Adani Ports acquires Karaikal Port for Rs 14.85 bn

Read full article

CW Gold Benefits

- Weekly Industry Updates

- Industry Feature Stories

- Premium Newsletter Access

- Building Material Prices (weekly) + trends/analysis

- Best Stories from our sister publications - Indian Cement Review, Equipment India, Infrastructure Today

- Sector focused Research Reports

- Sector Wise Updates (infrastructure, cement, equipment & construction) + trend analysis

- Exclusive text & video interviews

- Digital Delivery

- Financial Data for publically listed companies + Analysis

- Preconceptual Projects in the pipeline PAN India

Myanmar Port sold at discounted price of $30 million by Adani Ports

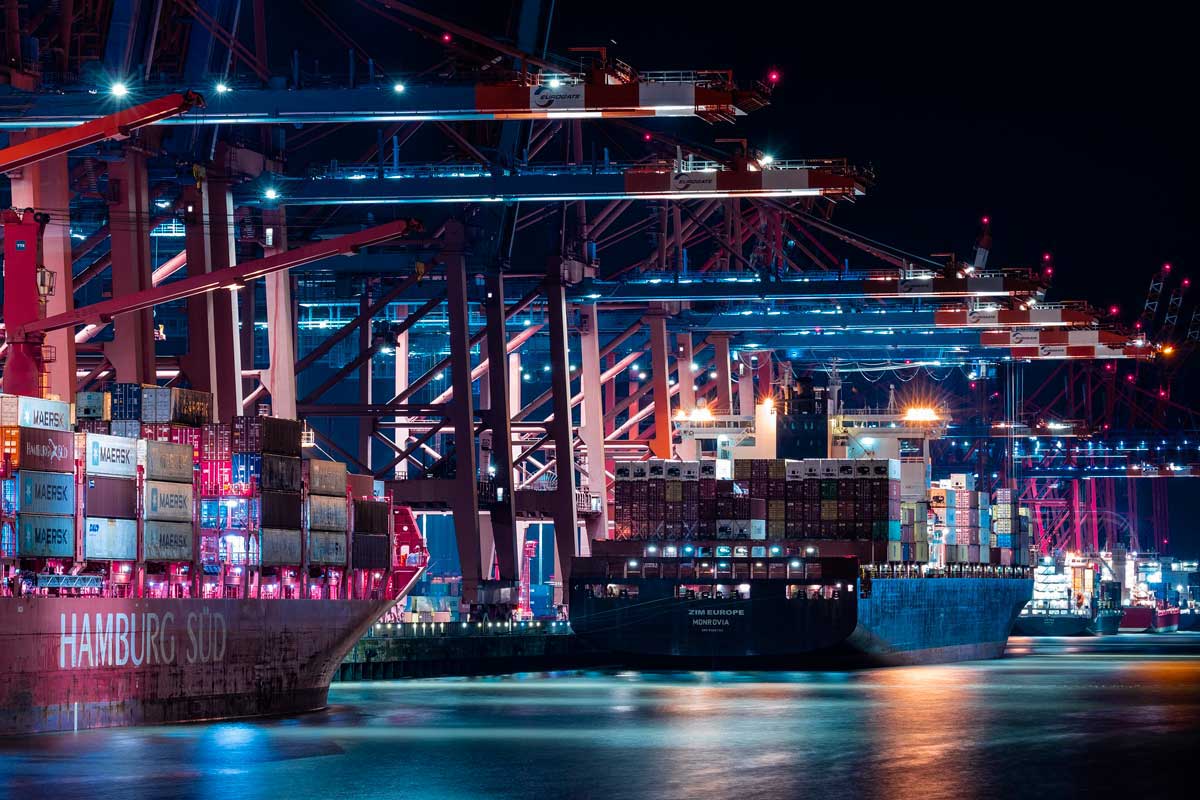

Adani Ports and Special Economic Zone (APSEZ), the largest private port operator in India, stated that it had agreed to sell the contentious Myanmar Port for $30 million, which is $120 million less than the value of its previous investment in the port. Karan Adani, CEO & Director, APSEZ stated that, "This exit is in line with the guidance provided by the APSEZ Board based on the recommendations made by the risk committee in October 2021." The business announced the signing of a share-purchase agreement for the sale of its Myanmar Port in May 2022. The agreement included a number of cond..

Adani Ports acquires Israel’s second largest port

The second-largest port in Israel, Haifa Port, has been privatised thanks to a partnership by Adani Ports and Special Economic Zone (APSEZ) and Gadot Group, the business announced in an index filing. The Adani-Gadot group has obtained the right to acquire all of the shares of Haifa Port Company. through the successful bid. The Port of Haifa is still under concession until 2054.

“Needless to say, we are delighted to win the privatisation tender of the Port of Haifa and this is one of ..

