- Home

- Infrastructure Transport

- RAILWAYS & METRO RAIL

- Metropportunities

Metropportunities

Suddenly it all seems to be happening in 'We-are-like-this-only' India. The transportation scene, even in areas not very long ago considered Jurassic by Western standards, has acquired a progressive oomph. The air around cities like Jaipur - once largely known for history, its camels laden with foreign tourists, than for any modern-day imagery or transportation convenience - is now thick with a hitherto unknown braggadocio.

If the city has got pinker, it probably owes it to the gleaming new Jaipur Metro coming up and the recent arrival of the first train-set. Leaving BEML's factory in Bengaluru at the end of April, the cars arrived at the city's Mansarovar depot on May 20 to much fanfare. The city's first metro line is slated to open in August and the remainder of the 10 four car train-sets from BEML will arrive in time for another round of celebrations during Diwali. The 12.1-km Green Line from Mansarovar to Chandpole has 11 stations, three of them underground.

The phenomenon may well be dubbed Metromorphosis.

Cutting a wide swath across India, it is set to leave its impact in places like Chennai, Hyderabad, Ahmedabad, Chandigarh, Ludhiana, Gurgaon, Navi Mumbai, Pune and Kochi apart from Delhi, Bengaluru and Mumbai - thanks largely to the recent government decision to extend the reach of metro rail systems to many more smaller urban agglomerations.

There is already frenetic activity happening across India in terms of building new - and expanding existing - metro rail networks. While much of the inspiration for this derives from the success of the Delhi Metro, there are other models too, like Bengaluru's Namma Metro. Very soon, the Jaipur and Gurgaon metros are expected to be up and running. Further, bids for the third phase of the Delhi Metro, Mumbai's Line 3, Bengaluru's Phase 2, Kochi and Ahmedabad are to be finalised this year. With the prospect of about 750 km of new networks being added across India in another two years - of which 162 km will be underground - the space presents both formidable challenges and huge business opportunities for manufacturers of products and services related to metro rail systems.

Ergo, like piranhas in a feeding frenzy, they have begun to converge on the areas of potential development. The products to be offered range from rolling stock and tunnel boring machines to signalling equipment, train control systems, flap barriers, electromechanical components, contactless cards, tokens and safety and security equipment. The investments being planned for various metro projects across the country are estimated to be in the vicinity of Rs 200,000 crore. And, as the experts will tell you, the market is the second fastest after China. Declares Rajesh Gajjar, Managing Director, GMD Consultants, the Mumbai firm that has guided CIDCO in the Navi Mumbai Metro project, "With over 25 cities on the metro rail development radar, it is a huge opportunity for various manufacturers of metro products, and for those offering related services."

The coaching czars

Veritably, these are busy times for India's metro rail sector. Ask the folks at Bombardier Transportation who manufacture a coach a day at their 55,000-sq-m, Rs 230-crore dedicated facility at Savli outside Vadodara, its 400-plus workers operating in three shifts, to meet delivery deadlines. The $18-billion company, which was contracted to supply the Delhi Metro Rail Corporation (DMRC) in mid-2007 (it has already manufactured over 1,250 Bombardier Flexx Metro 3000 bogies) has delivered 614 rail cars for the Metro. And now with extensions to lines 5 and 6, which will add 35 km to the network in Delhi by 2016, there is more work in store. DMRC recently awarded Bombardier a Ç35-million contract to supply CityFlo 350 signalling and train control.

Harsh Dhingra, Chief Country Representative, Bombardier Transportation India, is gung ho about his firm's prospects. "We foresee an available market volume of about 1,500 metro cars in the next five years," he says. "In terms of market opportunities available in India, it is looking promising indeed. We are pursuing various metro projects such as Bangalore Metro Phase II, Kochi Metro and Mumbai Metro Phase III." The Canadian firm is also looking to expand capacities depending on future orders. It estimates an order book of 500 metro cars from Delhi, 300 from Bengaluru, 100 each from Kochi and Ahmedabad-Gandhinagar, and about 120-150 from Mumbai metro projects.

While Bombardier assuredly has the first mover's advantage on the metro coach front because of its own manufacturing facilities - and is even contemplating exporting metros to neighbouring countries - French major Alstom has now set up its own Ç30-million metro rail carriages plant at Sri City along the Tamil Nadu-Andhra Pradesh border. The unit is equipped to manufacture up to 300 rail cars every year. Alstom has signed a Ç243-million contract with Chennai Metro Rail Ltd to supply 168 cars. As a multi-specialist rail transport solutions supplier, it has also previously provided train control and signalling systems for Delhi Metro and Bengaluru's Metro. Not to be outdone, Spanish manufacturer Construcciones y Auxiliar de Ferrocarriles(CAF), the fourth largest rolling stock player in the world, is looking to set up a manufacturing unit in the country. Along with its JV partner MELCO, CAF was awarded a contract for nearly Rs 800 crore to supply 84 coaches to the East West Metro project in Kolkata. The company has previously supplied eight rakes for the airport link of the Delhi Metro. And Siemens is to supply five metro trains as well as advanced signalling and automatic train control systems for the Gurgaon Metro.

