Maharashtra's amnesty scheme to help unlock Rs 35k cr stuck loans

Jyoti Structures Commissions Galvanisation at Second Nashik Unit

Jyoti Structures has commissioned galvanisation operations at its second tower manufacturing unit in Nashik, strengthening its in-house capabilities across critical stages of power transmission infrastructure production. The listed Engineering, Procurement and Construction (EPC) company operates globally and has delivered projects for customers across more than 50 countries.The second Nashik unit, with an annual manufacturing capacity of 36,000 metric tonnes, has become operational following the completion of installation, testing and readiness of the new galvanising facilities. With this deve..

Rosatom Connects First Kursk NPP-2 Unit to National Grid

Rosatom has launched the first power unit of the Kursk Nuclear Power Plant-2 (Kursk NPP-2) into Russia’s Unified Energy System, marking a key milestone in the country’s nuclear energy programme. The initial grid connection took place at the end of the year, bringing a new source of low-carbon electricity online for the Kursk region and the broader Central Energy System.The newly commissioned unit is the first implementation of the VVER-TOI reactor design, which incorporates advanced safety and performance features. With an installed capacity of 1,250 MW, it is the most powerful nuclear pow..

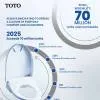

TOTO Crosses 70 Million WASHLET Sales as India Fuels Growth

TOTO has announced that global shipments of its WASHLET range have surpassed 70 million units, marking a major milestone in the brand’s more than four decades of innovation in bathroom hygiene and wellness. Headquartered in Japan, the company supplies WASHLET products across residential and public restroom applications in over 100 countries, with rising demand across the Americas, Europe and Asia.The milestone reflects a global shift toward higher standards of hygiene, comfort and wellness. While overall demand continues to grow worldwide, India has emerged as one of TOTO’s fastest-growing..