- Home

- Real Estate

- Booming space

Booming space

Over the past decade and a half, India has emerged among the leading countries for establishing data centres. Growth in storage demand and increasing computing needs have resulted in the rise of data centres with significant capacities. Millions of sq ft of data centres have been set up across cities like Bengaluru, Pune, Chennai and Delhi and demand for IT real estate is at an all time high. Though many multinational companies, including Indian firms, have their own internal data centres, they are increasingly handing over data centre responsibilities to third parties. At present, the business is centred around 70-plus commercial data centres spread across the country while the numbers of in-house data centres or server rooms are upwards of 50,000.

Data centre space grew from about 3.4 million sq ft in 2009 to about 5.2 million sq ft in 2012; the industry growth rate is around 25 per cent per annum.

The storage market

Banks, government PSUs, enterprises and online service providers are the major business generators for the data centre industry, the demand driven by regulatory compliance the IT Act requires maintenance of records for seven years and messages for five years improved connectivity from 3G or 4G services, increased penetration of the internet, mobile devices and smart phones, analytics, and data capture and storage, not to mention government initiatives like NeGP Mission Mode and Aadhar. While captive data centres currently dominate India´s IT landscape, outsourcing has increased owing to the need for companies to keep costs down to the bare minimum and shift key resources to focus on core business while gaining access to quality products and services. Ergo, enterprises across the country, both large and small, are increasingly adopting data centre services to manage large quantities of data. Services obtaining from cloud and virtualisation technologies are helping companies reduce their capital assets and bring down costs.

Data centre facilities typically house computer systems and related components such as telecommunications and storage systems that include power supplies, data communication connections, environment controls like air-conditioning and fire suppression systems, security and access control solutions. The entire value chain comprises a mix of segments such as real estate and construction, hardware equipment such as servers, utilities such as power, water and cooling, networking and software services.

The current player profile includes real estate facilities management companies that own office space and offer them on lease to various organisations, multinationals, Indian firms and telcos and networking firms with a presence across the data centre value chain, from pure hardware or connectivity providers to a mix of hardware suppliers and captive or managed service providers. The key data centre operators are Reliance IDC, Tata Communications, Bharti Airtel, Sify, Ctrls, Netmagic and Tulip Telecom. The last has 2,000 cities covered on wireless and 300 cities on fibre. With a floor space of 9 lakh sq ft, Tulip Telecom is the third biggest in the world after Lakeside Technology Centre in Chicago (1.1 million sq ft) and QTS Metro Data Centre in Atlanta (9.7 lakh sq ft). Other players with varying presence across segments like hardware equipment and software services include IBM, HP, Wipro, HCL, TCL, Cisco, Emerson and Schneider Electric.

Gathering oomph

The new data centre build out is primarily being driven by service providers, thus lending more impetus to the market. The data centre business has been a major attraction for foreign investors more so with the depreciation of the rupee and is expected to throw up opportunities for IT professionals over the next decade. A few telecom firms like Nxtra Data, an Airtel subsidiary, are looking to invest in additional data centres across cities like Bengaluru, Delhi NCR and Kolkata. The company currently manages 1.60 lakh sq ft of space across seven data centres and plans to add another 1 lakh sq ft over the next couple of years. In May this year, Netmagic announced it was building a 100,000 sq ft net floor space data centre to bolster high-quality supply in Bengaluru´s constrained data centre space. With the existence of 6 million small and medium businesses in India, of which 30,000-50,000 are medium enterprise, it is easy to see that the demand is growing.

A typical data centre, whether physical or virtual, offers storage management and dissemination of data and information for businesses. India´s still nascent data centre market could reach $1.3 billion with 6.6 million sq ft space by 2016, says a Gartner report. ôThe data centre services market in India is growing at a CAGR of 21.6 per cent,´ says Venugopal Ramanathan, Sales Head-Enterprise, Trimax IT Infrastructure & Services. ´With the growing volume of data being stored in organisational networks, the need for additional computing facilities is also increasing.´ Trimax owns and operates a 30,000 sq ft Tier-III data centre in Airoli, Navi Mumbai, an emerging IT hub in the suburbs of Mumbai. It also operates a Tier-III compliant data centre in Bengaluru using a facility owned by manufacturer and supplier of telecommunication products, Indian Telephone Industries.