Meanwhile in Bengaluru, the government-owned BEML deploys its own unit to produce rail cars for the metro system. It has bagged a Rs 1,800-crore contract from L&T Hyderabad Metro rail in collaboration with South Korea's Hyundai Rotem for the supply of 171 cars. "We are not being reactive to the arrival of global rolling stock majors on India's metro scene," explains a BEML official. "We are keen to make the most of opportunities in the urban rapid mass transport segment and are being proactive."

Component deliverers

While the coach manufacturers undoubtedly rule the roost, there are also the manufacturers of components - hundreds of thousands of which are used in rail cars - who play a major role through supply of parts. This includes French firm Faiveley Transport Rail Technologies, which has provided brake assembly systems, couplers, platform screen doors, air-conditioning systems and pantographs for various metro projects. The company, which has a manufacturing unit at Hosur in Tamil Nadu and another at Baddi in Himachal Pradesh, is looking to raise capacities and is eyeing the prospect of producing metro rail doors that are currently manufactured abroad. "There is such a huge demand for these products," trills Dhakshayani Kumar, Executive Director, Faiveley Transport Rail Technologies. "For another 20 years, we can be assured of a booming market." Companies offering roof-mounted, air-conditioning units for metro cars and railway track systems will also be in demand.

For his part, Vilas Parulekar, Managing Director, Schaltbau, the German firm that supplies electromechanical components like plug connectors, snap switches and contactors for metro rolling stock, prefers to be more guarded in his response to questions on available business opportunities. "Every city needs to have a project like Delhi Metro for business like ours to become more viable." The oblique allusion in this case is to projects like Mumbai's Metro, which has been delayed for long for various reasons thus having a negative impact on the cost of materials.

It is easy to see therefore why companies - both Indian and international - have been keeping a hawk eye on the progress being made by the metro rail segment across India.

"Most of the opportunities on the Hyderabad Metro project have been exhausted; all orders have been placed save for small things such as equipment related to the workshop," reveals Vivek B Gadgil, Chief Executive and Managing Director, L&T Metro Rail Hyderabad. "Right now, we are more or less on stream. By next September, we hope to have our first train trial run. We want to start running the first phase by the middle of 2015." One reason why it looks like rush hour in the Deccan city is that, like Delhi, Hyderabad's $3.03-billion metro project too has been ambitious in its scope and swift in execution. With a construction band of just five years, the project, touted as the 'world's largest metro PPP', and comprising three lines totalling 71 km with 66 stations, is expected to be delivered by mid-2017. And that is a remarkable feat by Indian standards.

The Metro Link Express of Gandhinagar and Ahmedabad (MEGA) project, too offers great scope. Sanjay Gupta, Executive Chairman, MEGA, says, "The project done on EPC basis offers opportunities to renowned contractors. The total cost, hard and soft, of the project is Rs 19,000 crore of which civil works would be to the tune of 58 per cent. Business opportunities exist in the construction of buildings, viaduct, superstructure and substructure, bridges and tunnels."

Underground fixers

With close to 162 km of underground work needing to be done in the new metro stretches, tunnel boring machines (TBMs) will occupy prime position on work sites. It is instructive to know that while Phase 1 of Delhi metro involved the construction of 13 km of tunnels and 13 underground stations, 34.9 km of tunnels and 18 underground stations were constructed in Phase 2. Phase 3 will require the construction of 41 km of tunnels and 28 underground stations. It is being assessed that around 25 TBMs will be used, compared to 14 in Phase 2. The end result is that close to 40 per cent of the DMRC network will be underground by 2016. With such rising demand, it is easy to see why firms like Herrenknecht fit into the picture. The Ç1-billion German TBM major has contributed 30 of the 40-odd TBMs used on metro projects across India. Herrenknecht EPBMs with a range of 6.35-6.6 m have been used to excavate 71 km of metro tunnels in four metros. Recent expansions in TBM orders have led to the company establishing a facility outside Chennai to support sub-continental projects and customers.

Security and safety specialists

Security, a crucial element on metro networks, is the province of firms like Sweden's Gunnebo, which offers integrated packages like entrance control systems that include flap gates, turnstiles, automatic fare collection and safety devices like fire alarms and extinguishers in rolling stock. Incidentally, India is the second largest market for Gunnebo worldwide. "We are the world leaders in security solutions," asserts Sandeep Deshpande, Managing Director, Gunnebo India Pvt Ltd. "There will be a wealth of opportunities as other metro projects come up in India. And we are naturally excited both by the business and the challenge it offers."

Further, a huge market exists for technologies that optimise fire detection and facilitate evacuation and CCTV surveillance of metro spaces. Vikas Chaddha, Regional General Manager, Honeywell Building Solutions, India, which has provided such services for projects like the Delhi Metro, says, "We have an established presence in the safety, security and energy domain on metros. Having operated on global platforms, our capabilities to do large projects have been well documented and demonstrated. India's metro market is huge and we are keenly eyeing the action."

Meanwhile, international technology giant Thales has been awarded the contract for a passenger information system for Jaipur Metro's first line. The system, similar to the one on the Delhi Metro, will interface with the traffic management system to provide both visual and audio information. The company is also providing communication-based train control (CBTC) and integrated communications and supervision (ICS) systems for the Hyderabad Metro Rail Project.

