Pawan Hans disinvestment process in final lap: Centre

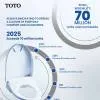

TOTO Crosses 70 Million WASHLET Sales as India Fuels Growth

TOTO has announced that global shipments of its WASHLET range have surpassed 70 million units, marking a major milestone in the brand’s more than four decades of innovation in bathroom hygiene and wellness. Headquartered in Japan, the company supplies WASHLET products across residential and public restroom applications in over 100 countries, with rising demand across the Americas, Europe and Asia.The milestone reflects a global shift toward higher standards of hygiene, comfort and wellness. While overall demand continues to grow worldwide, India has emerged as one of TOTO’s fastest-growing..

Hindustan Zinc, Silox India Boost Low-Carbon Manufacturing Push

Hindustan Zinc Limited and Silox India have strengthened their long-standing partnership with the adoption of Hindustan Zinc’s low-carbon zinc brand, EcoZen, across Silox India’s manufacturing operations. The move marks a key step in advancing low-carbon manufacturing practices and underlines the role of upstream material producers in enabling downstream decarbonisation across India’s industrial value chains.EcoZen is Asia’s first low-carbon zinc produced entirely using renewable energy and carries a verified carbon footprint of less than one tonne of CO₂ per tonne of zinc—around 7..

JK Tyre Earns EcoVadis Silver, Ranks Among Global Sustainability Leaders

JK Tyre & Industries has secured a Silver Rating from EcoVadis, placing the company among the top-performing organisations globally on sustainability parameters. With this recognition, JK Tyre ranks in the 93rd percentile worldwide, positioning it within the top 7 per cent of companies assessed across industries for environmental, social and governance (ESG) practices.EcoVadis evaluates companies on four core pillars—Environment, Labour & Human Rights, Ethics, and Sustainable Procurement—offering a comprehensive assessment of sustainability performance. JK Tyre’s Silver rating re..