Similarly, ESDS Software Solution, with a customer base of over 20,000 across the globe, operates a high-specification, carrier-neutral and fully managed data centre at Nashik built with an investment of about $4 million. The data centre, which provides turnkey solutions and core banking solutions on hosted model along with cross platform disaster recovery services one of the largest thermal plants in the country uses ESDS also host portals of many state government organisations and counts among its clients private manufacturing players and players from the hospitality, education and travel sectors. ´The data centre business in India is still in its infancy but the possibilities are endless,´affirms Dr Rajeev Papneja, COO, ESDS Software Solution. ´ESDS is coming up with a data centre in Navi Mumbai that should be ready within the next six to eight months, followed by plans to open one in Bengaluru. We are also working on an initiative to launch one in Dubai soon.´

In Bengaluru, Nxtgen, a managed infrastructure services provider with over 200 man years of data centre experience, offers customers in the under-served mid-market segment a choice of having their data centres on the premises or fully outsourced to its facilities. On premise data centre (OPDC) solutions reduce capex and opex by over 30 per cent for customers and can be delivered in weeks instead of a typical data centre implementation over months, significantly reducing cost and management complexities.

"We are building a data centre with a power density of 15 kw per rack, compared to 3 kw per rack offered by most other facilities. This enables our customers to host five times more computing in our racks,´says AS Rajgopal, Managing Director, NxtGen Datacenter & Cloud Technologies, whose firm is investing over Rs 280 crore over three years in HDDC, a 28 MW data centre campus in Bengaluru. The proposed facility, spread over a 10 acre area, will be cloud-ready, designed to host high-density IT infrastructure and offering the highest energy efficiency in the region. The HDDC campus, expected to be live for customer services by March 2014, is expected to be LEED Gold and Uptime Institute certified for Tier III. Next year, the company plans to add one more facility in India and is exploring the possibility of adding two international locations.

Challenging space

Firms around the world are currently faced with an explosion of data, which needs to be stored, secured and managed efficiently to leverage as an asset. A major challenge for data centre vendors, therefore, is infrastructure related to the rising cost of power and real estate, not to mention low penetration and non reliability of bandwidth. With the increase in the number of data centres, power consumption has increased dramatically it occupies 40 per cent of total operational costs and is not matched by supply. Thus, ensuring uninterrupted power supply is a key concern. Rising cost of diesel has led firms like Nxtra to resort to a combination of solar, wind and hydro power. They are also operational issues such as cost and energy management, hardware and software reliability.

To address such concerns, data centre service providers are opting to develop green data centres that curtail power consumption. Adoption of green building standards reduce sensible heat load, which further subtracts the power consumed for cooling by at least 30 per cent. Such savings will lead firms to adopt green building standards while constructing new data centres or upgrading existing facilities. Data centres are expected to fulfil up to 15-25 per cent of their requirements through renewable energy sources by 2016, says a Gartner study, but right now not many Indian data centres have taken the green route. Last December, Bharti Airtel launched a green data centre in Mumbai that was designed to achieve 1.7-1.75 power usage effectiveness (PUE), thus making it one of the most energy-efficient facilities in the country.

Admittedly, the Indian data centre industry is still going through the learning curve. ´Enterprises are experiencing the pain of maintaining in-house data centres and with technology evolving at such speed, it is difficult for organisations to focus on keeping their IT departments updated,´says ESDS´ Papneja. However, standards are expected to improve thanks to the demanding work environment at data centres. ´Organisations are demanding that their data centres have the highest security, availability, environmental impact and adherence to standards. Standard documents from accredited professional groups, such as the Telecommunications Industry Association, specify the requirements for data centre design,´avers Balaji Sreenivasan, Founder and CEO, Aurigo Software Technologies Inc, a global provider of capital project planning and project portfolio management software, catering to the construction, energy and public-sector markets. The clients of the firm, which is headquartered in Austin, Texas, include large public-sector agencies in the US and energy and construction companies in India.

