Kabelschlepp India Installs Robotic VMC in Bengaluru

Kabelschlepp India, part of the Tsubaki Group, has installed a state-of-the-art Vertical Machining Center (VMC) integrated with robotic automation at its Bengaluru facility. The inauguration was held in the presence of Henning Preis, President & CEO, Kabelschlepp Group, Jörg Schulz, Vice President – Production, and Srinivas P. Kamisetty, Managing Director, Kabelschlepp India.The high-precision CNC VMC is designed for advanced milling, drilling, tapping and multi-axis machining. Equipped with a vertical spindle orientation, automatic tool changer and intelligent CNC control system, it en..

Highway Delivery Reset!

Project delays and inefficiencies continue to bedevil the progress of India’s National Highways network. A multi-pronged reform agenda is needed to inject greater transparency and accountability at every stage – from planning and procurement to execution, maintenance and oversight. This article offers key recommendations and reform strategies that government stakeholders – from the Ministry of Road Transport & Highways (MoRTH) and the National Highways Authority of India (NHAI) to state agencies and oversight bodies – should pursue to put highway development on a better track.Decen..

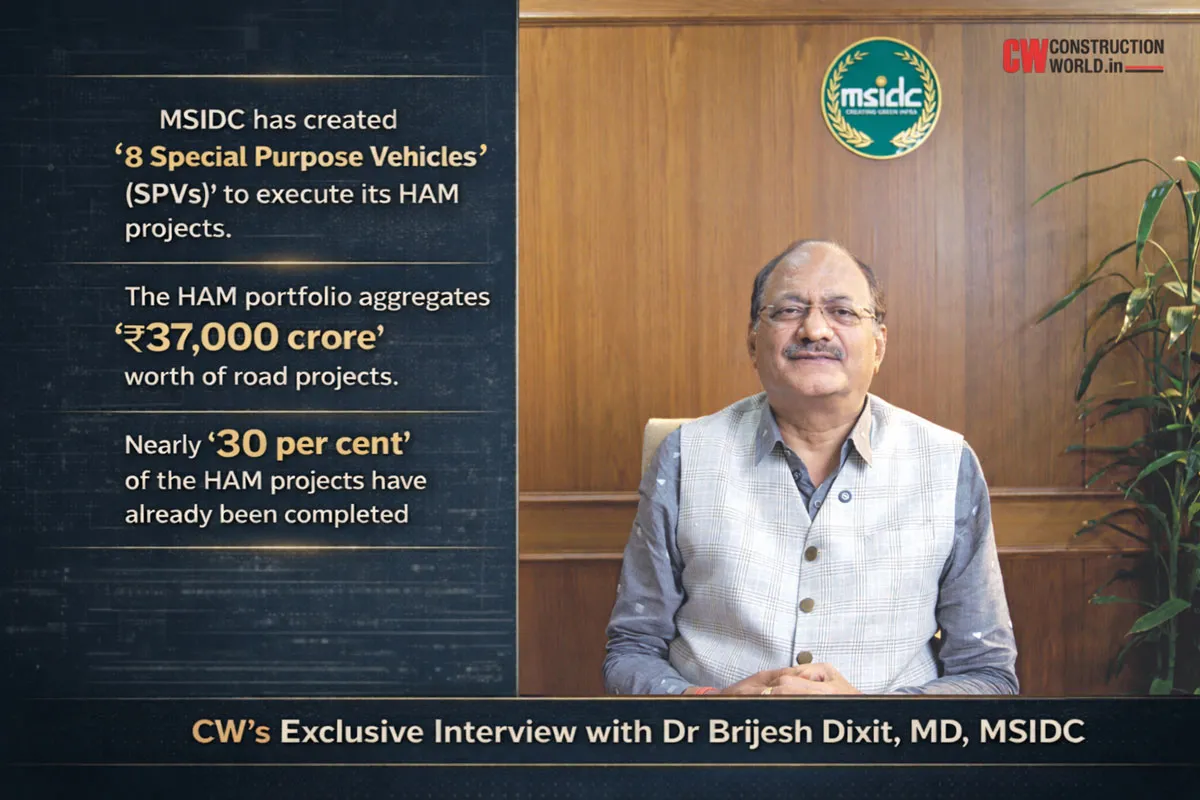

MSIDC Executes ₹37,000 Crore Road Programme

With Rs 37,000 crore worth of road projects under execution across Maharashtra, Maharashtra State Infrastructure Development Corporation (MSIDC) is driving one of the state’s largest infrastructure programmes. Dr Brijesh Dixit, Managing Director, discusses the institutional reforms, execution frameworks, financing strategies and technology adoption enabling timely, high-quality delivery, in conversation with PRATAP PADODE, Editor-in-Chief, CW.With over Rs 37,000 crore worth of road projects underway across districts – many under tight timelines – what institutional and executio..