- Shriyal Sethumadhavan

- Arbitration

- DEBT

- Pending Clearences

- CW highlights problem

- DK Vyas

- Srei BNP Paribas

- GDP

- Infrastructure

- Siddharth Singh

- Construction Federation of India

- B Manohar

- Lanco Infratech

- A Ranga Raju

- NCC Ltd

- Arvind Mahajan

- KPMG

- N Kalyanaraman

- Feedback Infra

- EPC

- WIP projects

- Gurjeet Singh Johar

- C&C Constructions Ltd

- Atul Punj

- Punj Lloyd Group

- CII National Committee

- Construction

- URDG

- Praveen Sood

- Hindustan Construction Company Ltd

- Sood avers

- MCA

- BOT

- NHDP

- RoW

- Central Governmen

- NASSCOM

- PMG

- CFI

- Dr VP Joy

- Mukund Gajanan

- IL&FS Transportation Networks Ltd

- DK Vyas

- BNP Paribas

- NBFC

- RBI

- Shaktikanta Das

- ECB

- AFC

- PPP roads

- Swachh Bharat Abhiyan

- CVC

- DRB

- NHPC

- NTPC

- INCOTERMS

- FIDIC

- URDG

- Construction

- CW highlights

Arbitration Delayed Projects Stalled Projects Dispute Companies in DEBT Pending Clearences While issues related to banking and financing, claims and contracts continue to discourage contractors, CW highlights problem areas and offers 16 concrete solutions that will help resolve issues and make the construction sector a success. The Indian construction sector is in an imbroglio and the emergency alarm has been buzzing for a while now. But is anyone listening?The sector today is facing a severe financial crisis, which is fast becoming existential. The fact that this has happened in the middle of ambitious targets, and not owing to lack of projects on offer, clearly indicates that the fundamentals governing infrastructure projects have not been sound. Thus, a thorough review and corrective measures are urgently required. Over the years, rapid urbanisation and strong population growth have rendered India´s current infrastructure inadequate. The result: A huge funding gap for infra finance today. Also, the country compares poorly on the infrastructure pillar, ranking only 87th out of 148 countries according to a recent report on Global ompetitiveness. To address this gap, the Twelfth Five-Year Plan has earmarked close to $1 trillion to be spent on infrastructure. ´However, the plan envisioned only half of this to come from the public sector,´ says DK Vyas, CEO, Srei BNP Paribas. ´The private sector thus has to play a pivotal role, but is plagued by its own share of challenges.´ Nonetheless, the present day is not completely gloomy. Green shoots are evident, signalled by an uptick in the macroeconomic environment and greater emphasis by the government on infrastructure development. New project announcements are gaining traction and, as reported, the total value of tenders has increased by 62 per cent year-on-year. The government is emphatic about reviving stalled projects, which have declined to 6.6 per cent of GDP in June 2015 compared to 8.4 per cent in March 2014. All considered, the success of the sector is of paramount importance. It contributes about 8 per cent of the GDP, and is one of the largest generators of employment. Considering that 15 million jobs need to be created each year for the next 20 years, the construction sector will play a key role in this area. Also, its success is also vital for every programme announced by the government (see box on page XX). However, issues related to banking and financing, claims and contracts don´t seem to be getting resolved. While factors like locking funds, delaying judgments, delay in project completion owing to delay in deliverables from the project owner´s end, and others, have been discouraging contractors; there seems to be lack of trust between the government and industry stakeholders. There is a real mess hindering the success of the sector - it needs to be cleaned up. Current affairs At present, from an infrastructure perspective as well as projects from related sectors, there are a huge number of stalled projects. Several reasons have led to this situation. Contracting companies are in deep financial trouble and are on the verge of closure; they have to borrow to pay interest. Land acquisition is another area that affects many of these projects. And subsequently, cumulative effects of multiple issues - financing, environment clearances and others - have stalled projects. For his part, Siddharth Singh, Secretary-General, Construction Federation of India, holds the Government responsible for the current state of affairs. B Manohar, COO-Head Construction, Lanco Infratech, adds, ´There is a lack of government reforms in contracting methodology across various departments, and each department follows its own agenda.