Bluebeam launches Task Link and mobile upgrades

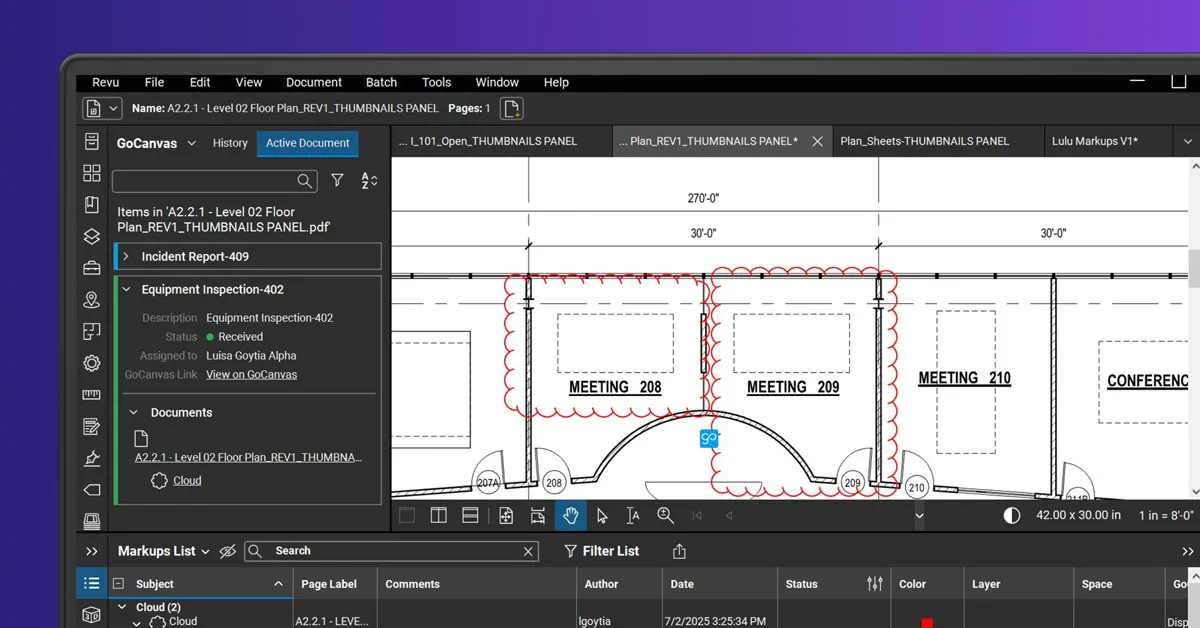

Bluebeam, part of the Nemetschek Group, has announced the launch of Task Link along with major upgrades to its iOS and Android applications, aimed at unifying office and field teams across construction projects.Task Link is described as a first-of-its-kind native integration between Bluebeam Revu and GoCanvas, enabling a connected workflow between planning and on-site execution. Through the integration, tasks can be pushed directly from Revu to the field, with real-time updates and automated notifications as work progresses. Field teams can capture verifiable on-site data using GoCanvas mobile..

Kumaraswamy Invites Envoys to Join Flagship Bharat Steel 2026

Union Minister for Steel and Heavy Industries, HD Kumaraswamy, held an interactive meeting with Ambassadors and diplomatic representatives of key partner countries, inviting them to actively participate in Bharat Steel 2026, the flagship international conference-cum-exhibition of the Ministry of Steel scheduled for April 2026.The meeting saw strong participation from representatives of countries that play a significant role in the global steel value chain. It formed part of the Ministry’s broader outreach efforts to deepen international cooperation and strengthen India’s engagement with ma..

Centre Clears Rs 8.87 Bn Plan for World-class Mumbai Marina

The Union Government has approved a Rs 8.87 billion proposal to develop a world-class marina at Mumbai Harbour, a move expected to significantly boost coastal shipping, maritime tourism and waterfront-led urban development in India’s financial capital.The proposed ‘Viksit Bharat Mumbai Marina’ has been cleared by the Ministry of Ports, Shipping and Waterways in line with the vision of Prime Minister Narendra Modi to create global-standard tourism destinations and strengthen the country’s maritime economy. The project is designed to open up Mumbai’s waterfront for public use while att..