Owing to the nature of information stored, data centres require architecture that ensures complete data protection and security. This means that structural design considerations have to take into account safety from fire and natural calamities like earthquakes and tsunamis and require measures in place for power backup and instant data recovery. Such centres are also required to be designed as green centres, which are environment-friendly in every aspect from construction to optimal use of wind and solar power wherever feasible. As heating, ventilation and air-conditioning systems (HVAC) represent 40-50 per cent of energy consumption for facilities in the expanding data centre industry, considerable cost is involved in having cooling systems in place, thus presenting opportunities for manufacturers. Data centres also require high value installations including CCTV cameras, alarm systems, access control, and energy and building management systems (BMS). ôThe cost is very subjective and would depend on the requirements and size of the premises being secured,´says a senior manager from L&T Electrical & Automation. ôThe package ranges from as low as Rs 50 lakh for a small area up to Rs 8-10 crore to secure a 100,000 sq ft premises.´ Incidentally 15 per cent of L&T´s security automation business is from the data centre industry and the volumes are growing 40 per cent year on year.

Himanshu Nadkarni, Marketing Manager, Performance Chemicals, Anantco Enterprises, a Mumbai based company, which supplies fire retardant coatings from the US to data centres, one of which is managed by the Mahindra Group, says, ôWith data centres working 24/7, there is a lot of heat generated leading to fire hazards. If you consider the loss after the accident it is enormous. It has to be prevented and that is where we come in with our passive fire measures.´

The data centre market is becoming a key area of investment for Indian businesses,´says Tarun Kaura, Director- Technology Sales, India & SAARC, Symantec. ôHowever, today data centres are faced with the challenge of increasing complexity, which is an area of concern to an IT manager. Enterprises should understand what their IT assets are, how they are being consumed, and by whom. This will help cut costs and risk.´

Future push

The massive increase in data growth has led to rising cost of maintenance and, therefore, investments. Firms have just begun to understand the criticality of the cost and risk implications of build vs co-locate. For most organisations in India, co-location would make more economic sense than building a traditional data centre facility. According to one Returns On Investment assessment, the net present value (NPV) over 15 years of building and managing a data centre works out to $56 million while collocation amounts to just $30.5 million. With this in mind, IT firms are increasingly offering virtualisation and cloud computing services enabling significant capital and operational costs savings while increasing business mobility. Some organisations are also considering establishing their data centres in cooler climes like the Nordic regions to save energy costs.

In India, growth is being driven by consolidation and modernisation as well as new build-outs with companies shifting from a distributed set up to a more manageable and efficient centralised model. Efficiencies are being sought to be improved on the data asset sprawl by more access to third-party data centres, minimising of technical obsolescence risks and increasing reliance on the cloud. Indian organisations have started looking for greater efficiencies in running their data centres, almost operating like a cloud vendor. Sectors such as government, IT and telecom are showing maximum traction given the high volume of information they have to manage. These sectors require seamless, highly reliable and robust, shared and secured infrastructure with scalable capacity.

Evidently, the data sector, with a change in its operations and architecture, is set to grow as India spins into an increasingly digital future. But key issues will have to be sorted out to allow the surge to the cloud according to Cushman & Wakefield´s Data Centre Risk Index 2013, India was placed 29th on the global list of preferred data centre locations, just one rung above Brazil, which was ranked lowest. ôIndia can certainly improve its ranking but will need to build on its strengths like labour and operational sustainability,´says Arvind Nandan, Executive Director, Consultancy Services, Cushman & Wakefield. "It will have to address issues like energy cost and energy security and provide an improved environment for business."

Case Study

Secure Construction

Data Center Stats

- At $2.2 billion in 2012, India is one of fastest growing markets and is expected to grow to $3 billion by 2016.

- India is expected to have the highest IP traffic growth rate in the world with a 62% CAGR from 2011 to 2016.

- India-¦s IT infrastructure spending will reach $2.3 billion by 2014.

- Global data centre spending is up by 8% from $99 billion to $106 billion during 2011-12.

- Growth is expected to accelerate the CAGR of 19% between 2012-15 will reach $126 billion.

- Storage consumes 5-15% of total power in data centre and volumes are growing between 30% and 50% per year.

- IT infra like power, cooling and space for centralised suites is critical for 70% of Indian IT decision makers.