Smart devices

Crossing the barriers at metro stations comes with an important qualification: possession of magnetic cards or contactless tokens. On the Delhi Metro, nearly 1.5 million smart cards are currently in circulation. Close to 1.8 million commuters ride metro trains daily in the national capital, out of which 55 per cent of commuters use smart cards while the remainder use tokens. Now with metros coming up in various cities, it is being assessed that there will be a need to produce 25 million magnetic cards in five years' time. Siepmanns, which started manufacturing in 2004 for the Delhi metro - and is therefore the pioneer and leader in the contactless card segment - is readying to increase capacities to cater to the demand.

"We have to increase production capacities; what we have is only enough for 2014. I have to soon start thinking of future requirements and that will be huge," says Ravindranath Bhas, Managing Director, Siepmann's Card System Pvt Ltd.

There are also other players in the fray who supply contactless tokens. APK Identification, or APK-ID, a firm operating out of the Noida Special Economic Zone, bagged a global tender to supply contactless tokens for the Delhi Metro eight years ago. It now provides 3 million tokens to the network every year. Then there are a host of other foreign players who are keenly eyeing the Indian metro market with the prospects of an ever increasing number of commuters. The government's plans to expand the Delhi Metro network to 440 km by 2021, bringing every home in the capital within 500 m of a station, will only serve to give a fillip to the smart card business.

Job avenues

That Indians are adept at doing smart metro business was driven home recently when Siliguri-based PCM Group, which produces concrete sleepers, turnouts and level crossings, and conducts flash butt welding of rails, acquired European track specialist Rail.One, Germany, bringing to an end the latter's search for a strategic investor. The giant step of using a business opportunity at the right time has catapulted the Indian firm to the position of the world's leading conglomerate in railway infrastructure.

Clearly, metro buzz spells opportunity. Increased manufacturing of metro rail equipment and offering of metro-related services will lead to the generation of hundreds of thousands of jobs apart from creating even larger number of indirect work for people. In Hyderabad, for instance, L&T has set up a facility to train people in metro rail systems. Metro developments in various cities are also spawning the need for international infrastructure consulting, technical and management firms like AECOM and Parsons Brinkerhoff, both of which have been involved in the Delhi and Gurgaon Metro in various capacities.

Metromorphosis is well and truly in the Indian air. Who knows, come August when the Green Line gets going, even the Jaipur camels may begin to walk with a metro swagger!

World Metrobuzz

OSLO, NORWAY: Siemens' largest ever contract for metro trains has been implemented with the delivery of the 100th MX3000 metro train to Oslo Metro operator Collective Transport Production (KTP). This has led to the replacement of older T1000 and T1300 stock. The aluminium-bodied MX3000s are being assembled at Siemens's plant in Vienna. Each 54-m-long train, with regenerative braking leading to the recovery of up to 46 per cent of power consumption, can accommodate 678 passengers.

PARIS, FRANCE: The French capital recently got its 303rd metro station with the commissioning of the Ç185.3-million southern extension of Line 4 to Mairie de Montrouge. This is the first station addition to Line 4 - the second-busiest Metro Line in Paris - in over a century and will boost ridership on the line to the extent of 37,900 passengers per day. According to the plans of the Paris Transport Authority (RATP), the line is due for another extension by the end of 2019.

QUITO, ECUADOR: Authorities in the Ecuadorian capital have invited prequalification bids to build Phase 2 of the first metro line for the city. The $1.5-billion project involves the supply of 18 six-car trains, construction of a depot and workshop, track, stations, electrification, power supply, signalling, telecommunications, and a control centre, project supervision and consultancy. The first phase of the 22.5-km, 15-station line in Quito was awarded to Spanish firm Acciona Infrastructure.

ISTANBUL, TURKEY: Bids have been invited by authorities in Istanbul for a fleet of 21 six-car driverless trains for operation on the new 20-km Line M6 being built as the second metro line. The trains, which will run on the Asian side of the city, will be in service by May 2015. The route, which will be entirely underground, will connect to the Marmaray rail link under the Bosphorus, via _mraniye to ¦ekmek÷y, and will have 16 stations.

DOHA, QATAR: Qatar Rail has entered into a design-build contract with a consortium led by Impregilo, Italy, for the Red Line North section of the Doha metro network. The Ç1.7-billion contract covers the construction of the 13-km stretch of the Red Line from Mushaireb to Education City, which will have seven stations. The line will run in two parallel tunnels. Incidentally, the Italian firm has a 41.25 per cent share in the consortium, which includes SK Engineering & Construction and Galfar Engineering & Construction.

JEDDAH, SAUDI ARABIA: The financial capital of Saudi Arabia will soon have a metro network with plans being approved for the construction of a 108-km light metro at a cost of $12 billion. The three-line network - Orange, Blue and Green - is scheduled for completion by 2020. While preliminary design for the project is nearing completion, tenders for the design and build contract for the first phase are slated to be released by year end.

