The ongoing Non-Banking Financial Companies’ (NBFC) cash crunch can hit close to home as it could have a cascading impact on the somewhat improving residential real sector. This is primarily because for last few years, developers had been availing term loans from NBFCs and Housing Finance Companies (HFCs) and any turmoil in the latter is bound to impact the Indian realty industry. Further, at a time when the festive season fervour and loan melas are expected to boost residential market sales, the state of financial markets is likely to play a vital role. ?

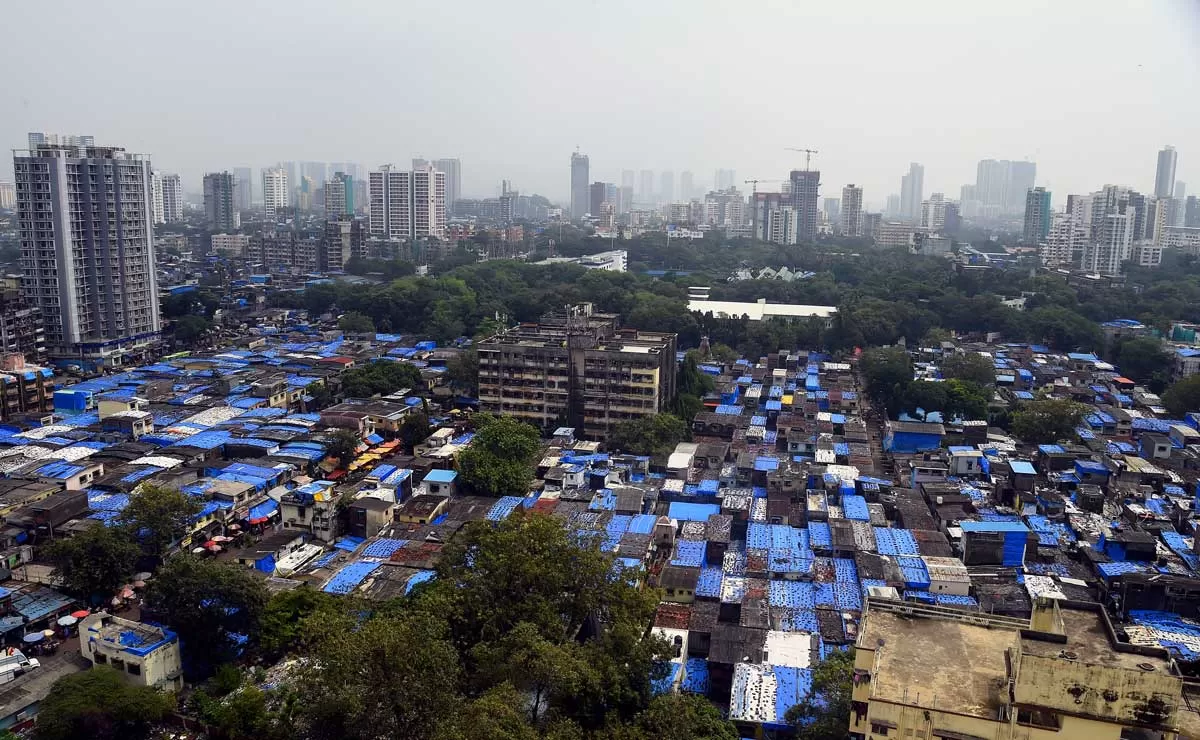

The Indian residential market volumes spiralled down in terms of demand and supply almost every successive year in this decade. From a high of 480,000 units in 2010, the supply last year stood at mere 103,000 units across the top eight cities. Investor frenzy in the initial part of the decade and focus on premium projects propelled prices to stratospheric levels, which were not in harmony with buyer affordability. Subsequently, with end-user demand cracking up and investors progressively receding from the scene, markets adopted a sombre mood and prices witnessed moderation.

Preceding the recent financial turmoil, a wave of structural calibrations had swept the landscape, beginning in 2016. Starting with Benami Transactions (Prohibition) Amendment Act, 2016 and demonetisation of high value currencies, coupled with measures of integrated indirect tax structure brought by GST and the unified realty sector regulator, Real Estate (Regulation and Development) Act (RERA), 2016 have been significant landmarks, which have transformed the DNA of the country’s realty. Together, while these measures have created much-desired and long-awaited reforms in the industry, they have also heightened the participation-threshold of stakeholders. The intent is clearly to balance the scales with consumers becoming paramount in the overall transaction process.

However, as the impact of these reforms crystalises, the challenges are still quite there for market players. In fine balance as of now, but any blip on the financing side of the eco-system could send a strong ripple effect on demand, supply and more consequently, the price.

The recent NBFC crisis, triggered by a near explosion of debt-pile in IL&FS, is one such development. The jury is still out whether it could have been contained, but the resultant cascading impact on several NBFCs, has caused a stir in residential markets. There had been some early signs of improvements in the residential sector, for which the hope still remains, but the path appears more contoured now. For some years now, developers had been availing term loans from NBFCs and HFCs, which in turn raised money through commercial paper from mutual funds, banks and corporate treasuries. Mutual funds also had a dream run in terms of subscription to their short-term debt and liquid schemes during this period. However, just as the market appeared to be gaining some strength, the aforesaid financial shake-up has caused a rewind-like situation amongst the financial community.

Now, with investors pulling out money from the debt schemes of mutual funds and lack of confidence about the repayment ability of NBFCs, the mutual fund credit line appears to have turned gray. The banking segment, despite recent RBI attempt to prop-up credit line by allowing leeway for lending, has been cautious with its share of Non-Performing Asset (NPA) issues. It does appear highly watchful and will take far greater precautions before actively participating in the process. In such a liquidity scenario with NBFC segment, even the sanctioned credit lines to realty projects face the risk of a temporary freeze, putting project completions in jeopardy.

It is estimated that more than half of financing to realty industry in recent years has been contributed by the NBFCs including the HFCs. With such a lopsided dependence on this financier segment, a large number of projects must align themselves again.

The supply side remains in a highly sensitised zone, with consistent efforts and offers to resuscitate the demand. Especially at a time when the festive season fervour and loan melas provide the customary boost to residential market sales, the state of financial markets has a deciding role. As observers and analysts of the marketplace, we remain highly watchful and hopeful of the measures by all stakeholders to continue clearing the roadblocks, for a much-anticipated rejuvenation.

It can be said that the revival of the market has been slightly slowed on account of the recent financial stress, which was practically out of reckoning till a couple of months ago. The step taken to contain the complete crash by bailing out of IL&FS is a commendable one, in the absence of which, we could have hurtled into the darkest of pits. The saving of situation under the circumstances, at least leaves us with better controls for survival and recovery.

In mapping the path forward, we will also factor-in a series of upcoming events like the state-elections, followed by General Elections in 2019, which will have a usual short-term impact on market-processes. However, we would take that up in another piece subsequently. As of now, we continue to watch the unfolding of financial reverses and their impact on realty in India.

About the Author: Arvind Nandan is Executive Director-Research at Knight Frank India.