- Cost of securing data centres with automation and systems varies according to the requirement and size. Packages are available from Rs 50 lakh to Rs 8 crore from a small-sized unit to 100,000 sq ft facility.

- The net present value over 15 years of building and managing a traditional data centre in India jumps to

- $56 million while co-location will cost about $30.5 million.

- India was placed 29th on the global list of preferred data centre locations on Cushman & Wakefield-¦s Data Centre Risk Index 2013.

- Digital Realty, Chicago, 1.1 million sq ft

- Quality Technology, Atlanta, 990,000 sq ft

- Terremark, Miami, 750,000 sq ft

- Microsoft Chicago, 700,000 sq ft

- Microsoft Dublin, 550000 sq ft

- i/O data center, Phoenix, 538,000 sq ft.

- DuPont Fabros, Chicago, 485,000 sq ft .

- Microsoft Washington 470,000 sqft

- Microsoft San Antonio 470,000 sq ft

- Switch Communications, Las Vegas, 470,000 sq ft

To share your views on the growing demand for data centres, write in at feedback@ASAPPmedia.com

They are not quite multiplying like digital piranhas in a feeding frenzy but data centres are adding significant volumes to the Indian IT real estate. SHRIKANT RAO examines the developments in storage space. Over the past decade and a half, India has emerged among the leading countries for establishing data centres. Growth in storage demand and increasing computing needs have resulted in the rise of data centres with significant capacities. Millions of sq ft of data centres have been set up across cities like Bengaluru, Pune, Chennai and Delhi and demand for IT real estate is at an all time high. Though many multinational companies, including Indian firms, have their own internal data centres, they are increasingly handing over data centre responsibilities to third parties. At present, the business is centred around 70-plus commercial data centres spread across the country while the numbers of in-house data centres or server rooms are upwards of 50,000. Data centre space grew from about 3.4 million sq ft in 2009 to about 5.2 million sq ft in 2012; the industry growth rate is around 25 per cent per annum. The storage market Banks, government PSUs, enterprises and online service providers are the major business generators for the data centre industry, the demand driven by regulatory compliance the IT Act requires maintenance of records for seven years and messages for five years improved connectivity from 3G or 4G services, increased penetration of the internet, mobile devices and smart phones, analytics, and data capture and storage, not to mention government initiatives like NeGP Mission Mode and Aadhar. While captive data centres currently dominate India´s IT landscape, outsourcing has increased owing to the need for companies to keep costs down to the bare minimum and shift key resources to focus on core business while gaining access to quality products and services. Ergo, enterprises across the country, both large and small, are increasingly adopting data centre services to manage large quantities of data. Services obtaining from cloud and virtualisation technologies are helping companies reduce their capital assets and bring down costs. Data centre facilities typically house computer systems and related components such as telecommunications and storage systems that include power supplies, data communication connections, environment controls like air-conditioning and fire suppression systems, security and access control solutions. The entire value chain comprises a mix of segments such as real estate and construction, hardware equipment such as servers, utilities such as power, water and cooling, networking and software services. The current player profile includes real estate facilities management companies that own office space and offer them on lease to various organisations, multinationals, Indian firms and telcos and networking firms with a presence across the data centre value chain, from pure hardware or connectivity providers to a mix of hardware suppliers and captive or managed service providers. The key data centre operators are Reliance IDC, Tata Communications, Bharti Airtel, Sify, Ctrls, Netmagic and Tulip Telecom. The last has 2,000 cities covered on wireless and 300 cities on fibre. With a floor space of 9 lakh sq ft, Tulip Telecom is the third biggest in the world after Lakeside Technology Centre in Chicago (1.1 million sq ft) and QTS Metro Data Centre in Atlanta (9.7 lakh sq ft). Other players with varying presence across segments like hardware equipment and software services include IBM, HP, Wipro, HCL, TCL, Cisco, Emerson and Schneider Electric. Gathering oomph The new data centre build out is primarily being driven by service providers, thus lending more impetus to the market. The data