Actis Acquires Stride Climate Investments in Green Energy Push

Army Chief Concludes Defence Outreach to UAE and Sri Lanka

The Chief of the Army Staff (COAS), Upendra Dwivedi, has recently concluded his official visit to the United Arab Emirates and Sri Lanka, reaffirming India’s commitment to strengthening defence cooperation, military-to-military engagement and strategic partnerships across West Asia and the Indian Ocean Region.During his visit to the UAE, the COAS held wide-ranging discussions with senior leadership of the UAE Armed Forces, including the Commander of the UAE Land Forces. The interactions focused on enhancing interoperability, expanding joint training initiatives and strengthening professional..

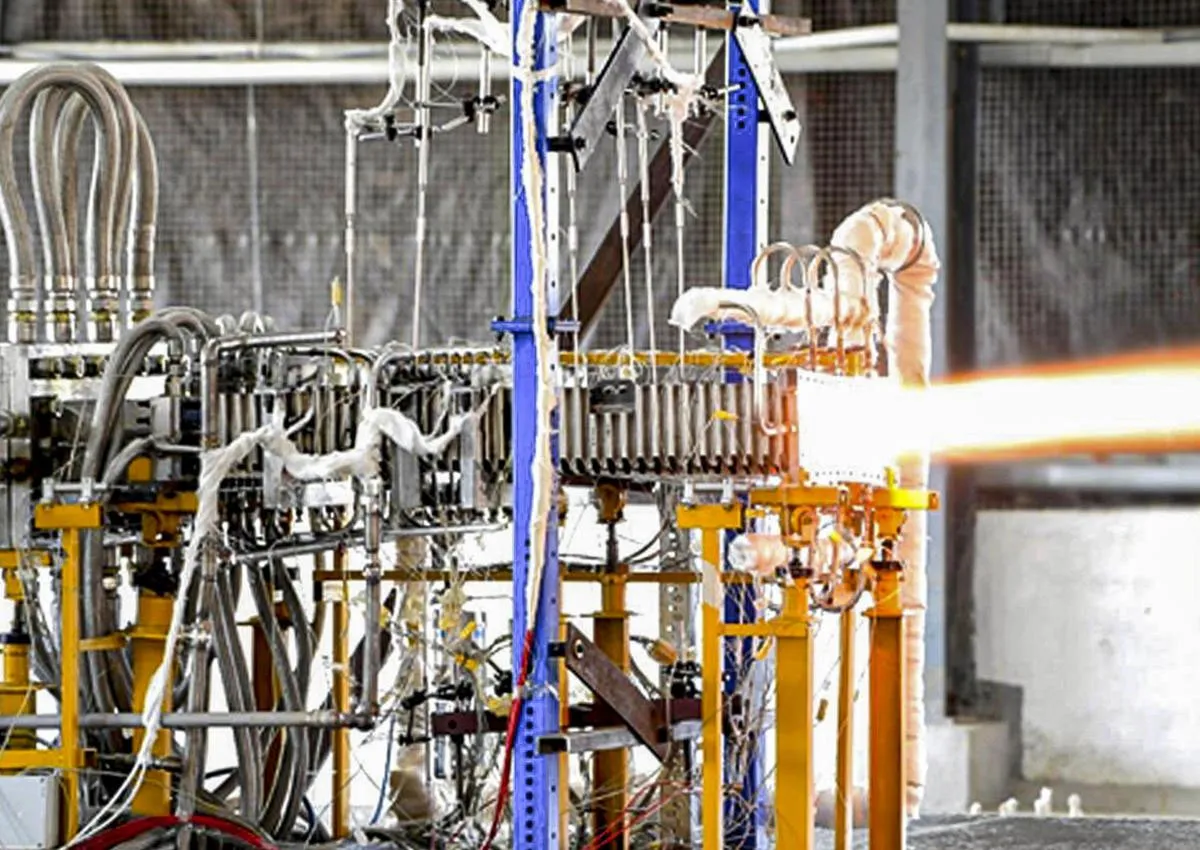

DRDL Achieves Breakthrough in Hypersonic Missile Engine Tests

The Defence Research & Development Laboratory (DRDL), a Hyderabad-based laboratory of the Defence Research and Development Organisation (DRDO), has recently achieved a major milestone in the development of hypersonic missile technology. The laboratory successfully conducted a long-duration ground test of its Actively Cooled Scramjet Full Scale Combustor, recording a run time of over 12 minutes at the Scramjet Connect Pipe Test (SCPT) Facility on 9 January 2026.This achievement builds on an earlier successful subscale long-duration test carried out in April 2025 and represents a significant..

TRAI Drive Test Assesses Mobile Network Quality in Sonipat

The Telecom Regulatory Authority of India (TRAI) has released the findings of an Independent Drive Test (IDT) conducted across Sonipat city in Haryana during December 2025, aimed at informing consumers about the real-world quality of mobile network services. The exercise evaluated both voice and data performance offered by Telecom Service Providers (TSPs) under live network conditions.During the IDT, TRAI captured performance data on key indicators such as call setup success rate, drop call rate, call setup time, speech quality and data throughput. Advanced test handsets and software tools wer..