- Home

- Infrastructure Transport

- ROADS & HIGHWAYS

- Toll exemption for select vehicle categories by some states, a risk for state-led BOT model: ICRA

Toll exemption for select vehicle categories by some states, a risk for state-led BOT model: ICRA

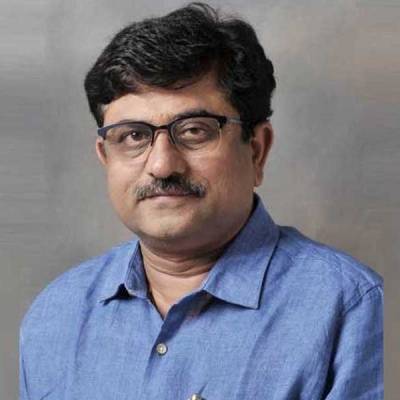

Giving more insights, Shubham Jain, Vice-President & Group Head, Corporate Ratings, ICRA, says,“The actual traffic on a majority of the state toll road stretches is already lower at around 60-65 per cent of that of initial estimates. Toll exemption for select vehicle categories will be an additional burden on the cash flow and would affect the debt-servicing capability further. Therefore, timely and adequate reimbursements from the respective state governments will remain critical for the concessionaires from the debt-servicing point of view.”

The toll exemption policy was rolled out by Maharashtra (in June 2015), Gujarat (August 2016) in the past and recently by Rajasthan (April 2018) pose a risk to the state-led build-operate-transfer (BOT) model. Around 27 per cent of the BOT (Toll) projects in Maharashtra, with an outstanding debt of Rs 11.10 billion, are vulnerable, while nearly 43 per cent of the BOT (Toll) projects in Rajasthan with outstanding debt of Rs 31.09 billion are vulnerable.

As far as compensation is concerned, in case of Maharashtra, the quantum of compensation has been disputed by many concessionaires; the payments are made with a lag of three to six months and several payments for projects under dispute are still pending. Gujarat has started compensating for the revenue loss on an adhoc basis pending finalisation of the formula; however, the payments are made within 30-45 days. The compensation formula is yet to be finalised by the Government of Rajasthan (GoR). The liquidity stress till the receipt of compensation from the GoR could jeopardise the concessionaire’s ability to service debt in a timely manner in the absence of sponsor support or maintenance of debt service reserve account (DSRA). Moreover, timeliness in receiving compensation is yet to be established given that toll exemption came into force only two months ago.

Speaking on the impact of increased traffic movement from exempted categories on maintenance expenses, Jain added: “Two, three-wheelers and the car segments of the local traffic, which were earlier using the service road have started using the main carriageway, post exemption. There would be no change in traffic volumes, pertaining to other segments (state transport buses). The vehicle damage factor (VDF), which is one of the key inputs to determine wear and tear (a multiplier for converting the number of commercial vehicles of different axle loads and axle configurations to the number of standard axle-load repetitions) is considered only for the two-axle and above categories. Therefore, increase in passenger vehicles is expected to have a negligible impact on the maintenance expenses.”

Deviations like these from the contractually binding concession agreements, are likely to result in disputes as the quantum of compensation in such cases is always not agreeable to all parties. At a time when the participation from the private sector is muted and lenders tread cautiously into new infrastructure projects, this move could further dent the confidence of both private participants and lenders, says ICRA.

The toll exemption policy announced by a few state governments, for select category of vehicles, is emerging as one of the major risks for the road sector developers, particularly the state-led build operate transfer (BOT) model. In terms of vehicular movement, the state highways are typically dominated by passenger vehicles, which account for more than 50 per cent of the total traffic; this translates to about 25-30 per cent of traffic in passenger car unit (PCU) terms and revenues. ICRA estimated the net present value (NPV) of cash flows available for debt servicing (CFADS) as a percentage of debt outstanding for each of the affected special purpose vehicles (SPVs) across these states, to determine the vulnerability of the projects in terms of meeting their debt obligations. Giving more insights, Shubham Jain, Vice-President & Group Head, Corporate Ratings, ICRA, says,“The actual traffic on a majority of the state toll road stretches is already lower at around 60-65 per cent of that of initial estimates. Toll exemption for select vehicle categories will be an additional burden on the cash flow and would affect the debt-servicing capability further. Therefore, timely and adequate reimbursements from the respective state governments will remain critical for the concessionaires from the debt-servicing point of view.” The toll exemption policy was rolled out by Maharashtra (in June 2015), Gujarat (August 2016) in the past and recently by Rajasthan (April 2018) pose a risk to the state-led build-operate-transfer (BOT) model. Around 27 per cent of the BOT (Toll) projects in Maharashtra, with an outstanding debt of Rs 11.10 billion, are vulnerable, while nearly 43 per cent of the BOT (Toll) projects in Rajasthan with outstanding debt of Rs 31.09 billion are vulnerable. As far as compensation is concerned, in case of Maharashtra, the quantum of compensation has been disputed by many concessionaires; the payments are made with a lag of three to six months and several payments for projects under dispute are still pending. Gujarat has started compensating for the revenue loss on an adhoc basis pending finalisation of the formula; however, the payments are made within 30-45 days. The compensation formula is yet to be finalised by the Government of Rajasthan (GoR). The liquidity stress till the receipt of compensation from the GoR could jeopardise the concessionaire’s ability to service debt in a timely manner in the absence of sponsor support or maintenance of debt service reserve account (DSRA). Moreover, timeliness in receiving compensation is yet to be established given that toll exemption came into force only two months ago. Speaking on the impact of increased traffic movement from exempted categories on maintenance expenses, Jain added: “Two, three-wheelers and the car segments of the local traffic, which were earlier using the service road have started using the main carriageway, post exemption. There would be no change in traffic volumes, pertaining to other segments (state transport buses). The vehicle damage factor (VDF), which is one of the key inputs to determine wear and tear (a multiplier for converting the number of commercial vehicles of different axle loads and axle configurations to the number of standard axle-load repetitions) is considered only for the two-axle and above categories. Therefore, increase in passenger vehicles is expected to have a negligible impact on the maintenance expenses.” Deviations like these from the contractually binding concession agreements, are likely to result in disputes as the quantum of compensation in such cases is always not agreeable to all parties. At a time when the participation from the private sector is muted and lenders tread cautiously into new infrastructure projects, this move could further dent the confidence of both private participants and lenders, says ICRA.