Budget cuts by states to adversely affect contractors in FY2021

Read full article

CW Gold Benefits

- Weekly Industry Updates

- Industry Feature Stories

- Premium Newsletter Access

- Building Material Prices (weekly) + trends/analysis

- Best Stories from our sister publications - Indian Cement Review, Equipment India, Infrastructure Today

- Sector focused Research Reports

- Sector Wise Updates (infrastructure, cement, equipment & construction) + trend analysis

- Exclusive text & video interviews

- Digital Delivery

- Financial Data for publically listed companies + Analysis

- Preconceptual Projects in the pipeline PAN India

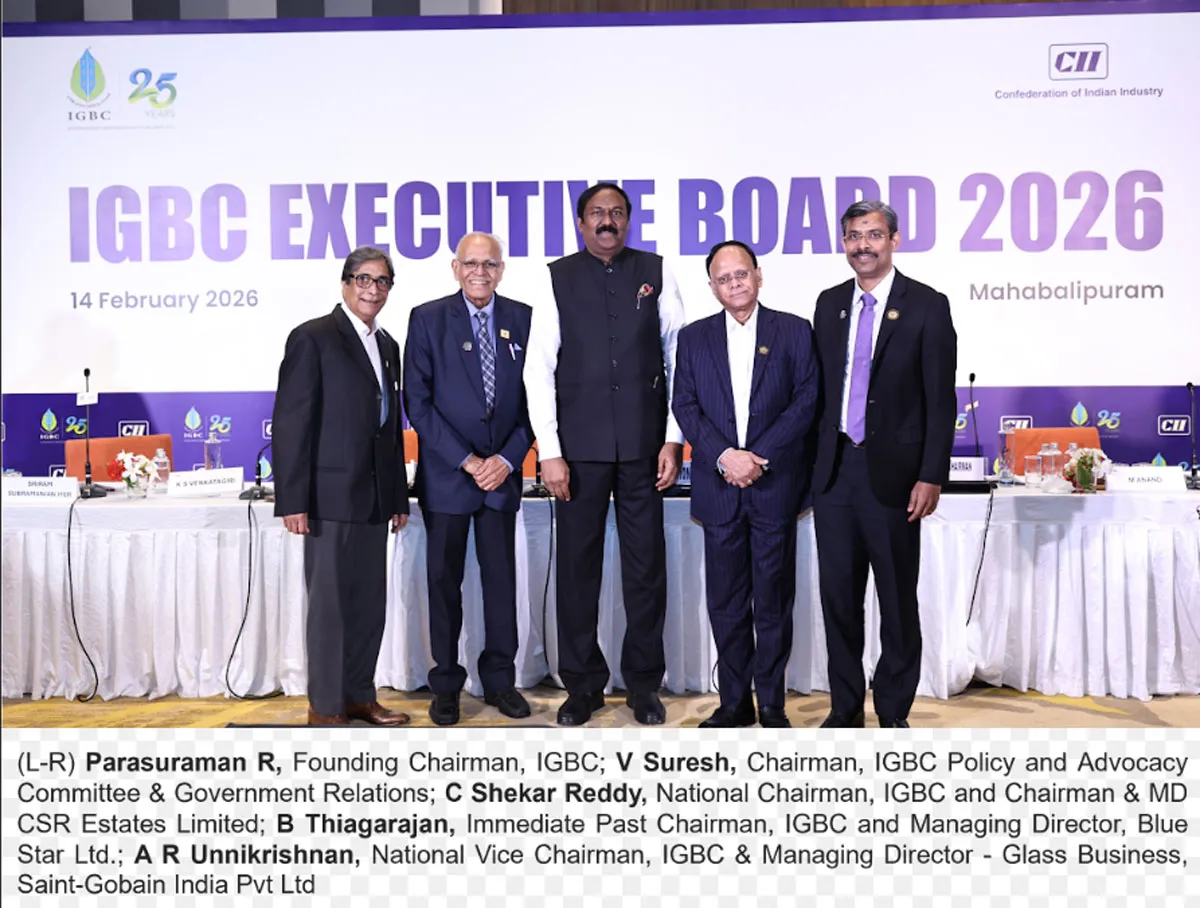

CII-IGBC Announces National Leadership Transition

Confederation of Indian Industry Indian Green Building Council (CII-IGBC) has announced leadership changes effective 1 April 2026. C. Shekar Reddy, Chairman and Managing Director of CSR Estates Ltd and current National Vice-Chairman, will assume office as National Chairman, succeeding B. Thiagarajan, Managing Director of Blue Star Ltd, whose two-year tenure concludes. A. R. Unnikrishnan, Managing Director – Glass Business, Saint-Gobain India Pvt Ltd, will take over as National Vice-Chairman.Since its inception in 2001, IGBC has registered over 18,850 projects, representing more than 15.52 bi..

Hexalog Appoints AVP for Global Expansion Drive

Hexalog has appointed a new Assistant Vice President (AVP) to support its international expansion and product-led growth strategy across global trade corridors.The AVP will lead the development and scaling of new cross-border logistics products, with a focus on high-impact international trade lanes and emerging corridors. The role includes identifying unmet market needs, shaping product strategy, enabling new trade lanes and driving strategic partnerships aligned with the company’s growth agenda.The appointee will oversee product development, market expansion, trade-lane enablement and comme..

Unispace Appoints Paul Saville-King as Group CEO

Unispace has appointed Paul Saville-King as Group Chief Executive Officer, effective February 2026. The company is a global provider of integrated workplace strategy, design and construction services.“Paul brings the right mix of industry, global and leadership experience for where Unispace is heading,” said Jodi Ingham, Managing Director at PAG. “We see this appointment as an important step in strengthening the business and supporting its next phase of growth.”Paul joins from CBRE, where he most recently served as Chief Product Officer of Global Workplace Solutions and earlier as Glob..