´ And A Ranga Raju, Managing Director, NCC Ltd, shares, ´In the recent past, many leading industry players suffered and are in recovery phase. More investment in the country´s infrastructure is definitely required.´ The industry also expresses that government spending is not happening at the desired level. But there is no single solution as projects have been stalled for a while, says Arvind Mahajan, Head of Energy, Infrastructure, Healthcare & Government Practice, KPMG. ´Projects that have taken off four to five months ago have been facing issues for two to three years now,´ he points out. And there is a large basic stock of stalled projects that, if cleared, would add significant points to the GDP. Claims and contracts Today, contractors are plagued with several contract-related issues. One major issue is non-standardised contracts with various unfair clauses, which include, for example, unconditional bank guarantee encashment and interest on advance payments, provisions for both retention and performance bank guarantees, etc. ´In India, the formulation of construction contracts is pathetic and mostly one-sided,´ says N Kalyanaraman, Joint CEO-Realty and Social Infra, Feedback Infra. ´They are client-oriented, often too heavy on the constructors. It is not uncommon that the contracts are improperly drafted with vague provisions, sometimes even conflicting conditions. This leads to claims and counter claims from either side.´ Further, in the current scenario, there are severe delays in claims settlement or payment across different government employers. According to a recent survey, claims awarded by arbitrators are normally challenged in court by the employer (~6.5 years to settle; 85 per cent of claims raised currently pending (as per analysis from data received from top six EPC companies, for claims related to WIP projects, or projects completed in last three years). What´s more, reports suggest that the government owes Rs 1 lakh crore to the industry by way of various claims. Even if this is overstated and we discount 50 per cent, there is still Rs 50,000 crore of contractor money stuck. A robust system needs to be built to clear that. Here Gurjeet Singh Johar, Chairman, C&C Constructions Ltd, says,´Today, we have claims as old as 14-15 years. How do you survive in a situation like that?´ EPC companies today have a multitude of disputes, most of which consume the time and money of all parties to the contract. Atul Punj, Chairman, Punj Lloyd Group, and Chairman, CII National Committee on Construction, offers four points for quick government action, as these can get the economy moving and take India many notches up in ´ease of doing business´: Often, the contracts themselves are not equitable, and are one-sided favouring the owner. The first need is for contracts to be designed in a manner that works for both the owner and contractor. There have been instances where bank guarantees given by contractors in the prevailing banking system have been unfairly en-cashed by the owner. There is an urgent need to adopt global best practices like uniform rules for demand guarantees (URDG) to check the abuse of unconditional bank guarantees. In the EPC sector, there often exist disputes between owners and contractors over claims, which are resolved only after the expensive and time-consuming process of arbitration or court litigation. The Indian Arbitration Act needs to be amended to put a cap on time for giving the award, a cap on fees, and introduction of strict conditions to go for appeal in court. At present, thousands of crores are stuck in arbitration or courts. As a consequence of the issues mentioned above, contractors suffer from serious liquidity crises. As a discrete sector, construction needs to have a one-time debt realignment to be extended to it by the RBI. To this, Johar adds, ´The most primary requirement is liquidity of equity in the system, which can be achieved by settling claims. What is due to us should be paid because that´s the only way we can survive.´ Supporting this is Praveen Sood, Group CFO, Hindustan Construction Company Ltd: ´If required, a bank guarantee will be given; so one en-cashes the guarantee and takes the money out in case final order is different. This is where we are putting all our efforts.´ Now, through the Arbitration Act, the government is trying to introduce a timeframe within which the case has to be closed with the arbitrator being made accountable if the case is not settled within a given time. Question of capital Money, as always, remains a problem. The infrastructure sector has a major volume of jobs and crores worth of government-based projects. Thus, banks can lend them money in the form of funds and non-funds. ´But they have looked at funds from the interest angle,´ says Manohar. ´Initially, banks encouraged contractors to spend money on contracts. But as contractors did not get the desired returns, not even for the interest rate required, banks are now afraid to give loans to the contractor, and that is why the industry is struggling.