Industry Welcomes Infra Push In Maharashtra Budget 2026

The Maharashtra State Budget 2026, presented by Devendra Fadnavis, has received a positive response from the real estate sector, with industry leaders highlighting its strong focus on housing, infrastructure expansion and urban development. The budget outlines the completion of 3.57 lakh houses under Pradhan Mantri Awas Yojana with rooftop solar incentives, alongside significant investments in metro corridors, highways and digitised urban services. It also includes development plans for Pune, Nashik and Nagpur, with the broader aim of strengthening Maharashtra’s economic growth and urban in..

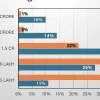

Vedanta Power Reports 29 Per Cent Women Workforce

Vedanta Power marked International Women’s Day by highlighting rising gender diversity across its workforce, with women now comprising nearly 29 per cent of employees in FY2026, among the highest levels in India’s thermal power sector. At Talwandi Sabo Power Limited (TSPL) in Punjab, women account for about 52 per cent of the workforce. Other assets also show increasing representation, with Meenakshi Energy reporting 26 per cent women employees and Vedanta Limited Chhattisgarh Thermal Power Plant (VLCTPP) recording 19.5 per cent. Women are contributing across engineering and plant operat..

DRA Homes Debuts AI Sales Assistant At Fairpro

DRA Homes has launched Chennai’s first multi-lingual Virtual Sales AI Assistant at the CREDAI Chennai Fairpro exhibition, marking a step towards technology-led customer engagement in the city’s real estate sector. Designed as a digital sales assistant, the AI-powered tool enables prospective buyers to access project information, pricing details, configuration options and amenity specifications. It also allows users to schedule site visits, helping buyers explore projects with greater convenience. Ranjeeth Rathod, Managing Director – DRA Homes, said, “Innovation in real estate is no l..