CapitaLand to acquire 40% stake in SC Capital for $209 million

ISRO’s IMAT Success Boosts Readiness for Maiden Gaganyaan Mission

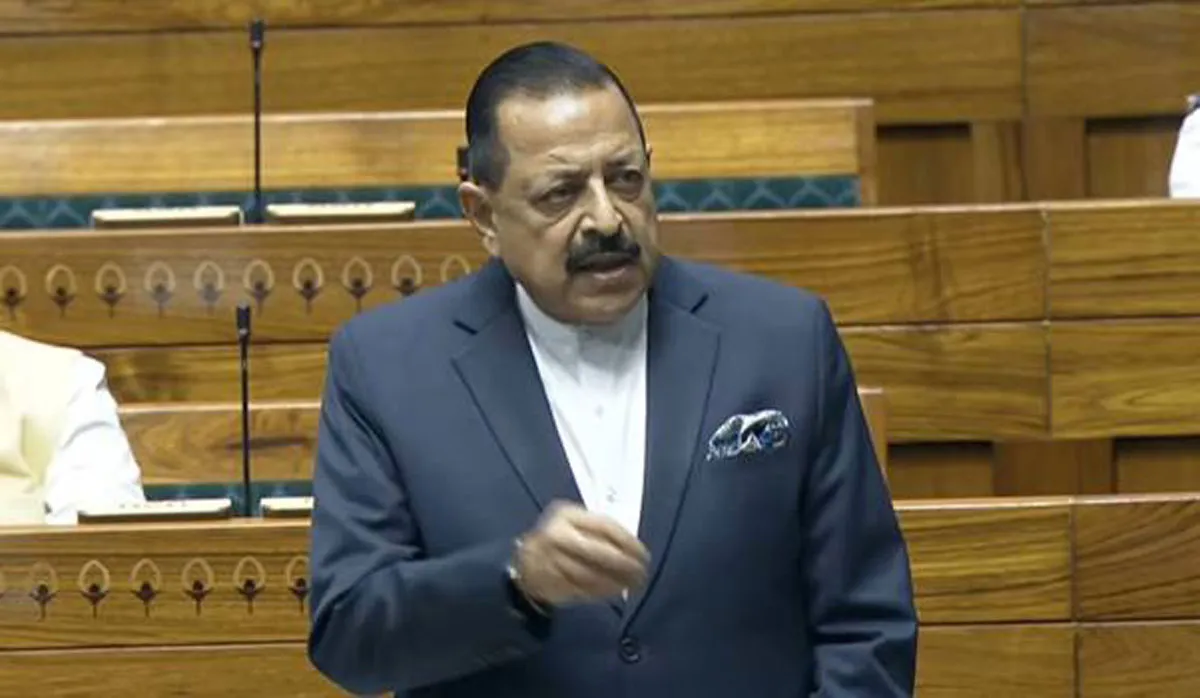

Union Minister of State for Science and Technology Dr Jitendra Singh informed Parliament that ISRO has achieved a key milestone in its preparations for India’s first human space mission with the successful completion of the Integrated Main Parachute Airdrop Test (IMAT). He said in the Lok Sabha that the test forms a central part of the qualification campaign for the Crew Module’s parachute-based deceleration system, one of the most vital elements in human-rating the mission.According to Dr. Jitendra Singh, the IMAT recreated one of the most demanding descent conditions by intentionally del..

Gyanesh Kumar Takes Charge as Chair of International IDEA Council

Chief Election Commissioner of India Gyanesh Kumar has assumed the Chairship of the Council of Member States of the International Institute for Democracy and Electoral Assistance for 2026. The ceremony in Stockholm was also attended by India’s Ambassador to Sweden, Anurag Bhushan. India, a founding member of International IDEA, has long contributed to the organisation’s governance and global democratic dialogue, and the new Chairship signals broad recognition of the Election Commission of India as a trusted and innovative election management institution.During his visit, Kumar held discuss..

Coal Mines Boost Local Growth and Support India’s Energy Self-reliance

The Magadh and Amrapali coal mines in Jharkhand are playing a pivotal role in strengthening India’s energy security, contributing nearly half of Central Coalfields Limited’s total coal production in 2024–25. Both mines support the broader goal of ensuring steady coal availability for the power sector under the vision of Aatmanirbhar Bharat. Magadh has estimated mineable reserves of 854.91 million tonnes, while Amrapali holds 456.34 million tonne. For FY 2025–26, the two are expected to generate net sales revenues of Rs 28.12 billion and Rs 23.67 billion respectively. Local development ..