centre business has been a major attraction for foreign investors more so with the depreciation of the rupee and is expected to throw up opportunities for IT professionals over the next decade. A few telecom firms like Nxtra Data, an Airtel subsidiary, are looking to invest in additional data centres across cities like Bengaluru, Delhi NCR and Kolkata. The company currently manages 1.60 lakh sq ft of space across seven data centres and plans to add another 1 lakh sq ft over the next couple of years. In May this year, Netmagic announced it was building a 100,000 sq ft net floor space data centre to bolster high-quality supply in Bengaluru´s constrained data centre space. With the existence of 6 million small and medium businesses in India, of which 30,000-50,000 are medium enterprise, it is easy to see that the demand is growing. A typical data centre, whether physical or virtual, offers storage management and dissemination of data and information for businesses. India´s still nascent data centre market could reach $1.3 billion with 6.6 million sq ft space by 2016, says a Gartner report. ôThe data centre services market in India is growing at a CAGR of 21.6 per cent,´ says Venugopal Ramanathan, Sales Head-Enterprise, Trimax IT Infrastructure & Services. ´With the growing volume of data being stored in organisational networks, the need for additional computing facilities is also increasing.´ Trimax owns and operates a 30,000 sq ft Tier-III data centre in Airoli, Navi Mumbai, an emerging IT hub in the suburbs of Mumbai. It also operates a Tier-III compliant data centre in Bengaluru using a facility owned by manufacturer and supplier of telecommunication products, Indian Telephone Industries. Similarly, ESDS Software Solution, with a customer base of over 20,000 across the globe, operates a high-specification, carrier-neutral and fully managed data centre at Nashik built with an investment of about $4 million. The data centre, which provides turnkey solutions and core banking solutions on hosted model along with cross platform disaster recovery services one of the largest thermal plants in the country uses ESDS also host portals of many state government organisations and counts among its clients private manufacturing players and players from the hospitality, education and travel sectors. ´The data centre business in India is still in its infancy but the possibilities are endless,´affirms Dr Rajeev Papneja, COO, ESDS Software Solution. ´ESDS is coming up with a data centre in Navi Mumbai that should be ready within the next six to eight months, followed by plans to open one in Bengaluru. We are also working on an initiative to launch one in Dubai soon.´ In Bengaluru, Nxtgen, a managed infrastructure services provider with over 200 man years of data centre experience, offers customers in the under-served mid-market segment a choice of having their data centres on the premises or fully outsourced to its facilities. On premise data centre (OPDC) solutions reduce capex and opex by over 30 per cent for customers and can be delivered in weeks instead of a typical data centre implementation over months, significantly reducing cost and management complexities. We are building a data centre with a power density of 15 kw per rack, compared to 3 kw per rack offered by most other facilities. This enables our customers to host five times more computing in our racks,´says AS Rajgopal, Managing Director, NxtGen Datacenter & Cloud Technologies, whose firm is investing over Rs 280 crore over three years in HDDC, a 28 MW data centre campus in Bengaluru. The proposed facility, spread over a 10 acre area, will be cloud-ready, designed to host high-density IT infrastructure and offering the highest energy efficiency in the region. The HDDC campus, expected to be live for customer services by March 2014, is expected to be LEED Gold and Uptime Institute certified for Tier III. Next year, the company plans to add one more facility in India and is exploring the possibility of adding two international locations. Challenging space Firms around the world are currently faced with an explosion of data, which needs to be stored, secured and managed efficiently to leverage as an asset. A major challenge for data centre vendors, therefore, is infrastructure related to the rising cost of power and real estate, not to mention low penetration and non reliability of bandwidth. With the increase in the number of data centres, power consumption has increased dramatically it occupies 40 per cent of total operational costs and is not matched by supply. Thus, ensuring uninterrupted power supply is a key concern. Rising cost of diesel has led firms like Nxtra to resort to a combination of solar, wind and hydro power. They are also operational issues such as cost and