Knight Frank India, a leading international property consultancy, in its latest half yearly report, India Warehousing Market Report, recorded a 42 per cent Y-o-Y surge in leasing volumes to 32.1 million square feet (mn sq ft) across the top eight1 markets. This sharp rise in demand was led by the manufacturing sector, which saw a 71 per cent Y-o-Y growth in space uptake, accounting for 45 per cent of the total transactions.

The report highlights the expanding role of India as a resilient, consumption-led, and manufacturing-driven economy whose industrial and warehousing market is benefiting from global trade realignments, government-led infrastructure and PLI investments. The increasing focus on higher grade facilities is also apparent Transaction volumes reflect this shift as 63 per cent of leased space was Grade A, up from 54 per cent a year ago.

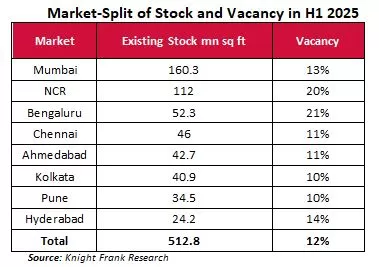

Pan-India stock exceeded 500 mn sq ft in H1 2025, with Grade A assets constituting 75 per cent of new supply; vacancy dropped from 13.1 per cent to 12.1 per cent as supply lagged demand.

Manufacturing sector strengthens dominance

The manufacturing sector emerged as the leading occupier during H1 2025, accounting for 45 per cent of all transactions, a significant leap from prior periods. The sector’s leasing volume reached 14.6 mn sq ft, up 71 per cent Y-o-Y in H1 2025. Notably, Mumbai and Pune together absorbed 44 per cent of this space, led by prominent companies such as SKS Fasteners, RenewSys India, Godrej & Boyce, and Lupin.

The shift of global supply chains, government support through PLI schemes, and India’s competitiveness in energy, chemicals, automotive, and heavy engineering has positioned the country as a viable manufacturing destination. Interestingly, warehouses are also increasingly being retrofitted to industrial specifications to capitalise on the upswing in manufacturing activity.

3PL, e-commerce also on upward curve

3PL firms absorbed 8.7 mn sq ft (27 per cent share), rising 30 per cent Y-o-Y, with Mumbai constituting 35 per cent of the sector’s transacted volumes followed by NCR, and Pune. E-commerce, while no longer the dominant sector, made a strong comeback with 3.3 mn sq ft, a 61 per cent increase over the previous year, now accounting for 10 per cent of all activity.

City-wise growth led by Mumbai, Pune, Chennai

Transaction volumes grew across all cities except Kolkata. Mumbai led with 7.5 mn sq ft, up 63 per cent Y-o-Y. Pune and Chennai registered 76 per cent and 135 per cent growth respectively, led by strong manufacturing uptake. Ahmedabad and Bengaluru also recorded notable expansion.

The Ahmedabad market reached a new half-yearly high of 3.6 mn sq ft, driven by manufacturing firms which took up 48 per cent of the area transacted. Similarly, Bengaluru also saw a 72 per cent Y-o-Y surge, with 65 per cent of leasing volume led by manufacturing sector occupiers—the highest share for the city since H1 2023.

Supply struggles to match demand: Grade A dominates

While the office market has almost reached the one billion sq ft mark, the warehousing and industrial market crossed 513 mn sq ft in H1 2025, with 26.9 mn sq ft becoming operational across the top eight markets. However, this trailed demand during the period, helped lower the pan-India vacancy to 12.1 per cent , from 13.1 per cent in H1 2024.

Grade A properties constituted 75 per cent of the new supply, reflecting developer response to occupier preference for high-specifications, ESG-aligned spaces. Grade A vacancy (12.9 per cent ) remained higher than Grade B (10.7 per cent ), due to speculative development in anticipation of demand.

Rents rise steadily across markets

All primary markets recorded a 3–5 per cent Y-o-Y rise in rental values, led by Mumbai at 4.7 per cent , Kolkata at 4.6 per cent , and Pune at 3.8 per cent . Healthy occupier traction and the rising demand for efficient, automated logistics parks with sustainability features has kept rent growth buoyant across markets.

Shishir Baijal, Chairman and Managing Director, Knight Frank India, said, “The healthy surge in the volumes transacted in the industrial and warehousing market reflects the depth of India's rapidly expanding manufacturing and consumption base. A 71 per cent Y-o-Y rise in manufacturing-led activity highlights the shift toward India as a preferred production hub amid global realignments. The evolving demand profile, backed by infrastructure build-up, policy stability, and rising investor interest in Grade A assets, signals a more mature and future-ready warehousing ecosystem. With supply trailing demand and vacancy at a low 12.1 per cent , this sector is now poised for another breakout phase. We expect sustained momentum as 3PL, e-commerce, and energy continue to drive expansion, and more institutional capital flows into industrial real estate.”

With India’s macroeconomic resilience, strong PMI, (Purchasing Managers’ Index) and improving global positioning, demand from the industrial and warehousing market is expected to sustain. The growth seen in H1 2025 signals a well-diversified and broad-based occupier demand, reducing reliance on any one sector. As businesses prioritize supply chain efficiency and cost control, Grade A, ESG-compliant assets should continue to dominate future demand.