Things are looking up in the luxury housing segment. Sales almost doubled between the January and September 2023 period as against the previous year, to 9,200 units from 4,700 units, respectively, according to CBRE.

What’s behind this luxury housing boom?

Demand drivers

A growing economy and rising aspirations have spurred an increase in lifestyle investments, especially by HNIs and NRIs seeking stability amid global economic uncertainties, according to Anshuman Magazine, Chairman & CEO - India,

South-East Asia, Middle East

& Africa, CBRE.

In particular, “the rise in capital markets has influenced HNI buyers to invest in real estate, especially in the luxury segment,” adds Ritesh Mehta, Senior Director, Head - North, West & East, Residential Services, JLL.

Bhavik Bhandari, Chief Sales & Marketing Officer, Ashwin Sheth Group, believes the luxury housing boom has been fuelled by the post-pandemic shift in consumer behaviour, with homebuyers prioritising larger, functional homes complemented by green spaces for holistic living experiences. “NRIs and HNIs are drawn by India’s stable economy delivering stable returns, the depreciating rupee offering attractive returns, and the delivery of global-standard projects,” he says. “Regulatory changes such as deductions in long-term capital gains have surpassed expectations, even with the limit capped at `100 million under Union Budget 2023-24.”

“The exponential rise of HNIs and UHNIs and their desire for integrated living for offering a high quality of life has driven the need for contemporary, imaginative, luxurious homes,” according to Sandeep Ahuja, Managing Director, Atmosphere Living.

Among buyer categories opting for luxury housing close to employment hubs, with robust connectivity, enhanced infrastructure and superior social infrastructure, Magazine cites young high-income professionals, start-up founders and nuclear families. He believes the pause in the interest rate cycle,

as well as incentives and schemes offered by developers during

the last quarter of 2023, further bolstered sales.

Drivers by city

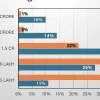

Delhi-NCR, Mumbai and Hyderabad have emerged as the top three luxury housing markets in the country, accounting for more than four-fifth of the luxury housing sales across the top seven cities.

“Delhi-NCR topped with a share of about 33 per cent,” says Mehta. “Mumbai, Hyderabad and Pune followed, accounting for approximately 31 per cent,

18 per cent and 4 per cent

of the market, respectively.”

According to Rohit Gupta, CEO, Mantra, Delhi-NCR, Mumbai, Hyderabad and Pune witnessed significant growth in luxury housing in 2023 compared to 2022, and Bhandari cites Mumbai, Delhi-NCR, Bengaluru and Pune as being

at the forefront of luxury

housing development.

While Mumbai’s luxury housing market is driven by the city’s population with deep pockets, “Pune’s real-estate market has consistently benefited from its proximity to Mumbai, perceived cost advantages and availability of land,” points out Ashish Dhami, EVP Sales and Marketing, K Raheja

Corp Homes. “Pune is a favoured market

for a cosmopolitan, globally exposed

aspirational audience.”

In Pune, Gupta points out that infrastructure improvements and the growing desire for a more luxurious lifestyle have spurred demand.

“Hyderabad is a preferred location for residential real-estate investment due to its strong growth prospects, appealing returns and ample space for developers to offer spacious homes combined with state-of-the-art amenities,”

adds Dhami.

Development challenges

Luxury projects are typically associated with significantly higher construction costs. “Securing appropriate financing and managing the project budget can present challenges,” opines Mehta. “High construction costs and land prices can make it difficult for developers to offer luxury properties at competitive prices,” adds Gupta.

Identifying an ideal location is another challenge, as is the meticulous planning and complexity that goes into balancing unique and luxury features with practicality and functionality to meet changing buyer preferences, continues Mehta. “Compliance and permit processes can be

time-consuming and complex, particularly for large-scale

luxury projects.”

“Permissions and regulatory procedures can pose a challenge at times due to convoluted approval processes,” agrees Ahuja.

“Timing the release of luxury projects to align with favourable market conditions can be difficult,” adds Mehta. “Effectively marketing and selling luxury properties requires targeted strategies, the right marketing channels, comprehensive marketing campaigns and access to a network of HNIs.”

“The fact that there is no one-size-fits-all approach to market luxury properties is another key challenge,” agrees Gupta. “Marketing strategies must be tailored per property and the

target audience.”

“Even after selling, providing exceptional customer services and managing the maintenance and operation of the extensive amenities of the properties can be more demanding compared to standard residential projects,” concludes Mehta.

Brand empowerment

What goes into a luxury property plays a vital role in giving it the ‘luxury’ tag – thus, the source of those materials, or the brands, matter.

“Brands play a pivotal role in elevating residences to the realm of luxury by infusing distinctive elements that enhance the overall living experience,” says Bhandari. “These collaborations span partnerships with hospitality brands for access to bespoke services, gourmet dining options and exclusive amenities; fashion houses for curated aesthetics and bespoke designs; luxury spa and wellness brands for state-of-the-art facilities; and tech brands for smart homes equipped with cutting-edge technologies (home automation systems, offering residents

seamless control over security, lighting, and entertainment).”

Gupta believes the luxury housing boom has pushed demand for eco-friendly products, especially paints and coatings, premium flooring products, better wood options and metal roofs.

Bhandari expects the trend of brand associations in luxury real estate to increase as developers recognise the value of these partnerships in distinguishing their projects and attracting a sophisticated clientele.

Indeed. “A study by the National Association of Realtors concluded that luxury homes with well-known and respected brands can fetch up to 7 per cent more than comparable non-branded homes,” says Gupta. “And a survey by Sotheby’s International Realty found that 88 per cent of luxury home buyers believed that a well-known brand associated with real estate had a positive effect on their perception of its value.”

Discerning buyers notice the fixtures, fittings, kitchen and bathroom accessories; so, yes, brands play a crucial role in luxury property, agrees Ashwin Chadha, CEO, India Sotheby’s International Realty. Here, he also counts the reputation of the developer and the architect. “Luxury projects by known brands like DLF, Prestige, Rustomjee, Brigade and Oberoi often sell out fast, reflecting buyer confidence. This trend is in line with global trends in gateway cities like Dubai, NYC, etc.”

Going forward, Abhishek Arora, Associate Director, Projects, Morphogenesis, expects various brand vendors to venture into the sector to capitalise on the rising affluence and discerning preferences of consumers seeking exclusivity, premium amenities and unique designs in their homes. “Entering the luxury housing

market will allow those brands to diversify, appeal to a wealthier demographic and potentially gain financial advantages in the margins,” he says.

Given the current footprint and increasing demand in the luxury housing segment, Arora says there is an elevated need for rare and unique materials and custom or handmade finishes that are also sustainable. “For material developers, collaborating with architects may result in innovative solutions and bespoke exclusive interiors. This, in turn, could lead to smart-home integration

and cutting-edge 3D printed technologies, among

other advancements.”

Good tidings

Typically, real-estate bull cycles span five to seven years, and all data points to India’s residential sector being at the beginning of this multiyear cycle, with expectations for sustained growth over the next three to five years, opines Chadha.

Bhandari expects robust economic growth, potential interest rate moderation and a continuous influx of new projects to fuel the ongoing boom, while Magazine predicts healthy traction in upcoming years, and Gupta expects international developers as well as more existing developers to enter the segment.

The more, the merrier!