energy management, hardware and software reliability. To address such concerns, data centre service providers are opting to develop green data centres that curtail power consumption. Adoption of green building standards reduce sensible heat load, which further subtracts the power consumed for cooling by at least 30 per cent. Such savings will lead firms to adopt green building standards while constructing new data centres or upgrading existing facilities. Data centres are expected to fulfil up to 15-25 per cent of their requirements through renewable energy sources by 2016, says a Gartner study, but right now not many Indian data centres have taken the green route. Last December, Bharti Airtel launched a green data centre in Mumbai that was designed to achieve 1.7-1.75 power usage effectiveness (PUE), thus making it one of the most energy-efficient facilities in the country. Admittedly, the Indian data centre industry is still going through the learning curve. ´Enterprises are experiencing the pain of maintaining in-house data centres and with technology evolving at such speed, it is difficult for organisations to focus on keeping their IT departments updated,´says ESDS´ Papneja. However, standards are expected to improve thanks to the demanding work environment at data centres. ´Organisations are demanding that their data centres have the highest security, availability, environmental impact and adherence to standards. Standard documents from accredited professional groups, such as the Telecommunications Industry Association, specify the requirements for data centre design,´avers Balaji Sreenivasan, Founder and CEO, Aurigo Software Technologies Inc, a global provider of capital project planning and project portfolio management software, catering to the construction, energy and public-sector markets. The clients of the firm, which is headquartered in Austin, Texas, include large public-sector agencies in the US and energy and construction companies in India. Owing to the nature of information stored, data centres require architecture that ensures complete data protection and security. This means that structural design considerations have to take into account safety from fire and natural calamities like earthquakes and tsunamis and require measures in place for power backup and instant data recovery. Such centres are also required to be designed as green centres, which are environment-friendly in every aspect from construction to optimal use of wind and solar power wherever feasible. As heating, ventilation and air-conditioning systems (HVAC) represent 40-50 per cent of energy consumption for facilities in the expanding data centre industry, considerable cost is involved in having cooling systems in place, thus presenting opportunities for manufacturers. Data centres also require high value installations including CCTV cameras, alarm systems, access control, and energy and building management systems (BMS). ôThe cost is very subjective and would depend on the requirements and size of the premises being secured,´says a senior manager from L&T Electrical & Automation. ôThe package ranges from as low as Rs 50 lakh for a small area up to Rs 8-10 crore to secure a 100,000 sq ft premises.´ Incidentally 15 per cent of L&T´s security automation business is from the data centre industry and the volumes are growing 40 per cent year on year. Himanshu Nadkarni, Marketing Manager, Performance Chemicals, Anantco Enterprises, a Mumbai based company, which supplies fire retardant coatings from the US to data centres, one of which is managed by the Mahindra Group, says, ôWith data centres working 24/7, there is a lot of heat generated leading to fire hazards. If you consider the loss after the accident it is enormous. It has to be prevented and that is where we come in with our passive fire measures.´ The data centre market is becoming a key area of investment for Indian businesses,´says Tarun Kaura, Director- Technology Sales, India & SAARC, Symantec. ôHowever, today data centres are faced with the challenge of increasing complexity, which is an area of concern to an IT manager. Enterprises should understand what their IT assets are, how they are being consumed, and by whom. This will help cut costs and risk.