´ (Read ´Lenders´ Block´ on page XX) Johar suggests raising equity, though this could be expensive. Meanwhile, Sood avers, ´First, we need to start behaving like a contractor. Aggressively bidding to bag a contract, and putting its own money to complete the contract, as client don´t pay on time, needs to come to an end. The government must follow the contract, and everything including land as per the contract should be provided. Also, whenever debt is due, pursue it hard contractually and legally.´ Getting working capital could be a major task for the industry. As Raju says, ´Many players are resolving issues resulting from exposure to high leverage.´ However, he believes financial institutions are playing a decisive role in controlling overexposure to financial risk in the market.´ On the other hand, Sood maintains that the construction industry does not require working capital as long as it behaves like contractors. ´Contractors do not put money into the project, but works around the client´s money,´ he reasons. ´On bagging a contract, we would get at least 5 per cent to 10 per cent advance money by giving guarantees. All payments are received normally on a monthly basis to us. So, if one works in a proper manner, working capital is not required.´ However, the problem started when projects started witnessing delays. Land acquisition has been a major problem. The contractor would be fully mobilised, yet the work would come to a halt. To get the work going, the contractor would have to put in his own money - and that´s where the problem starts. Securing loans Securing loans at lower interest rates would certainly ease the financial pressure. ´Lower interest rates are always welcome because infrastructure projects are so capital-intensive in nature,´ says Raju. RBI has already taken policy initiatives to lower interest rates and this will help the construction industry. However, Sood says, ´As long as a project is happening in time, an interest of 10-12 per cent can be serviced. But when the project gets stalled, 10 per cent becomes a big deal.´ He suggests interest rates should come down by a straight 2 per cent. ´In big economies like China, the US and Europe, funding is made available to infrastructure projects at a rate of not more than 2 per cent and that too for more than 15 to 20 years. In India, we still apply commercial rate, commercial norms, etc, and get funding at 10-12 per cent for not more than 10 to 12 years.´ Raju adds, ´Commercial banks in India generally do not fund projects beyond a 10-year tenure, which needs to be extended up to 15 years in deserving cases.´ Now, the government has approved some takeout schemes by which the loan can be for a longer period. ´In take off funding, after five years, you approach a new banker to take over,´ explains Sood. ´You also have the 5/25 scheme, according to which the loan for an infrastructure project can be refinanced and can be extended for typically 20-25 years.´ The report card While money, contracts and clearances continue to bedevil the industry, let´s see which sectors are stalled and which ones continue to show potential. Today, sectors in a limbo include hydropower, which has come to a halt in the past five years with no capacity addition. While there is much talk of smart cities, at present, there is not much construction or any other activity on the ground. Airports too have been stalled; but there is hope on the horizon with the new aviation policies. Also, in the past 10 years, no large projects have come up in the metal or steel segment or engineering manufacturing, either from the government or the private sector. However, amid the dark clouds, the road sector shines through like a silver lining. Here, the authorities are trying a new business model called the hybrid model to offload some risk (like traffic risk and resulting cash-flow stress) from developers and contractors. Recently, the highways sector received a big regulatory boost with the Ministry of Road Transport and Highways clearing amendments to the model concession agreement (MCA) for awarding projects on a BOT basis. These measures will help restore the confidence of developers as well as financiers and other entities. And this is the kind of momentum required across sectors. ´We are seeing good traction in both oil and gas and infrastructure space,´ says Punj, spelling out the positives. ´Public-sector units are planning expansion of refineries and new pipelines. In the infrastructure space, the government has already unfolded its plans for 20,000 km of the National Highways Development Programme (NHDP), its flagship road-building programme, which envisages the development of existing National Highways into world-class roads in different phases with a total investment of $45 billion over the next three years. Moreover, the government is also trying to ease business by providing fiscal incentives and right of way (RoW) for project land is being made available to concessionaires free from all encumbrances, while the National Highways Authority of India (NHAI) is providing capital grant up to 40 per cent of project cost to enhance viability on a case-to-case basis.