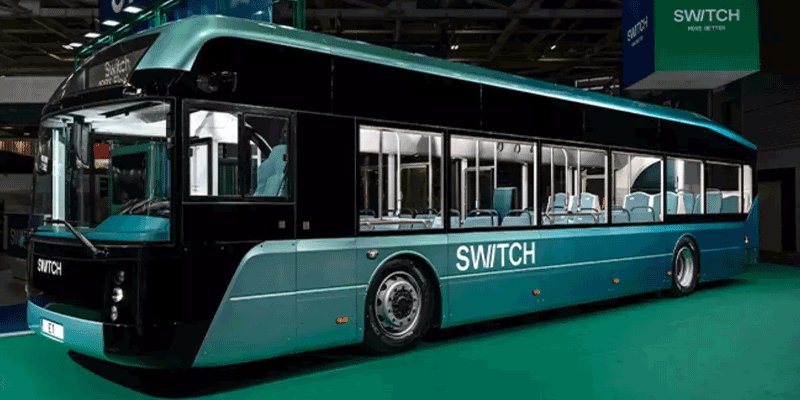

E-bus adoption set to double to 8%, fuelled by policy support

India Strengthens National Space Infrastructure In 2025

The Indian Space Research Organisation (ISRO) reported key advances in national launch and space infrastructure in 2025. The SPADEX mission demonstrated autonomous docking and undocking with power transfer and completed circumnavigation, making India the fourth nation to demonstrate docking in space. The PSLV Orbital Experimental Module (POEM-04) carried multiple payloads from ISRO, startups and academia, completed over 1,000 orbits and demonstrated a robotic arm and seed germination. GSLV-F15/NVS-02 was the 100th mission to lift off from Sriharikota and injected its satellite precisely to th..

India Advances Space Insurance And Debris Mitigation

Different types of space insurance products are available in India and are offered by Indian insurers in collaboration with global insurers, re-insurers, underwriters and brokers, allowing private entities the freedom to obtain appropriate cover for the activities they undertake. The Government encourages such entities to secure adequate insurance to address risks associated with high-value, capital-intensive space projects. Insurers and re-insurers worldwide commonly distribute risk among themselves for such complex ventures. The Indian Space Research Organisation (ISRO) has established the ..

ECI To Host National Conference Of State Election Commissioners

The Election Commission of India (ECI) will host a National Conference of the State Election Commissioners (SECs) on February 24, 2026, at the Bharat Mandapam in New Delhi. State Election Commissioners of all 36 States and UTs are expected to attend the conference along with their legal and technical experts. Chief Electoral Officers (CEOs) of the ECI from all 36 States and UTs will also be present. The National SEC Conference is being convened after a gap of over 25 years, the previous meeting having been held in 1999. The Chief Election Commissioner (CEC), Gyanesh Kumar, will chair the conf..