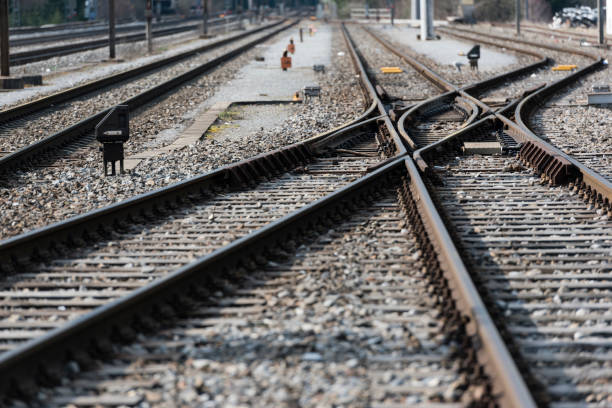

Gautam Adani to consolidate all rail assets under single company

Industrialist Gautam Adani is ready for consolidation of all the railway assets in a single entity, therefore removing duplication and building scale, which will help him in bidding for projects having a higher net worth.

Adani will be bringing the six rail assets; their portfolio comprises 690 km of track length under the Adani Tracks Management Services, which is completely a part of the listed Adani Ports and Special Economic Zone (APSEZ). Adani is currently aiming for a 2,000 km total track length portfolio by 2025. The consolidation will enable Adani to take part in pr..

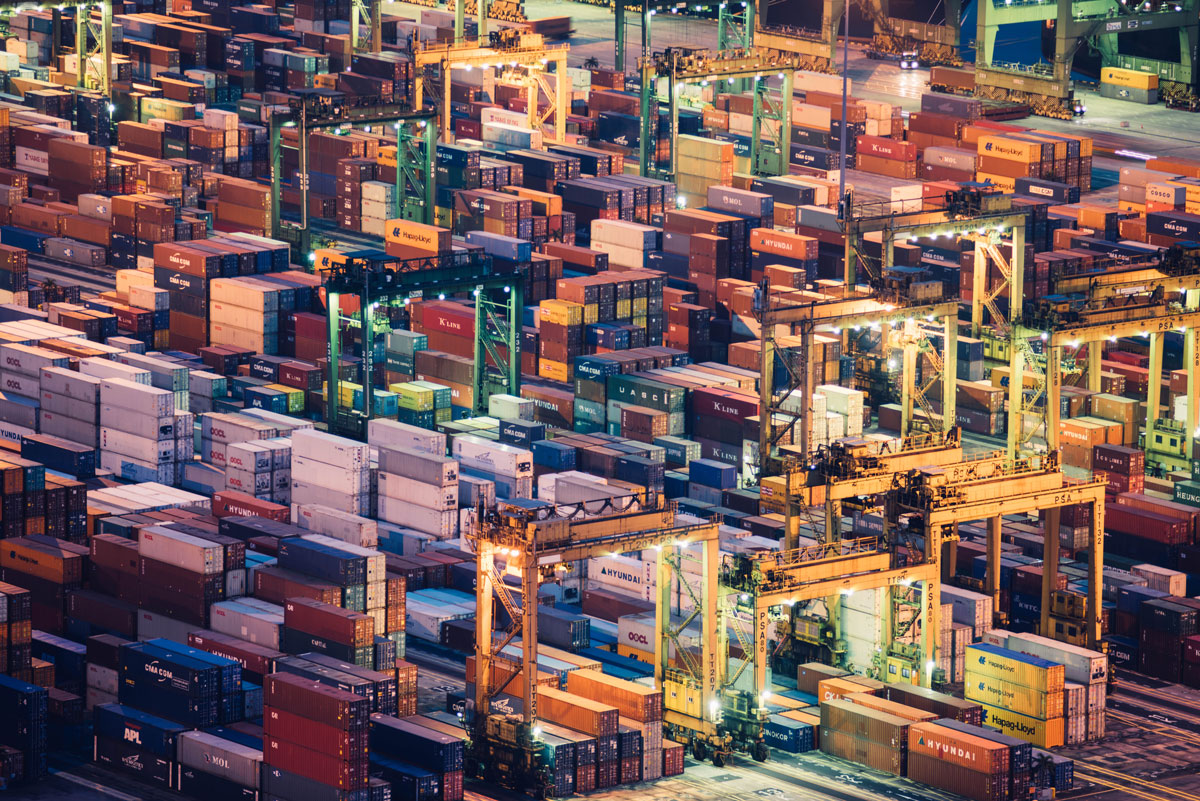

Indian container cargo set to expand by 8% in FY25 amidst Red Sea crisis

CareEdge Ratings forecasts that Indian container cargo volume will experience an 8% growth, reaching 342 million tonnes (mt) in FY25. They also anticipate the risk of a prolonged Red Sea crisis. In a sectoral report, the agency mentions that the connection of the Dedicated Freight Corridor to Jawaharlal Nehru Port Trust (JNPT) in FY26, coupled with capacity expansions by ports, will likely propel the growth in container volumes in the medium term. According to the report, significant adverse movements in charter rates affecting cargo volumes, as well as vessel additions by shipping lines, will..

Nalanda Capital Sells Stake in Great Eastern Shipping

Nalanda Capital has divested a 1.4% stake in Great Eastern Shipping, a prominent player in the ports and shipping industry, for a total sum of Rs. 1.90 billion. This move comes amidst evolving market dynamics and reflects Nalanda Capital's strategic realignment of its investment portfolio.

The sale of shares in Great Eastern Shipping represents a calculated decision by Nalanda Capital to optimise its investment holdings and capitalise on market opportunities. The transaction, valued at Rs. 1.90 billion, underscores the investor's confidence in realising returns while maintaining flexibi..