´ A senior NHAI spokesperson says, ´In the past two to three years, kilometres awarded have been about 1,116 km or 1,350 km and some 3,056 km. At present, we have awarded around 2,330 km. So, the capacity available in the market for project execution is quite good. And, the road sector is highly labour intensive. So the government should accept EPC as the ideal mode of award. Otherwise, at the look of it, the Central Government has been talking about having many road projects.´ Raju tells us that recent announcements on smart cities and water supply projects across the country are ´welcomed by the industry,´ while Kalyanaraman says, ´The sectors that are in momentum, though slowing down recently, are housing, commercial and core infrastructure, particularly highways.´ And in Mahajan´s view, the railways hold a lot of promise. ´Railway Minister Suresh Prabhu is doing a fair amount of activity to push on the railways front,´ he says. ´There is a lot expected, especially in station development.´ United we stand All considered, a united approach is the best way ahead for all stakeholders to convert this positive momentum into actual gains. It took about 15 years for the software market to grow and become a success in India, with NASSCOM playing a key role in uniting the sector. Can the construction industry take a cue from this? For his part, Johar says the industry being united is a far cry because the environment or the situation of every company is different, and now it´s a question of survival. However, Mahajan believes various parties will have to unite to resolve issues. While this might not be a workable solution for all projects, he believes that a mechanism needs to be created for the top 50-100 stalled projects, ´where bankers, promoters and the government come together to view them.´ Moving ahead, bodies like Project Monitoring Group (PMG) and the Construction Federation of India (CFI) can also play a key role in resolution. ´PMG does not clear any projects,´ says Dr VP Joy, Joint Secretary, Cabinet Secretariat and Head, Project Monitoring Group (PMG). ´It has been facilitating the resolution of issues by various ministries or state governments. So far, for central ministries, out of 668 projects considered by PMG, 313 projects have been fully resolved and in 83 projects, no further action or intervention is required from PMG. Thus, at present, 275 projects with 533 issues are under the consideration of PMG. Most of the resolved projects belong to sectors like power, steel, roads, railways, coal and civil aviation, and most have a significant construction component.´ Sood weighs in here, saying, ´Any advisory body will not serve the purpose unless it is given complete authority.´ And Punj adds, ´Today, the industry stands together on platforms such as the CII National Committee on Construction, through which it collectively seeks support from the government.´ Going forward, Mahajan is positive, provided the sector moves in the right direction and the right framework is in place. ´Five to 10 years down the line, the hope is to have a world-class construction and infrastructure industry,´ he envisions. Johar is quick to add a disclaimer: ´Provided there is enough business, and no money held up!´ Given the mammoth construction opportunity in the country - and all problems being addressed - what then is the execution strength that India needs? Well, a guesstimate would be 25-30 contracting companies of the size of L&T. That said, read on for our proposed 16 action points for the government to pave the way ahead. Quick Bytes Construction sector contributes to 8% of India´s GDP. Stalled projects: Declined to 6.6% of GDP in June 2015 compared to 8.4% in March 2014. Major issues are related to banking and financing, claimsand contracts. Quality infrastructure is critical for the competitiveness of govt programmes. Lenders´ Block Banks and financing institutions have been exercising caution in financing owing to their experiences over the past few years. In the recent past, it has been challenging for developers to achieve financial closure and contractors have been struggling with funding their working capital requirements. ´The rising proportion of non-performing assets (NPAs) (as reported, upwards of 4.5 per cent of their total advances) has led to higher provisioning and reduced capital availability for almost all banks, particularly the PSU banks,´ says Mukund Gajanan Sapre, Executive Director, IL&FS Transportation Networks Ltd. ´In the case of PPPs, where the toll model is being adopted, banks have shown less interest compared to annuity or assured revenue models.