While carrying out reforms, the government must ensure that they have a statutory foundation to ensure its binding nature. Vishnu Sudarsan, Abhishek Munot, and Samikrith Rao explain what the FM could do this year for discoms.

_______

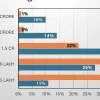

At the heart of problems plaguing the power sector for years now is the distribution of electricity. It is estimated that more than Rs. 3.5 lakh crore are owed to discoms in terms of receivables, and more than Rs. 1.4 lakh crore are owed by discoms to generators. This year debt levels of discoms are expected to rise beyond Rs. 2.6 lakh crore and appear to be without a clear path to resolution. The aftermath of such factors may impact the approximately Rs. 1.15 lakh crore of Non-Performing Assets(NPAs) hanging in balance.

This has resulted in a balance sheet problem together with a creditworthiness crisis that threatens to deteriorate the health of not only the power sector, but the financial sector as well.

The causes for this are manifold—primarily, operational and financial inefficiencies, lack of a cost-reflective tariff, regulatory delays, and so on. India has the dubious distinction of suffering around 30-45% in distribution and transmission losses, the highest in the world. Theft of electricity is estimated to cost the discoms around 1.5% of India’s GDP. Despite such losses, discoms are unable to charge cost-reflective tariffs because of political and regulatory hurdles.

To tackle this problem, several reforms have been attempted over the years, ranging from proposed amendments to the Electricity Act, debt restructuring, mandating certain payment norms to varying modes of privatisation. While structural reforms in the form of legislative amendments are yet to be passed, the central government in 2015 put in place the Ujwal Discom Assurance Yojana (UDAY) to tackle the ballooning debt of discoms. Under UDAY, state governments took over 75% of the existing debt of discoms through issuance of bonds which mature in 10-15 years. In return, discoms were to cut costs, reduce line losses, tackle theft and fix faulty meters. While appearing promising in 2015, the persisting structural and operational problems have led to debt reaching pre-UDAY levels today despite resolution under UDAY.

The privatisation efforts story

Considering the ever-deteriorating debt situation compounded by Covid-19, the Atmanirbhar Bharat package once again attempted to infuse liquidity into discoms. Such liquidity infusion was tied to performance improvements, in a flashback to UDAY. At the same time, there was a push for privatisation. A model draft Standard Bidding Guidelines (SBG)—a blueprint for privatising state discoms going forward—was released. The central and state governments will need to collaborate along with the regulators to effectively implement these guidelines. The government will also have to ensure that they come up with a financial restructuring plan that addresses the concerns of all stakeholders.

The franchise model. To avoid bankrolling revenue gaps again, the government seeks to push the privatisation agenda to avoid a third iteration of UDAY. A range of privatisation options can be considered, from distribution sub-licensee, franchising, public-private partnership (PPP), and complete privatisation. While successful private discoms existed before, the route of a distribution franchisee has been preferred lately, possibly due to political palatability. While some franchisees have been successful, there have been a few which have not taken off or shut down due to lack of stakeholder support or other reasons. The PPP model has delivered expected results in Delhi, once considered the power theft capital of the world with losses at around 55%. Those losses have now come down to under 15%.

Structural reforms through legislation

While privatisation may be inevitable, required structural reforms in the form of legislative changes must not be lost sight of.

-

The introduction of models of separation of wires and content, first mooted in 2014, would open further avenues for efficiency, increased consumer choice and competition.

-

Subsidies must be mandated to be in the form of a direct cash transfer which completely bypasses the accounts of the discom.

-

Cross subsidisation must be done away with or be substituted by direct subsidies.

-

Regulators must be strengthened and mandated to determine a cost reflective tariff in a time bound manner. Regulators must be kept away from political influence and their independence must be ensured. This will ensure a solvent path ahead for the discoms, so that private capital can be attracted.

While it is necessary to tackle this crisis urgently, experience has shown that a positive impact may not be forthcoming if all stakeholders are not on board. Thus, extensive consultation must be undertaken while putting a structural reform into motion.

While carrying out reforms, the government must ensure that they have a statutory foundation to ensure its binding nature. These reforms must also be tied in with the inevitable changes flowing over the sector, such as increased use of infirm renewable energy, proliferation of hybrid storage technologies and adoption of smart meters and smart grids.

Perhaps, that may ensure that good money is not thrown after bad money yet again.

Authors: Vishnu Sudarsan is a Partner; Abhishek Munot is a Partner; and Samikrith Rao is an Associate at J Sagar Associates. Views are personal.

Image: pvproductions