ONGC, NTPC eye joint bid for Ayana Renewables

Rays Power Infra Wins Rs 19.12 Bn Renewable Energy Project

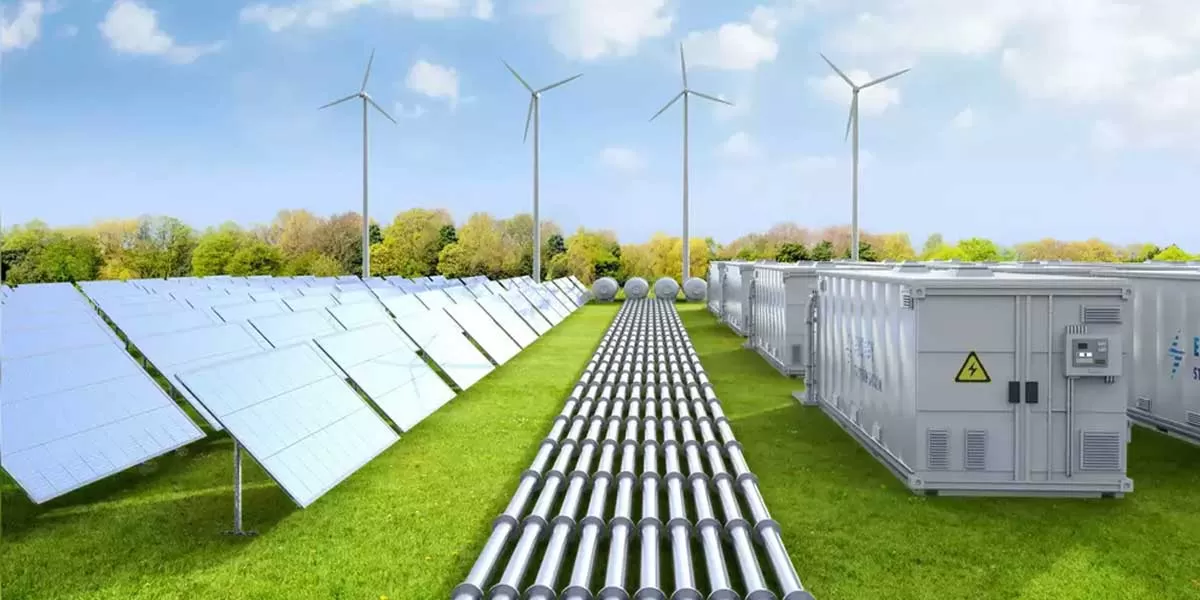

Rays Power Infra has secured a 300 MW renewable energy project valued at Rs 19.12 billion from a state-owned company, strengthening its position in India’s utility-scale clean energy sector. With this latest order, the company’s total order book has crossed Rs 80 billion.The project will be executed under Rays Power Infra’s co-development business model. Under this framework, the company will undertake land acquisition, secure interstate transmission system (ISTS) connectivity and carry out complete engineering, procurement and construction (EPC) works. The project is planned to be devel..

MMRDA Signs $96 Bn MoUs at Davos, Marks Record Day 1 Haul

The Mumbai Metropolitan Region Development Authority (MMRDA) marked a historic achievement on the opening day of the World Economic Forum (WEF) Annual Summit 2026 in Davos by securing investment commitments worth about Rs 8.73 trillion. The investments were formalised through the signing of 10 major Memoranda of Understanding (MoUs), setting a new benchmark for the authority’s global outreach.According to MMRDA, the agreements are expected to generate nearly 9.6 lakh direct and indirect jobs, reinforcing the Mumbai Metropolitan Region’s position as a major talent and economic hub in India ..

AAI Submits Hydrology Report to WRD for Chennai Airport Corridor

In a move to accelerate the implementation of an elevated corridor and the long-pending satellite terminal at Chennai Airport, the Airports Authority of India (AAI) has submitted a detailed study report to the Water Resources Department (WRD) of the Tamil Nadu government.The satellite terminal, first proposed nearly eight years ago, is aimed at easing congestion by handling additional aircraft and passenger traffic while optimally utilising remote bays at the airport. Although the project remained stalled for several years, it gained renewed momentum in 2024 after AAI revived the proposal.Acco..