MOSCOW, RUSSIA: Russian car builder Uralvagonzavod (UVZ) and Bombardier have unveiled models of a new high-capacity metro train that will be deployed on the Moscow Metro. The train features some of Bombardier's latest technology such as Flexx bogies, Mitrac propulsion and control equipment. UVZ won the contract last December to supply Moscow City Transport Agency with 120 low-floor Flexity LRVs.

CHENNAI, INDIA: Alstom has recently unveiled the first completed train for Chennai Metro at its Lapa plant in Spo Paulo, Brazil. This is part of Chennai Metro Rail Ltd's Ç243-million order with Alstom in 2010 for 42 four-car trains, which will be commissioned on the initial 45.1-km two-line phase of the network in 2014-15. While the first nine trains are being built at Lapa, the remaining 33 sets will be assembled at the new Sri City rolling stock assembly facility in Tamil Nadu.

SINGAPORE: Singapore's new Thomson Line, the first section of which is due to open in 2019, will require 53 four-car trains. The winner of the bid to be finalised in a few months will be required to design, manufacture, test and commission the trains as well as put them into service. The 30-km Thomson Line, which will be completed in 2021, will have 22 stations and carry 400,000 passengers a day. Officials are planning to double the city's rail network from 178 km to 360 km by 2030.

BEIJING, CHINA: An express metro linking Beijing South station to the Chinese capital's new airport is now being constructed in the south of the city. The 37-km line is expected to subtract journey time by around 30 minutes. Slated for completion in 2018, work on the $11.3-billion airport project is due to start next year. Meanwhile, the first phase of Beijing Metro Line 14 has opened with the start of commercial services on the 12.4-km section. When completed in 2016, Line 14 will stretch 47.3 km and have 37 stations.

JAIPUR, INDIA: The first 9.7-km section of the Jaipur Metro Green Line, which will have eight elevated and three underground stations, is scheduled to open on June 30, while the rest of the line together with the 23-km Orange Line with five underground and 15 elevated stations will be completed in March 2017. Thales has been awarded the contract for a passenger information system for the first line. The system, similar to the one on the Delhi Metro, will interface with the traffic management system to provide visual and audio information.

JAKARTA, INDONESIA: Authorities in the Indonesian capital have launched the construction of the city's first metro line. Three of five contractors have been selected for the construction of the 9.2-km underground section of the first 15.2-km phase of the north-south line. The first phase is slated for a 2017 opening. The line will have six underground and seven elevated stations. The second phase, which will be an 8.1-km extension, will be completed by 2019.

