India Reduces Windfall Tax on Crude Oil to Rs.2,100 per Tonne

Six ways a smarter workflow leads to faster, more accurate bids

In today’s fast-paced civil construction environment, estimators need more than just solid numbers. They need smart, streamlined processes. This article explores six key ways connected workflows can transform the estimated approach, help in minimising risk, move faster, and improve accuracy. By integrating tools, data, and teams, one can produce stronger bids with less rework, fewer surprises, and more confidence. As an estimator, the job goes beyond producing numbers. They are responsible for delivering bids that are fast, accurate, and built to win. In today’s civil construction ind..

Experion Launches Women-Only Co-Living Project in Greater Noida

Experion, part of Singapore-based AT Capital Group, has launched its first co-living space under its managed rental housing brand, VLIV, in Greater Noida. The all-women residence features 730 twin-sharing beds with a strong focus on safety, comfort, and well-being. VLIV has committed a $300 million investment to create a structured, service-led rental housing ecosystem in India. The brand aims to scale up to 20,000 beds in the next few years, with a long-term target of 100,000 beds nationwide. “India’s rental housing is fragmented. VLIV is our way of building long-term, dependabl..

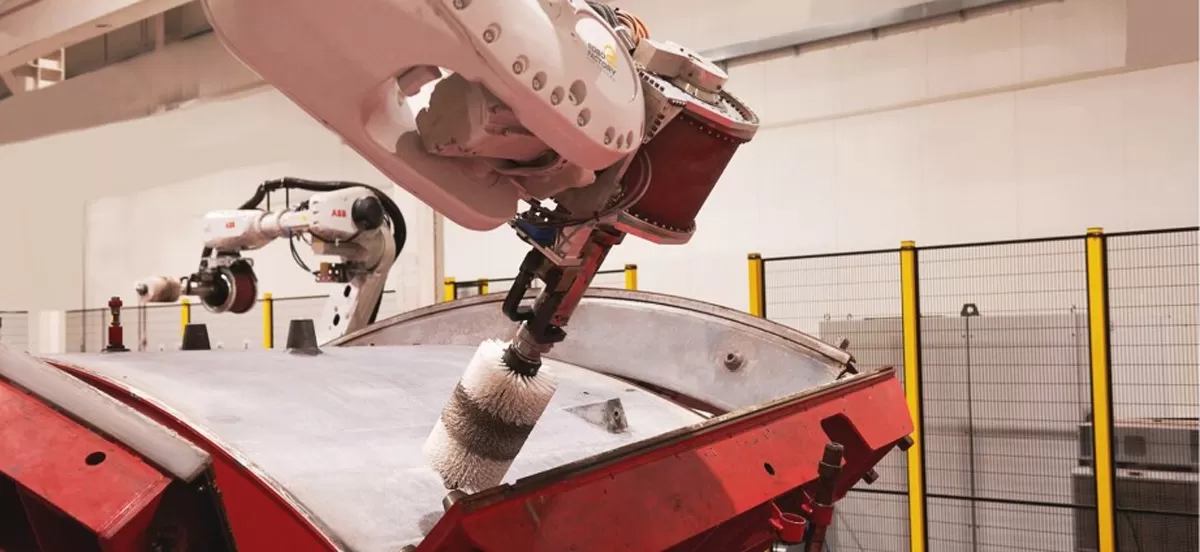

Officine Maccaferri Acquires CPT to Bolster Tunnelling Tech

Ambienta’s platform company, Officine Maccaferri S.p.A., has acquired CPT Group, a leading Italian developer of robotic prefabrication systems and digital control technologies for mechanised tunnelling. The move positions Maccaferri as a global player in integrated tunnelling solutions, blending traditional and advanced mechanised systems. Based in Nova Milanese, CPT serves major global contractors across Europe, Southeast Asia, and Australia. The company offers robotic prefabrication (Robofactory), productivity-monitoring software for Tunnel Boring Machines (TBMs), and eco-designed spa..