We have always bid for our projects with a healthy EBITDA margin

Greater Noida Film City to Begin with Rs 1.5 Billion First Phase

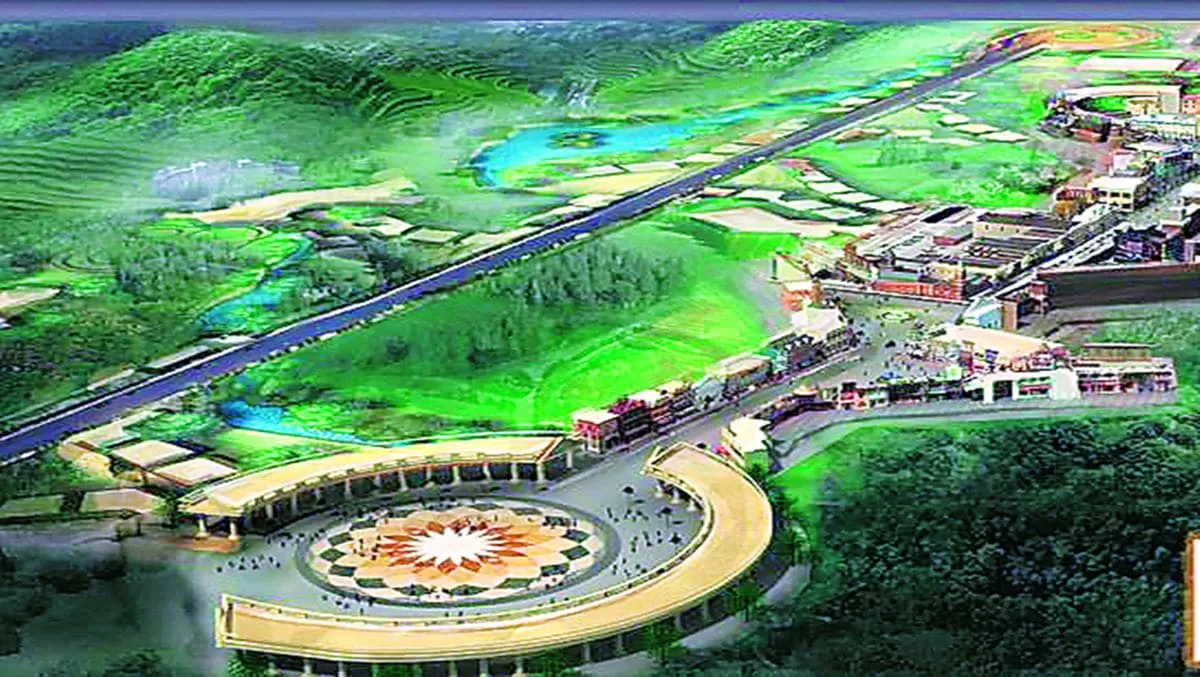

Greater Noida is set to host one of India’s most ambitious entertainment infrastructure projects with the upcoming International Film City in Sector 21, along the Yamuna Expressway. The Uttar Pradesh government, led by Chief Minister Yogi Adityanath, is expected to lay the foundation stone in late June, either in person or via video conference. While June 16 has been speculated, the final date is yet to be officially confirmed.The project is being developed by Bayview Bhutani Film City Pvt Ltd—a joint venture between filmmaker Boney Kapoor and the Bhutani Group—in collaboration with the ..

CCL to Add 2 New Mines, Boosting Output by 12 MT

Coal India subsidiary Central Coalfields Ltd (CCL) is set to commission two new coal mines in the 2025–26 financial year, aiming to enhance its annual production capacity by 10 to 12 million tonnes. The initiative is part of the company’s broader plan to exceed 110 million tonnes of coal production this fiscal and reach 150 million tonnes by 2030.“We have planned to open two new mines this year,” said Nilendu Kumar Singh, Chairman and Managing Director of CCL.Production at the Kotre Basantpur block, a coking coal mine with a peak rated capacity of 5 million tonnes per annum, is expecte..

India Cements Sells ICML Stake for Rs 980 Million

India Cements has announced the sale of its entire equity holding in Industrial Chemicals and Monomers Ltd (ICML) to Mirai Sensing Private Ltd for a consideration of Rs 980 million. The transaction was disclosed through a regulatory filing with the Bombay Stock Exchange.Following the completion of this sale, ICML will cease to be a subsidiary of India Cements, the filing confirmed.ICML, registered in Tirunelveli, Tamil Nadu, had earlier suspended operations. According to the company’s annual report for 2024, the business had become unviable due to reasons previously disclosed. The report fur..