´ Financiers have been getting increasingly averse to fund projects owing to sectoral caps being achieved and overall exposure limit restraint to individual group companies. Banks are also avoiding further lending of the sanctioned debt till assurances are given on the project work front availability (which is in the obligation of the project proponent) and till the borrowing company details its cash generation plan to fund the loan's interest and principal repayment. DK Vyas, CEO, Srei BNP Paribas, agrees that ´availability and ease of funding´ are the biggest challenges faced by the industry. He adds that it has also been tough for the traditional banking segment to lend to this industry ´on account of asset liability mismatches as infrastructure development involves long gestation periods.´ All considered, the past couple of years have been testing for the industry, leading to deteriorating asset quality and rising stressed assets, further impeding the growth of finance to this segment. Current approach towards lending Banking and NBFC segments are still burdened with the stressed asset of this sector. Vyas says, ´The infrastructure sector contributed to about 30 per cent of the total stressed advanced of all scheduled commercial banks as on December 2014. To add to this, the credit quality of the companies in this sector has also taken a beating in the past couple of years and there is visible stress on the balance sheets in terms of high leverages.´ However, Sapre says, ´Issues in the earlier concessions and contracts that were hindering the flow of funds to the sector have now been addressed.´ He adds that the advent of new concession models such as hybrid annuity, where the revenue risk lies with the client, will find better acceptance among the lenders. It accounts for interest fluctuation and accords due recognition to the bidder's total project cost assessment while funding 40 per cent of the project cost over the construction period; this reduces the extensive dependence on banks and financial institutions. Adding to the factors that have seen more willingness by the banks, he says, ´The plug-´n´-play model is being adopted by clients in projects recently bid out where almost 100 per cent work front will be provided.´ As soon as these innovations and improvements are brought to the fore by project proponents, banks and financial institutes are likely to shed their cautious approach. Restructuring and refinancing Last year, RBI allowed lenders to restructure existing loans above Rs 500 crore to infrastructure and core industries´ projects. Also, banks and financial institutions were given an option to periodically refinance such loans. ´While the move to restructure loans is welcome, we need to take care of the growing menace of stressed assets, especially infrastructure assets,´ says Vyas. In stressed infrastructure assets, promoters run out of resources, are unable to manage the risks or are unable to come up with the right capital structure. In such cases, ´a change in management or partner should be the ideal approach to revive an infrastructure project,´ he suggests. Also, as reported, many companies are lining up to avail the 5/25 scheme extended by RBI. To this, Sapre says, ´The model provides restructuring of principal and does not cater to the interest burden.´ Hence, despite the option, overall enthusiasm from developers and banks is not visible. Further, the Government is considering the option of allowing banks to take over projects from the borrowers and try to turn them around. ´Attempting a turnaround of such stalled projects is always a better alternative than one-time selling of NPAs to asset reconstruction companies at sharp discounts,´ believes Vyas. ´With some smart restructuring and re-engineering, both financial and technical, such projects can be resurrected and generate steady revenue over the years.´ Hence, the focus should be on how quickly the asset or project can be revived. ´However,´ Vyas says, ´àwhile banks are good at lending, expecting them to take over management of stressed infrastructure projects and then revive them may be expecting too much from them.