With the government planning metro rail networks in smaller cities, and extensions being created to existing ones, a huge business opportunity lies in store for manufacturers of metro rail products, writes SHRIKANT RAO. Suddenly it all seems to be happening in 'We-are-like-this-only' India. The transportation scene, even in areas not very long ago considered Jurassic by Western standards, has acquired a progressive oomph. The air around cities like Jaipur - once largely known for history, its camels laden with foreign tourists, than for any modern-day imagery or transportation convenience - is now thick with a hitherto unknown braggadocio. If the city has got pinker, it probably owes it to the gleaming new Jaipur Metro coming up and the recent arrival of the first train-set. Leaving BEML's factory in Bengaluru at the end of April, the cars arrived at the city's Mansarovar depot on May 20 to much fanfare. The city's first metro line is slated to open in August and the remainder of the 10 four car train-sets from BEML will arrive in time for another round of celebrations during Diwali. The 12.1-km Green Line from Mansarovar to Chandpole has 11 stations, three of them underground. The phenomenon may well be dubbed Metromorphosis. Cutting a wide swath across India, it is set to leave its impact in places like Chennai, Hyderabad, Ahmedabad, Chandigarh, Ludhiana, Gurgaon, Navi Mumbai, Pune and Kochi apart from Delhi, Bengaluru and Mumbai - thanks largely to the recent government decision to extend the reach of metro rail systems to many more smaller urban agglomerations. There is already frenetic activity happening across India in terms of building new - and expanding existing - metro rail networks. While much of the inspiration for this derives from the success of the Delhi Metro, there are other models too, like Bengaluru's Namma Metro. Very soon, the Jaipur and Gurgaon metros are expected to be up and running. Further, bids for the third phase of the Delhi Metro, Mumbai's Line 3, Bengaluru's Phase 2, Kochi and Ahmedabad are to be finalised this year. With the prospect of about 750 km of new networks being added across India in another two years - of which 162 km will be underground - the space presents both formidable challenges and huge business opportunities for manufacturers of products and services related to metro rail systems. Ergo, like piranhas in a feeding frenzy, they have begun to converge on the areas of potential development. The products to be offered range from rolling stock and tunnel boring machines to signalling equipment, train control systems, flap barriers, electromechanical components, contactless cards, tokens and safety and security equipment. The investments being planned for various metro projects across the country are estimated to be in the vicinity of Rs 200,000 crore. And, as the experts will tell you, the market is the second fastest after China. Declares Rajesh Gajjar, Managing Director, GMD Consultants, the Mumbai firm that has guided CIDCO in the Navi Mumbai Metro project, "With over 25 cities on the metro rail development radar, it is a huge opportunity for various manufacturers of metro products, and for those offering related services." The coaching czars Veritably, these are busy times for India's metro rail sector. Ask the folks at Bombardier Transportation who manufacture a coach a day at their 55,000-sq-m, Rs 230-crore dedicated facility at Savli outside Vadodara, its 400-plus workers operating in three shifts, to meet delivery deadlines. The $18-billion company, which was contracted to supply the Delhi Metro Rail Corporation (DMRC) in mid-2007 (it has already manufactured over 1,250 Bombardier Flexx Metro 3000 bogies) has delivered 614 rail cars for the Metro. And now with extensions to lines 5 and 6, which will add 35 km to the network in Delhi by 2016, there is more work in store. DMRC recently awarded Bombardier a Ç35-million contract to supply CityFlo 350 signalling and train control. Harsh Dhingra, Chief Country Representative, Bombardier Transportation India, is gung ho about his firm's prospects. "We foresee an available market volume of about 1,500 metro cars in the next five years," he says. "In terms of market opportunities available in India, it is looking promising indeed. We are pursuing various metro projects such as Bangalore Metro Phase II, Kochi Metro and Mumbai Metro Phase III." The Canadian firm is also looking to expand capacities depending on future orders. It estimates an order book of 500 metro cars from Delhi, 300 from Bengaluru, 100 each from Kochi and Ahmedabad-Gandhinagar, and about 120-150 from Mumbai metro projects. While Bombardier assuredly has the first mover's advantage on the metro coach front because of its own manufacturing facilities - and is even contemplating exporting metros to neighbouring countries - French major Alstom has now set up its own Ç30-million metro rail carriages plant at Sri City along the Tamil Nadu-Andhra Pradesh border. The unit is equipped to manufacture up to 300 rail cars every year. Alstom has signed a Ç243-million contract with Chennai Metro Rail Ltd to supply 168 cars. As a multi-specialist rail transport solutions supplier, it has also previously provided train control and signalling systems for Delhi Metro and Bengaluru's Metro. Not to be outdone, Spanish manufacturer Construcciones y Auxiliar de Ferrocarriles(CAF), the fourth largest rolling stock player in the world, is looking to set up a manufacturing unit in the country. Along with its JV partner MELCO, CAF was awarded a contract for nearly Rs 800 crore to supply 84 coaches to the East West Metro project in Kolkata. The company has previously supplied eight rakes for the airport link of the Delhi Metro. And Siemens is to supply five metro trains as well as advanced signalling and automatic train control systems for the Gurgaon Metro. Meanwhile in Bengaluru, the government-owned BEML deploys its own unit to produce rail cars for the metro system. It has bagged a Rs 1,800-crore contract from L&T Hyderabad Metro rail in collaboration with South Korea's Hyundai Rotem for the supply of 171 cars. "We are not being reactive to the arrival of global rolling stock majors on India's metro scene," explains a BEML official. "We are keen to make the most of opportunities in the urban rapid mass transport segment and are being proactive." Component deliverers While the coach manufacturers undoubtedly rule the roost, there are also the manufacturers of components - hundreds of thousands of which are used in rail cars - who play a major role through supply of parts. This includes French firm Faiveley Transport Rail Technologies, which has provided brake assembly systems, couplers, platform screen doors, air-conditioning systems and pantographs for various metro projects. The company, which has a manufacturing unit at Hosur in Tamil Nadu and another at Baddi in Himachal Pradesh, is looking to raise capacities and is eyeing the