RVNL bags NHAI contract for road upgradation in Odisha

Hettich Showcases ‘Magical Motion’ Innovations at Acetech 2025

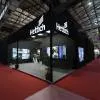

Staying true to its promise of ‘Magical Interior Experiences’, Hettich unveiled a futuristic showcase at Acetech 2025, reimagining the future of modern living and workspaces through innovative German engineering. As an Associate Partner, Hettich’s exhibit captivated visitors with the SpinLines family, headlined by its latest innovation — RoomSpin. This choreographed interior system transforms entire spaces within seconds by rotating room modules to create dynamic, flexible environments. Engineered with precision turning and swivelling mechanisms, it enables architects and designer..

HPWWI, Biesse Partner to Boost Woodworking Skill Development

The Hettich Poddar Wood Working Institute (HPWWI) has signed a Memorandum of Understanding (MoU) with Biesse, strengthening efforts to advance skill development in India’s woodworking sector.The partnership will enhance training in advanced woodworking machinery, helping learners integrate modern technology into traditional craftsmanship. It marks the second collaboration between HPWWI and Biesse — after Faridabad — now expanding to Bhandup, Mumbai, symbolising Biesse’s entry into India’s financial capital.Mr Amit Prasad, CHRO, Hettich India & Director, HPWWI, said, “At HPWWI, ..

ITA launches India programme to boost clean industry projects

The Industrial Transition Accelerator (ITA) has launched its India Project Support Programme and released the India Insights Briefing: Unlocking India’s Clean Industrialisation Opportunity, developed with Boston Consulting Group (BCG). The initiative seeks to accelerate investment-ready decarbonisation projects and drive low-carbon growth across India’s key industrial sectors. A global multi-stakeholder initiative launched at COP28, the ITA’s new programme aims to fast-track flagship industrial projects in sectors such as chemicals, steel, cement, aluminium, aviation, and shipping, supp..