´ Here, he sees a huge untapped opportunity for investors with the right expertise to step in and take control of such assets. Addressing fund needs Recently, Economic Affairs Secretary Shaktikanta Das announced that RBI will draft a paper on liberalising certain external commercial borrowing (ECB) norms. The liberalised ECB norms are expected to put pressure on banks to cut interest rates. Vyas terms this move a ´masterstroke´. He avers, ´With ECB to be allowed for purchasing or financing domestically produced infrastructure equipment, purchase of domestically produced second-hand capital goods for providing loan finance and financing infrastructure SPVs, infrastructure finance will certainly get a shot in the arm.´ At present, RBI is in the process of collecting industry feedback on these guidelines. Once notified, asset finance companies (AFCs) and infrastructure finance companies (IFCs) will emerge as important players. Vyas adds, ´NBFCs will serve as a crucial conduit of credit to the vast number of contractors in the construction and transportation sectors.´ Also, issues such as land acquisition, clearances and other approvals, if sorted out, can lead to lenders gaining more confidence in the bankability of projects. Hence, Sapre points out to the need for ´timely and sincere fulfilment of project obligations´ to increase the chances of lending. He adds, ´Time-bound addressing of disputes and claims of developers and contractors will also lead to adequate fund availability.´ Additionally, in the proposed hybrid annuity model for PPP roads, the successful bidder's project cost is considered to override the authority project cost, which aptly addresses the termination issue and project cost related issues that bankers earlier had. Sapre believes this provision, if included in other PPP projects too, will aid in resuming the fund flow to the sector. Major Contributor to Government Programmes The construction sector directly contributes to 8 per cent (approximately `4 trillion*) of India´s GDP. Further, the sector generates growth in other sectors through 1.8-2x multiplier effect: backward-construction materials (steel, cement, etc); forward-manufacturing, real estate, etc. What´s more, the sector is among India´s largest direct employers (approx 10 per cent of the total workforce, 46 million people), and generates indirect employment in other sectors. That said, while the construction sector is an essential part of the economy, it will also contribute to the success of every government programme. Make in India: Almost all sectors rely on good infrastructure (high-quality transport network, uninterrupted power, industrial clusters, etc) and quality infrastructure is critical for the competitiveness of the Make in India sectors. Almost all sectors chosen in the Make in India programme rely on availability of good quality infrastructure as a key enabler: - High quality transportation network (roads, railways and ports) - Uninterrupted power supply; Industrial parks or clusters - Easy access to raw materials. POOR INFRASTRUCTURE QUALITY IS A BIG DISADVANTAGE .tg {border-collapse:collapse;border-spacing:0;} .tg td{font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;} .tg th{font-family:Arial, sans-serif;font-size:14px;font-weight:normal;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;} .tg .tg-9hbo{font-weight:bold;vertical-align:top} .tg .tg-yw4l{vertical-align:top} Country Infra quality score (Higher is better) Manufacturing cost index (Lower is better) Mexico 4.2 91 Indonesia 4.4 83 Brazil 4.0 123 China 4.7 96 India 3.6 87 In addition, the industry is a large consumer of domestically manufactured products - over Rs.700,000 crore. All sectors except Tourism & Hospitality and IT & BPM Source: World Economic Forum competitiveness report 2014-15; Consulting report on manufacturing competitiveness (August 2014). Digital India and Smart Cities: Development of supporting infrastructure (100 smart cities, seven greenfield electronics manufacturing clusters, etc) Swachh Bharat Abhiyan: Waste management and public health facilities to be built across the country as part of the Clean India Initiative. à and various other initiatives such as growth of SMEs and strengthening India´s infrastructure (power, freight, etc). *Real GDP at factor cost (2004-2005 prices) as of 2014 16 Action Points for the Government CW proposes 16 recommendations as voiced by the construction and infrastructure sector for the government: 1. Infrastructure should be included in the priority sector with prescription of funding limits for the sector. 