prospect of producing metro rail doors that are currently manufactured abroad. "There is such a huge demand for these products," trills Dhakshayani Kumar, Executive Director, Faiveley Transport Rail Technologies. "For another 20 years, we can be assured of a booming market." Companies offering roof-mounted, air-conditioning units for metro cars and railway track systems will also be in demand. For his part, Vilas Parulekar, Managing Director, Schaltbau, the German firm that supplies electromechanical components like plug connectors, snap switches and contactors for metro rolling stock, prefers to be more guarded in his response to questions on available business opportunities. "Every city needs to have a project like Delhi Metro for business like ours to become more viable." The oblique allusion in this case is to projects like Mumbai's Metro, which has been delayed for long for various reasons thus having a negative impact on the cost of materials. It is easy to see therefore why companies - both Indian and international - have been keeping a hawk eye on the progress being made by the metro rail segment across India. "Most of the opportunities on the Hyderabad Metro project have been exhausted; all orders have been placed save for small things such as equipment related to the workshop," reveals Vivek B Gadgil, Chief Executive and Managing Director, L&T Metro Rail Hyderabad. "Right now, we are more or less on stream. By next September, we hope to have our first train trial run. We want to start running the first phase by the middle of 2015." One reason why it looks like rush hour in the Deccan city is that, like Delhi, Hyderabad's $3.03-billion metro project too has been ambitious in its scope and swift in execution. With a construction band of just five years, the project, touted as the 'world's largest metro PPP', and comprising three lines totalling 71 km with 66 stations, is expected to be delivered by mid-2017. And that is a remarkable feat by Indian standards. The Metro Link Express of Gandhinagar and Ahmedabad (MEGA) project, too offers great scope. Sanjay Gupta, Executive Chairman, MEGA, says, "The project done on EPC basis offers opportunities to renowned contractors. The total cost, hard and soft, of the project is Rs 19,000 crore of which civil works would be to the tune of 58 per cent. Business opportunities exist in the construction of buildings, viaduct, superstructure and substructure, bridges and tunnels." Underground fixers With close to 162 km of underground work needing to be done in the new metro stretches, tunnel boring machines (TBMs) will occupy prime position on work sites. It is instructive to know that while Phase 1 of Delhi metro involved the construction of 13 km of tunnels and 13 underground stations, 34.9 km of tunnels and 18 underground stations were constructed in Phase 2. Phase 3 will require the construction of 41 km of tunnels and 28 underground stations. It is being assessed that around 25 TBMs will be used, compared to 14 in Phase 2. The end result is that close to 40 per cent of the DMRC network will be underground by 2016. With such rising demand, it is easy to see why firms like Herrenknecht fit into the picture. The Ç1-billion German TBM major has contributed 30 of the 40-odd TBMs used on metro projects across India. Herrenknecht EPBMs with a range of 6.35-6.6 m have been used to excavate 71 km of metro tunnels in four metros. Recent expansions in TBM orders have led to the company establishing a facility outside Chennai to support sub-continental projects and customers. Security and safety specialists Security, a crucial element on metro networks, is the province of firms like Sweden's Gunnebo, which offers integrated packages like entrance control systems that include flap gates, turnstiles, automatic fare collection and safety devices like fire alarms and extinguishers in rolling stock. Incidentally, India is the second largest market for Gunnebo worldwide. "We are the world leaders in security solutions," asserts Sandeep Deshpande, Managing Director, Gunnebo India Pvt Ltd. "There will be a wealth of opportunities as other metro projects come up in India. And we are naturally excited both by the business and the challenge it offers." Further, a huge market exists for technologies that optimise fire detection and facilitate evacuation and CCTV surveillance of metro spaces. Vikas Chaddha, Regional General Manager, Honeywell Building Solutions, India, which has provided such services for projects like the Delhi Metro, says, "We have an established presence in the safety, security and energy domain on metros. Having operated on global platforms, our capabilities to do large projects have been well documented and demonstrated. India's metro market is huge and we are keenly eyeing the action." Meanwhile, international technology giant Thales has been awarded the contract for a passenger information system for Jaipur Metro's first line. The system, similar to the one on the Delhi Metro, will interface with the traffic management system to provide both visual and audio information. The company is also providing communication-based train control (CBTC) and integrated communications and supervision (ICS) systems for the Hyderabad Metro Rail Project. Smart devices Crossing the barriers at metro stations comes with an important qualification: possession of magnetic cards or contactless tokens. On the Delhi Metro, nearly 1.5 million smart cards are currently in circulation. Close to 1.8 million commuters ride metro trains daily in the national capital, out of which 55 per cent of commuters use smart cards while the remainder use tokens. Now with metros coming up in various cities, it is being assessed that there will be a need to produce 25 million magnetic cards in five years' time. Siepmanns, which started manufacturing in 2004 for the Delhi metro - and is therefore the pioneer and leader in the contactless card segment - is readying to increase capacities to cater to the demand. "We have to increase production capacities; what we have is only enough for 2014. I have to soon start thinking of future requirements and that will be huge," says Ravindranath Bhas, Managing Director, Siepmann's Card System Pvt Ltd. There are also other players in the fray who supply contactless tokens. APK Identification, or APK-ID, a firm operating out of the Noida Special Economic Zone, bagged a global tender to supply contactless tokens for the Delhi Metro eight years ago. It now provides 3 million tokens to the network every year. Then there are a host of other foreign players who are keenly eyeing the Indian metro market with the prospects of an ever increasing number of commuters. The government's plans to expand the Delhi Metro network to 440 km by 2021, bringing every home in the capital within 500 m of a station, will only serve to give a fillip to the smart card business. Job avenues That Indians are adept at doing smart metro business was driven home