´ Future push The massive increase in data growth has led to rising cost of maintenance and, therefore, investments. Firms have just begun to understand the criticality of the cost and risk implications of build vs co-locate. For most organisations in India, co-location would make more economic sense than building a traditional data centre facility. According to one Returns On Investment assessment, the net present value (NPV) over 15 years of building and managing a data centre works out to $56 million while collocation amounts to just $30.5 million. With this in mind, IT firms are increasingly offering virtualisation and cloud computing services enabling significant capital and operational costs savings while increasing business mobility. Some organisations are also considering establishing their data centres in cooler climes like the Nordic regions to save energy costs. In India, growth is being driven by consolidation and modernisation as well as new build-outs with companies shifting from a distributed set up to a more manageable and efficient centralised model. Efficiencies are being sought to be improved on the data asset sprawl by more access to third-party data centres, minimising of technical obsolescence risks and increasing reliance on the cloud. Indian organisations have started looking for greater efficiencies in running their data centres, almost operating like a cloud vendor. Sectors such as government, IT and telecom are showing maximum traction given the high volume of information they have to manage. These sectors require seamless, highly reliable and robust, shared and secured infrastructure with scalable capacity. Evidently, the data sector, with a change in its operations and architecture, is set to grow as India spins into an increasingly digital future. But key issues will have to be sorted out to allow the surge to the cloud according to Cushman & Wakefield´s Data Centre Risk Index 2013, India was placed 29th on the global list of preferred data centre locations, just one rung above Brazil, which was ranked lowest. ôIndia can certainly improve its ranking but will need to build on its strengths like labour and operational sustainability,´says Arvind Nandan, Executive Director, Consultancy Services, Cushman & Wakefield. It will have to address issues like energy cost and energy security and provide an improved environment for business. Case Study Secure Construction ESDS has a Tier-III fully managed data centre service provider located in Nashik with a total built-up area of 50,000 sq ft. The data centre site is safe from any natural disasters such as floods, tsunamis, earthquakes and landslides. Before constructing the Internet data centre building, a soil boring test was conducted and the structure of the building was built according to the result of the quality of soil present at the site area. To prevent the building from an earthquake, proper RCC structure construction has been employed. The entire building structure is on a single basalt rock. Approach roads are located close to the IDC site, which is in a quiet industrial area. Adequate rainwater harvesting pits are present to drain excess rainwater. The walls have been built using cellular lightweight concrete (CLC) block that provides better strength and higher fire rating. CLC also provides better acoustic and thermal insulation creating a temperature difference of up to 4-5-ª C. The double wall with a cavity of 3 ft helps decrease internal temperature and provides better security. Utilisation of vermiculite material in the floor helps reduce the temperature inside the floor. Data Center Stats At $2.2 billion in 2012, India is one of fastest growing markets and is expected to grow to $3 billion by 2016. India is expected to have the highest IP traffic growth rate in the world with a 62% CAGR from 2011 to 2016. India-¦s IT infrastructure spending will reach $2.3 billion by 2014. Global data centre spending is up by 8% from $99 billion to $106 billion during 2011-12. Growth is expected to accelerate the CAGR of 19% between 2012-15 will reach $126 billion. Storage consumes 5-15% of total power in data centre and volumes are growing between 30% and 50% per year. IT infra like power, cooling and space for centralised suites is critical for 70% of Indian IT decision makers. Cost of securing data centres with automation and systems varies according to the requirement and size. Packages are available from Rs 50 lakh to Rs 8 crore from a small-sized unit to 100,000 sq ft facility. The net present value over 15 years of building and managing a traditional data centre in India jumps to $56 million while co-location will cost about $30.5 million. India was placed 29th on the global list of preferred data centre locations on Cushman & Wakefield-¦s Data Centre Risk Index 2013.World's Largest Data Centers Digital Realty, Chicago, 1.1 million sq ft Quality Technology, Atlanta, 990,000 sq ft Terremark, Miami, 750,000 sq ft Microsoft Chicago, 700,000 sq ft Microsoft Dublin, 550000 sq ft i/O data center, Phoenix, 538,000 sq ft. DuPont Fabros, Chicago, 485,000 sq ft . Microsoft Washington 470,000 sqft Microsoft San Antonio 470,000 sq ft Switch Communications, Las Vegas, 470,000 sq ft To share your views on the growing demand for data centres, write in at feedback@ASAPPmedia.com