2. Considering that the average time for dispute resolution is seven years, the Arbitration and Conciliation Act must be amended to put a cap on the time, fees and appeals process, which will free up a huge chunk of money stuck in disputes with the owner, in arbitration, and in the courts. Pending the amendments, owners should release payments due to contractors against bank guarantees (BGs) for all cases in courts. The government or Central Vigilance Commission (CVC) should encourage this process. If there is a dispute, a timeframe should be designed and it should be settled within that timeframe. 3. Disputes arising during the course of project activities should be settled through effective dispute resolution boards set up for each project in a time-bound manner. As noted by a World Bank study, arbitration had upheld DRB recommendations in 92 per cent of cases in India and the same was confirmed in 90 per cent of the cases by the courts. 4. In case a matter has to be taken to arbitration or the courts, a provision must be made that the party will implement the award and pay the awarded sum to the other party before the arbitrators can hear the appeal. 5. Employers should be mandated to settle claims awarded by arbitrators on a fast track. At present, there is no deterrent for the authorities from entering into arbitration instead of taking the onus and settling disputes at their end itself. This should be introduced and may see fewer cases going into arbitration and litigation. 6. NHAI, NHPC, NTPC and other government implementing agencies should pay the backlog they owe to the infrastructure industry at various levels. NHAI itself owes about Rs 30,000 to Rs 35,000 crore to construction companies. NHPC owes about Rs 10,000-15,000 crore. This amounts to almost Rs 50,000 crore in construction deficit from two agencies alone. 7. A credible mechanism is required (for instance, by entering into a supplementary agreement detailing new terms at the time of extension of time) to deal with delays not attributable to contractors that will be fair to both parties, which will determine the additional cost during the approval of extension of time itself. 8. The contract document needs to be fair. One-sided documents may appear to aggressively protect public interests but actually give rise to endless disputes and delays, which actually result in far greater national losses. Globally accepted templates for fair contract documents for awarding large infrastructure projects are available through FIDIC. A standard bidding document on a similar basis should be adopted by the Government of India. This step alone could eliminate a large number of problems. 9. Contract terms should be standardised along the lines of INCOTERMS, which specify each clause with a clear-cut legal definition acceptable internationally by all courts and tribunals. 10. Funds of infrastructure companies are locked and have remained unpaid owing to litigations forced upon the contractor by employers. Owing to this, many infrastructure companies have incurred losses and are left with no alternative for survival, but to apply for corporate debt restructuring (CDR). Certain employees are now issuing tenders that contain clauses of restriction against bidder/s who had applied or entered CDR in the past two financial years from participating in the bid. In the interest of public work, healthy competition and giving impetus to infrastructure companies in CDR, such onerous restrictive clauses should be omitted in future tenders. 11. The banking sector should adopt uniform rules of demand guarantees (URDG) to prevent unfair encashment of BGs. 12. The release of retention monies with BGs as security could help mitigate the liquidity crunch faced by the industry. 13. The new external commercial borrowings (ECB) guidelines should be quickly notified and a formal mechanism established to revive stressed assets in the infrastructure sector. That would automatically address the woes of the players in the construction sector. 14. The cost-escalation formula has to be very clear. It has to depend on the market radar, not the RBI index. 15. The regulatory regime over extraction of minerals - earth, sand, stone; the most basic elements for any construction - should be simplified. The approval of building plans should be taken as state approval for obtaining all materials required for the structure without any further approvals by any other authority. 16. Problems plaguing the construction and infrastructure sector must be addressed on a war footing by bringing all stakeholders together. The government should start by focusing on, say, the largest 100 projects. Shriyal Sethumadhavan To share your views on this article, write in at feedback@ConstructionWorld.in