recently when Siliguri-based PCM Group, which produces concrete sleepers, turnouts and level crossings, and conducts flash butt welding of rails, acquired European track specialist Rail.One, Germany, bringing to an end the latter's search for a strategic investor. The giant step of using a business opportunity at the right time has catapulted the Indian firm to the position of the world's leading conglomerate in railway infrastructure. Clearly, metro buzz spells opportunity. Increased manufacturing of metro rail equipment and offering of metro-related services will lead to the generation of hundreds of thousands of jobs apart from creating even larger number of indirect work for people. In Hyderabad, for instance, L&T has set up a facility to train people in metro rail systems. Metro developments in various cities are also spawning the need for international infrastructure consulting, technical and management firms like AECOM and Parsons Brinkerhoff, both of which have been involved in the Delhi and Gurgaon Metro in various capacities. Metromorphosis is well and truly in the Indian air. Who knows, come August when the Green Line gets going, even the Jaipur camels may begin to walk with a metro swagger! World Metrobuzz OSLO, NORWAY: Siemens' largest ever contract for metro trains has been implemented with the delivery of the 100th MX3000 metro train to Oslo Metro operator Collective Transport Production (KTP). This has led to the replacement of older T1000 and T1300 stock. The aluminium-bodied MX3000s are being assembled at Siemens's plant in Vienna. Each 54-m-long train, with regenerative braking leading to the recovery of up to 46 per cent of power consumption, can accommodate 678 passengers. PARIS, FRANCE: The French capital recently got its 303rd metro station with the commissioning of the Ç185.3-million southern extension of Line 4 to Mairie de Montrouge. This is the first station addition to Line 4 - the second-busiest Metro Line in Paris - in over a century and will boost ridership on the line to the extent of 37,900 passengers per day. According to the plans of the Paris Transport Authority (RATP), the line is due for another extension by the end of 2019. QUITO, ECUADOR: Authorities in the Ecuadorian capital have invited prequalification bids to build Phase 2 of the first metro line for the city. The $1.5-billion project involves the supply of 18 six-car trains, construction of a depot and workshop, track, stations, electrification, power supply, signalling, telecommunications, and a control centre, project supervision and consultancy. The first phase of the 22.5-km, 15-station line in Quito was awarded to Spanish firm Acciona Infrastructure. ISTANBUL, TURKEY: Bids have been invited by authorities in Istanbul for a fleet of 21 six-car driverless trains for operation on the new 20-km Line M6 being built as the second metro line. The trains, which will run on the Asian side of the city, will be in service by May 2015. The route, which will be entirely underground, will connect to the Marmaray rail link under the Bosphorus, via _mraniye to ¦ekmek÷y, and will have 16 stations. DOHA, QATAR: Qatar Rail has entered into a design-build contract with a consortium led by Impregilo, Italy, for the Red Line North section of the Doha metro network. The Ç1.7-billion contract covers the construction of the 13-km stretch of the Red Line from Mushaireb to Education City, which will have seven stations. The line will run in two parallel tunnels. Incidentally, the Italian firm has a 41.25 per cent share in the consortium, which includes SK Engineering & Construction and Galfar Engineering & Construction. JEDDAH, SAUDI ARABIA: The financial capital of Saudi Arabia will soon have a metro network with plans being approved for the construction of a 108-km light metro at a cost of $12 billion. The three-line network - Orange, Blue and Green - is scheduled for completion by 2020. While preliminary design for the project is nearing completion, tenders for the design and build contract for the first phase are slated to be released by year end. MOSCOW, RUSSIA: Russian car builder Uralvagonzavod (UVZ) and Bombardier have unveiled models of a new high-capacity metro train that will be deployed on the Moscow Metro. The train features some of Bombardier's latest technology such as Flexx bogies, Mitrac propulsion and control equipment. UVZ won the contract last December to supply Moscow City Transport Agency with 120 low-floor Flexity LRVs. CHENNAI, INDIA: Alstom has recently unveiled the first completed train for Chennai Metro at its Lapa plant in Spo Paulo, Brazil. This is part of Chennai Metro Rail Ltd's Ç243-million order with Alstom in 2010 for 42 four-car trains, which will be commissioned on the initial 45.1-km two-line phase of the network in 2014-15. While the first nine trains are being built at Lapa, the remaining 33 sets will be assembled at the new Sri City rolling stock assembly facility in Tamil Nadu. SINGAPORE: Singapore's new Thomson Line, the first section of which is due to open in 2019, will require 53 four-car trains. The winner of the bid to be finalised in a few months will be required to design, manufacture, test and commission the trains as well as put them into service. The 30-km Thomson Line, which will be completed in 2021, will have 22 stations and carry 400,000 passengers a day. Officials are planning to double the city's rail network from 178 km to 360 km by 2030. BEIJING, CHINA: An express metro linking Beijing South station to the Chinese capital's new airport is now being constructed in the south of the city. The 37-km line is expected to subtract journey time by around 30 minutes. Slated for completion in 2018, work on the $11.3-billion airport project is due to start next year. Meanwhile, the first phase of Beijing Metro Line 14 has opened with the start of commercial services on the 12.4-km section. When completed in 2016, Line 14 will stretch 47.3 km and have 37 stations. JAIPUR, INDIA: The first 9.7-km section of the Jaipur Metro Green Line, which will have eight elevated and three underground stations, is scheduled to open on June 30, while the rest of the line together with the 23-km Orange Line with five underground and 15 elevated stations will be completed in March 2017. Thales has been awarded the contract for a passenger information system for the first line. The system, similar to the one on the Delhi Metro, will interface with the traffic management system to provide visual and audio information. JAKARTA, INDONESIA: Authorities in the Indonesian capital have launched the construction of the city's first metro line. Three of five contractors have been selected for the construction of the 9.2-km underground section of the first 15.2-km phase of the north-south line. The first phase is slated for a 2017 opening. The line will have six underground and seven elevated stations. The second phase, which will be an 8.1-km extension, will be completed by 2019.