Della, Hiranandani & Krisala unveil Rs 11 billion themed township in Pune

In a first-of-its-kind initiative, Della Resorts & Adventure has partnered with Hiranandani Communities and Krisala Developers to develop a Rs 11 billion racecourse-themed township in North Hinjewadi, Pune. Based on Della’s proprietary CDDMO™ model, the hospitality-led, design-driven project aims to deliver up to 9 per cent returns—significantly higher than the typical 3 per cent in residential real estate.Spanning 40 acres within a 105-acre master plan, the mega township will feature an 8-acre racecourse and international polo club, 128 private villa plots, 112 resort residences, a ..

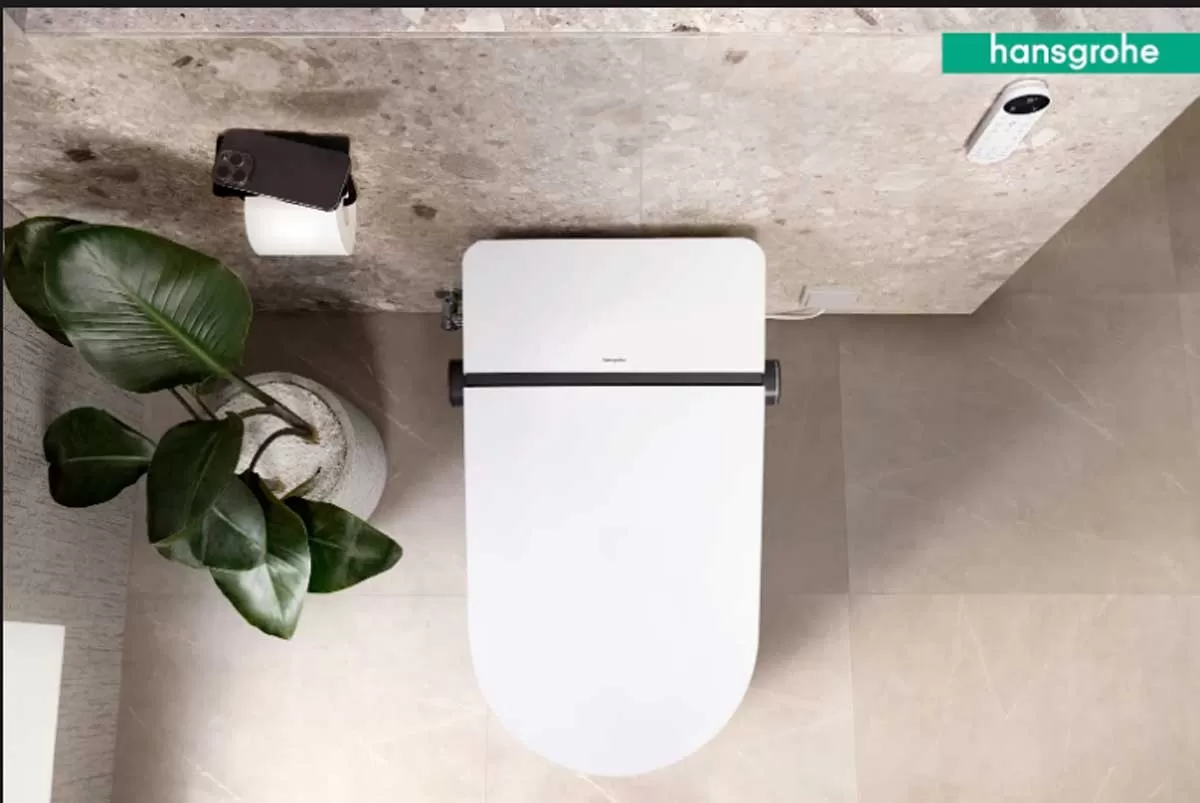

Hansgrohe unveils LavaPura Element S e-toilets in India

Hansgrohe India has launched its latest innovation, the LavaPura Element S e-toilet series, introducing a new standard in hygiene-focused, smart bathroom solutions tailored for Indian homes and high-end hospitality spaces.Blending German engineering with minimalist aesthetics, the LavaPura Element S combines intuitive features with advanced hygiene technology. The series is designed for easy installation and optimal performance under Indian conditions, reinforcing the brand’s focus on functional elegance and modern convenience.“With evolving consumer preferences, smart bathrooms are no lon..

HCC Net Profit Stands at Rs 2.28 Billion for Q4 FY25

Hindustan Construction Company (HCC) reported a standalone net profit of Rs 2.28 billion in Q4 FY25, a sharp increase from Rs 388 million in Q4 FY24. Standalone revenue for the quarter stood at Rs 13.30 billion, compared to Rs 14.28 billion in Q4 FY24. For the full fiscal year, the company reported a standalone net profit of Rs 849 million, down from Rs 1.79 billion in FY24. Standalone revenue for FY25 was Rs 48.01 billion, compared to Rs 50.43 billion in the previous year.Consolidated revenue for Q4 FY25 stood at Rs 13.74 billion, and for FY25 at Rs 56.03 billion, down from Rs 17.73 billion i..

Latest Updates

Advertisement

Recommended for you

Advertisement

Subscribe to Our Newsletter

Get daily newsletters around different themes from Construction world.

Advertisement

Advertisement

Advertisement

subscribe to the newsletter

Don't miss out on valuable insights and opportunities

to connect with like minded professionals