Della, Hiranandani & Krisala unveil Rs 11 billion themed township in Pune

In a first-of-its-kind initiative, Della Resorts & Adventure has partnered with Hiranandani Communities and Krisala Developers to develop a Rs 11 billion racecourse-themed township in North Hinjewadi, Pune. Based on Della’s proprietary CDDMO™ model, the hospitality-led, design-driven project aims to deliver up to 9 per cent returns—significantly higher than the typical 3 per cent in residential real estate.Spanning 40 acres within a 105-acre master plan, the mega township will feature an 8-acre racecourse and international polo club, 128 private villa plots, 112 resort residences, a ..

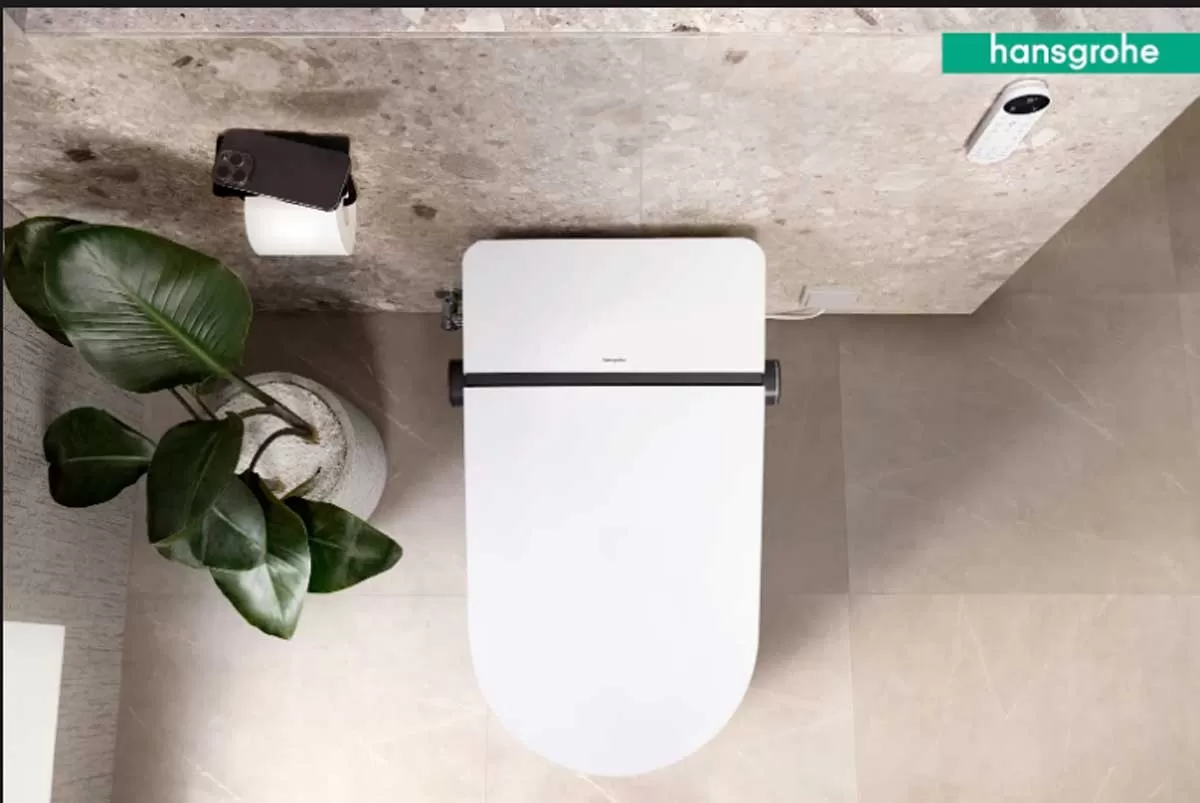

Hansgrohe unveils LavaPura Element S e-toilets in India

Hansgrohe India has launched its latest innovation, the LavaPura Element S e-toilet series, introducing a new standard in hygiene-focused, smart bathroom solutions tailored for Indian homes and high-end hospitality spaces.Blending German engineering with minimalist aesthetics, the LavaPura Element S combines intuitive features with advanced hygiene technology. The series is designed for easy installation and optimal performance under Indian conditions, reinforcing the brand’s focus on functional elegance and modern convenience.“With evolving consumer preferences, smart bathrooms are no lon..

HCC Net Profit Stands at Rs 2.28 Billion for Q4 FY25

Hindustan Construction Company (HCC) reported a standalone net profit of Rs 2.28 billion in Q4 FY25, a sharp increase from Rs 388 million in Q4 FY24. Standalone revenue for the quarter stood at Rs 13.30 billion, compared to Rs 14.28 billion in Q4 FY24. For the full fiscal year, the company reported a standalone net profit of Rs 849 million, down from Rs 1.79 billion in FY24. Standalone revenue for FY25 was Rs 48.01 billion, compared to Rs 50.43 billion in the previous year.Consolidated revenue for Q4 FY25 stood at Rs 13.74 billion, and for FY25 at Rs 56.03 billion, down from Rs 17.73 billion i..

Latest Updates

Advertisement

Recommended for you

Advertisement

Subscribe to Our Newsletter

Get daily newsletters around different themes from Construction world.

Advertisement

Advertisement

Advertisement

subscribe to the newsletter

Don't miss out on valuable insights and opportunities

to connect with like minded professionals