Della, Hiranandani & Krisala unveil Rs 11 billion themed township in Pune

In a first-of-its-kind initiative, Della Resorts & Adventure has partnered with Hiranandani Communities and Krisala Developers to develop a Rs 11 billion racecourse-themed township in North Hinjewadi, Pune. Based on Della’s proprietary CDDMO™ model, the hospitality-led, design-driven project aims to deliver up to 9 per cent returns—significantly higher than the typical 3 per cent in residential real estate.Spanning 40 acres within a 105-acre master plan, the mega township will feature an 8-acre racecourse and international polo club, 128 private villa plots, 112 resort residences, a ..

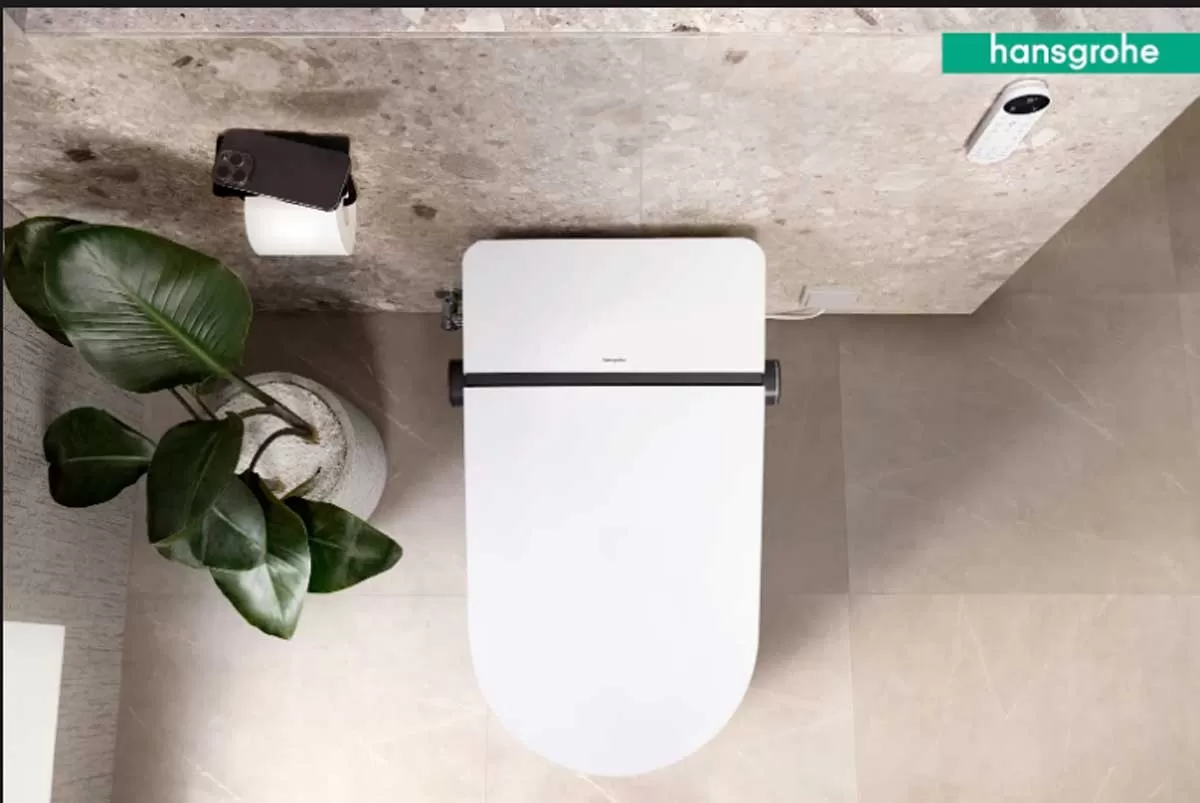

Hansgrohe unveils LavaPura Element S e-toilets in India

Hansgrohe India has launched its latest innovation, the LavaPura Element S e-toilet series, introducing a new standard in hygiene-focused, smart bathroom solutions tailored for Indian homes and high-end hospitality spaces.Blending German engineering with minimalist aesthetics, the LavaPura Element S combines intuitive features with advanced hygiene technology. The series is designed for easy installation and optimal performance under Indian conditions, reinforcing the brand’s focus on functional elegance and modern convenience.“With evolving consumer preferences, smart bathrooms are no lon..

HCC Net Profit Stands at Rs 2.28 Billion for Q4 FY25

Hindustan Construction Company (HCC) reported a standalone net profit of Rs 2.28 billion in Q4 FY25, a sharp increase from Rs 388 million in Q4 FY24. Standalone revenue for the quarter stood at Rs 13.30 billion, compared to Rs 14.28 billion in Q4 FY24. For the full fiscal year, the company reported a standalone net profit of Rs 849 million, down from Rs 1.79 billion in FY24. Standalone revenue for FY25 was Rs 48.01 billion, compared to Rs 50.43 billion in the previous year.Consolidated revenue for Q4 FY25 stood at Rs 13.74 billion, and for FY25 at Rs 56.03 billion, down from Rs 17.73 billion i..

Latest Updates

Advertisement

Recommended for you

Advertisement

Subscribe to Our Newsletter

Get daily newsletters around different themes from Construction world.

Advertisement

Advertisement

Advertisement

subscribe to the newsletter

Don't miss out on valuable insights and opportunities

to connect with like minded professionals