Shell-MRPL and Reliance-BP jet fuel sales jumped in April

Strong Bid Response for Bhubaneswar Ring Road

"National Highways Authority of India (NHAI) has received a strong response from bidders for the 111 km six-lane Access Controlled Greenfield Capital Region Ring Road (Bhubaneswar Bypass) project in Odisha.Bids were invited in three packages under the Hybrid Annuity Mode (HAM). Package I received 23 bids, Package II drew 25 bids, and Package III attracted 16 bids, reflecting robust competition across all sections. The contracts are expected to be awarded by March 2026, with construction scheduled for completion within 2.5 years from award.The project, approved by the Union Cabinet, involves de..

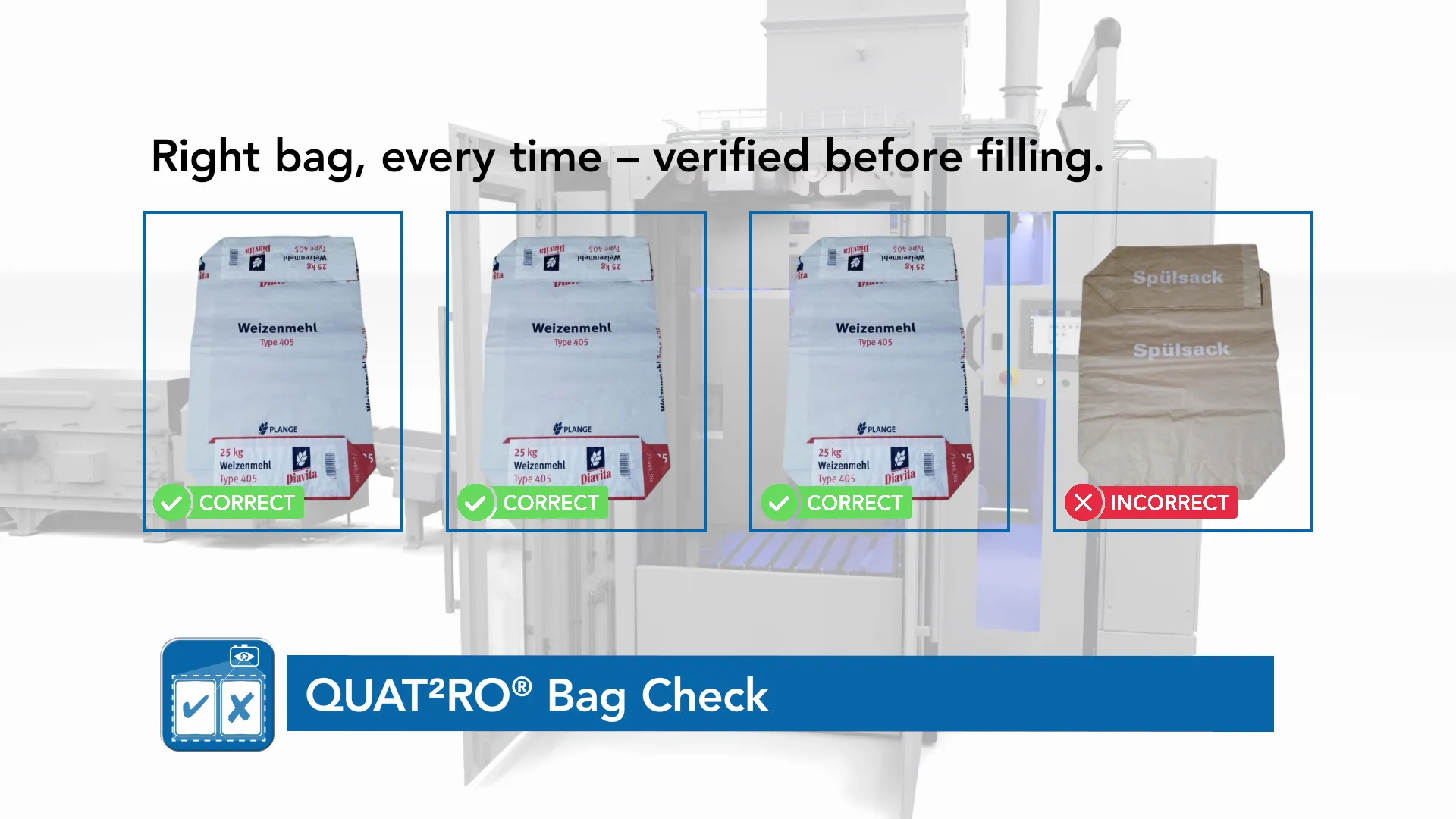

HAVER & BOECKER Expands QUAT2RO AI Suite

"HAVER & BOECKER has expanded its QUAT2RO® AI product suite with the addition of QUAT2RO® BAGcheck and QUAT2RO® SEALcheck, strengthening automation capabilities for industrial packing and filling operations across the cement, building materials, food and chemical sectors.The new AI-powered systems complement existing solutions — QUAT2RO® MATEXcheck and QUAT2RO® VALVEcheck — creating a comprehensive inspection and detection ecosystem for enclosed automated packing lines.Enhancing Accuracy at Both Ends of the LineQUAT2RO® BAGcheck prevents incorrect bag usage by verifying the bag p..

Delson Contracts Adds Liebherr PR 716 G8 Dozer

"Delson Contracts has strengthened its earthmoving fleet with the addition of the PR 716 G8 Crawler Dozer from Liebherr Group, supporting mixed-use developments in Kirriemuir, north of Dundee.Operating across recycled aggregates, civil engineering, demolition and design-and-build packages since 1990, the contractor continues to prioritise reliability and long-term equipment ownership.Expanding Liebherr FleetSupplied by Liebherr Great Britain, the new dozer joins a fleet that includes A 910 and A 914 Compact wheeled excavators and an R 922 crawler excavator. Managing Director Bruce Stott noted ..