R.Evolution Launches Eywa Way of Water on Dubai Water Canal

R.Evolution has unveiled Eywa Way of Water, a landmark waterfront residential development along the Dubai Water Canal, marking the second project in its Eywa Collection. Conceived as a holistic living ecosystem, the development seeks to redefine ultra-luxury living by integrating principles of well-being, longevity and regenerative design.Building on the philosophy established with the first Eywa project, Eywa Way of Water explores the relationship between architecture, nature, energy and human experience. Inspired by the rhythm and intelligence of the ocean, the project incorporates water, ai..

Liebherr Launches Power Deals 2026 With Financing and Discounts

Liebherr has kicked off 2026 with the launch of its “Power Deals” campaign, introducing three limited-period promotional offers aimed at supporting customers across the earthmoving and material handling segments. Available in selected markets through participating sales and service partners, the initiatives combine financing incentives, anniversary benefits and cost-saving maintenance solutions.As part of Power Deal 1, Liebherr is offering a financing subsidy on selected construction and material handling machines purchased in the first half of 2026. Customers can avail of an annual subsid..

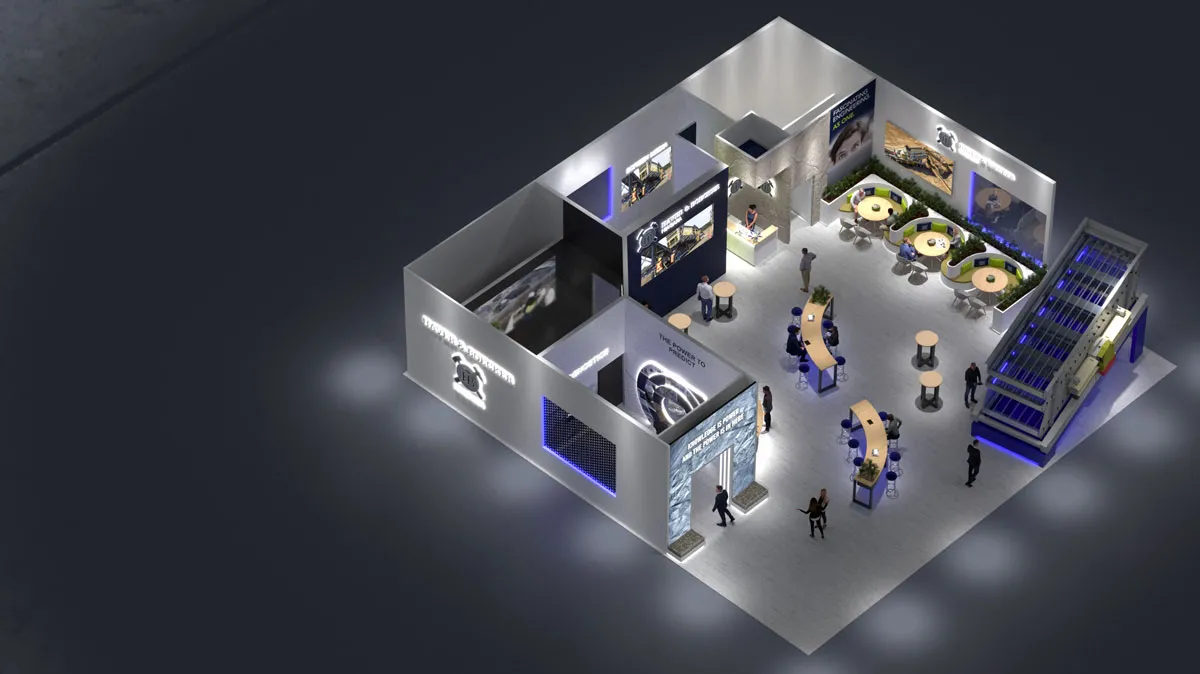

Haver & Boecker Niagara to Showcase Largest Booth at CONEXPO 2026

Haver & Boecker Niagara has announced that it will unveil its largest and most interactive exhibit to date at CONEXPO-CON/AGG 2026, scheduled to be held from March 3 to 7 in Las Vegas. The company’s expansive booth, located at C32616 in the Central Hall, has been designed as an immersive, museum-style experience offering visitors a comprehensive view of its latest mineral processing technologies.The exhibit will feature multiple themed rooms highlighting Haver & Boecker Niagara’s end-to-end solutions, including diagnostics, processing equipment, screen media, and aftermarket servic..