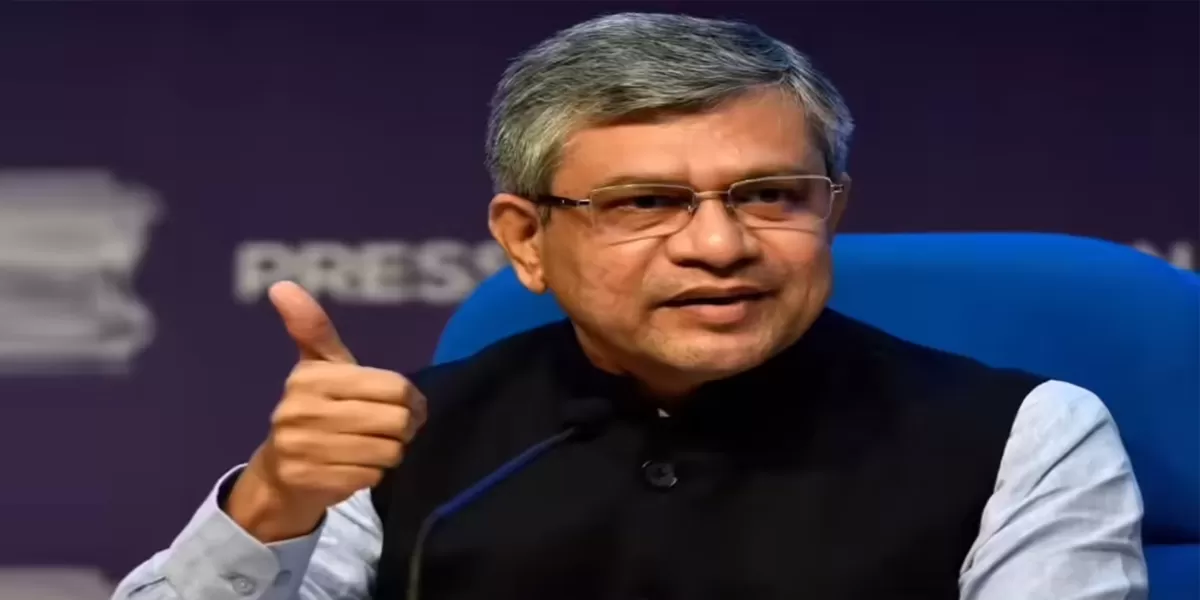

- Shrikant Joshi, Chief Executive, L&T Realty

Larsen & Toubro (L&T), the $14.3-billion engineering-construction-manufacturing-financial services global giant and India´s largest construction organisation, does not need any introduction. And it is no surprise that L&T Realty - a 100-per cent subsidiary - has followed fast in the illustrious footsteps of its parent organisation in a span of just three years after establishment. In fact, L&T Realty made a successful foray into residential complexes in 2012, when it sold 400 apartments in Parel, Mumbai, within four days of the launch. For Shrikant Joshi, Chief Executive, L&T Realty, venturing into the realty sector was ¨a logical extension¨. Here, Joshi shares his perspectives on the journey, his wishlist for the sector, and much more, with CW. Edited excerpts...

What inspired L&T to venture into the realty sector? How has the journey been?

Over the past decade or so, the real estate business is gradually becoming corporatised. Most large corporate houses have entered the sector, which has tremendous growth opportunities. For L&T, with capabilities in construction and project execution and great brand equity of excellence and trust, it was a logical extension. Our journey so far has been great. In just three years, we have significantly ramped up operations and would qualify as one of the large companies in the sector. During this period we have launched a couple of large projects and are currently committed to the development of 36 million sq ft of real estate across four different cities.

What are the current challenges faced by the corporate sector venturing into the real estate space? How have you successfully overcome the same?

The challenges remain common to all. The multiplicity of approvals and their timelines are definitely a challenge. As a business, we ensure that we start projects only after all approvals are received. We are also selective in choosing partners with similar values and capabilities. While we have been able to handle the challenges, we would like the process to be time-bound. For making funds available to the sector, the cap in the investment limits of banks should be increased. The Government should also take steps to liberalise polices so that foreign capital can come in at any stage of the development of projects, especially for the retail and commercial segments.

L&T had opted to put up some of its real-estate assets on the block in 2013. What was the strategy behind this and how did it pan out?

For any real estate business, financial churning is part of the process. After developing the projects, monetisation is required for efficient capital utilisation. Some investments made in the past need to be sold now as part of our business plan to monetise those investments. We constantly review the portfolio and exit non-core investments depending on various commercial factors.

What is your area of specialisation? Also, what is the per-sq-ft development cost of your projects?

Currently, it is definitely residential development, which offers great demand and value proposition. We have launched two residential projects in Mumbai and one in Chennai. There are a couple of more projects in the pipeline, which we plan to launch in the near future. Development cost varies based on the type of project, specifications and location. On an average, the sale price last year was Rs 14,033 per sq ft.

The real estate sector has been demanding industry status. How challenging has it been for you to grow and execute projects at the policy level?

Industry status will help the sector further organise and can bring structural changes. For L&T Realty, funding is not an issue. The challenge faced by us is the time taken for approvals, which is common to the industry. However, we launch projects only after approvals are in place to mitigate the environment risk to the project. Commercial and retail have excess supply at present. The Government should take policy measures so that real estate companies can unlock their investments quickly. Now, Real Estate Investment Trusts (REITs), if implemented properly would be a game changer for the real estate sector in India. All over the world, REITs contribute significantly towards development of commercial real estate. It also creates a secondary market for interest-bearing properties and provides investment opportunities to small investors in the realty sector.

Nearly Rs 100,000 crore of private equity funds have been locked in the real estate sector, leading to project delays. How has this affected the industry´s operations?

Most players in real estate are facing a stretched balance sheet owing to slow sales offtake and limited source of funding. Private equity (PE) players will start seeing exit once projects start delivery. PE players should start active engagement with developers to get projects delivered. Now, the situation is changing and with a pickup in the economy in the next few quarters, offtake of the inventory will facilitate exit of PE funds from existing projects.

With the new Government in place, what is your wishlist for the sector?

We have the following expectations:

- Industry status to real estate.

- Single-window and time-bound approval process.

- Promotion of ´walk-to-work´ policy through incentivisation of transit-oriented developments.

- Implementation of REIT legislation to facilitate monetisation of assets created by developers.

- Tax benefits for individual investments to be enhanced on the interest payment.

- FDI liberalisation for investments at any stage of projects.

- Tax breaks for affordable housing to make it a viable option for the developers.

Fact Sheet

Year of establishment: 2012

USP: Building landmarks of excellence

Centres of operation: Mumbai, Chennai, Chandigarh

Ongoing projects: Crescent Bay, Mumbai: 2.7 million sq ft of development; Emerald Isle, Mumbai: 2.75 million sq ft of development; Eden Park intergrated township, Chennai: Spread over 90 acre; Seawood Grand Centre, Navi Mumbai: India´s largest transit oriented development

Awards received in 2014: 6th Estate Award for Residential Project of the Year to Crescent Bay, Lokmat National Real Estate Award for Residential Project of the Year to Emerald Isle, ABP Real Estate Award for Professional Excellence in Real Estate, ABP Real Estate Award for Developer of the Year - Commercial, ABP Real Estate Award for Best Use of Technology to Pragati Parel