Of 36,260 units launched in Q2 2021 in the top 7 cities, the premium segment (priced b/w INR 80 lakh to INR 1.5 Cr) had the highest share (approx. 13,130 units); mid-segment (INR 40-80 lakh) had a 32% share (nearly 11,760 units)

Hyderabad, Bengaluru & Chennai together comprised a 72% share of total new premium supply in the second quarter

Covid-19 dents affordable housing supply share - reduced to 20% (approx. 7,230 units) as of Q2 2021

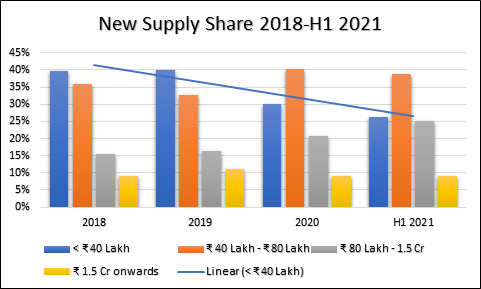

In the pre-COVID-19 period, affordable housing supply share dominated; post-pandemic, share drops dramatically from 40% in 2019 to 30% in 2020 - at 20% in Q2 2021

Developers strategically following trends - buyers of affordable homes most affected economically by COVID-19; high unsold affordable housing stock another concern at 33% of total 6.54 lakh unsold units in top 7 cities by Q2 2021-end

The pandemic has significantly altered previously dominant trends in the Indian residential market. Notably, it has dented the overall new affordable housing supply share across the top 7 cities. Latest ANAROCK research indicates that out of the total new launches of approx. 36,260 units across the top 7 cities in Q2 2021, the affordable segment (priced

Anuj Puri, Chairman, ANAROCK Property Consultants, says, “The premium segment (priced between INR 80 lakh to INR 1.5 Cr) had the highest launch share of 36% (approx. 13,130 units), followed closely by the mid-segment with a 32% share (approx. 11,760 units).”

“The main Southern cities of Hyderabad, Bengaluru and Chennai together accounted for at least 72% of the total new premium supply in the second quarter. Prominent realty hotspots NCR and MMR had the highest share of affordable housing supply at 52% of a total of 7,230 units launched in this category.”

The new launch trends in both the pre and post COVID-19 periods across the top 7 cities indicate that the new affordable supply share has been reducing post the pandemic.

In 2018, out of approx 1.95 lakh units launched in the top 7 cities, affordable housing had the highest share at 40%, followed by 36% in the INR 40-80 lakh budget category and 16% in the premium segment.

Likewise, of the total 2.37 lakh units launched in 2019, the affordable segment accounted for a 40% share, followed by the mid-segment with a 33% share and the premium category with a 16% share.

However, in 2020, of the total 1.28 lakh units launched in the top 7 cities, the affordable segment’s share reduced to 30%. The mid-segment had the highest share in 2020 at 40%, while the premium category saw its share increase to 21%. The dramatic drop in affordable housing's new launch share was profound from Q2 2020 onwards – the period since the pandemic.

In H1 2021, affordable housing's share of new launches dropped further to approx. 26% of 98,380 units launched between January and June. The mid-segment had the highest share at 39% while the premium housing segment had a 25% share. Further quarterly trend analysis reveals that in Q1 2021, the affordable housing supply share was at 30% while in Q2 2021 it dropped to just 20%.

Factors Impacting Affordable Housing Supply

Notwithstanding the incumbent government’s continued focus on affordable housing, private players have changed their strategy on the back of the new pandemic realities. Various factors could be responsible for the drop in affordable housing's supply share drop:

Abundant new affordable supply was launched in the top 7 cities after the government began incentivizing this segment post-2014 to back the ‘Housing for all by 2022’ scheme. Demand for affordable housing remains high, but there is now a pileup of unsold stock across cities. As per ANAROCK data, of a total of 6.54 lakh unsold units in the top 7 cities as of Q2 2021-end, the affordable segment has the highest share at 33%.

The target audience of the affordable segment (many employed in MSMEs) has been severely impacted by the pandemic in contrast to premium and luxury category buyers. Many affordable housing buyers have had to defer purchase decisions.

Affordable housing developers' profit margins are wafer-thin. Amid rising inflationary trends of basic input costs (cement, steel, labour, etc.), it has become difficult for them to launch budget homes since increasing prices in this highly cost-sensitive segment is inadvisable at this time. Also, overall sales volumes have declined in the last one year because of the pandemic.

Home loan eligibility for many affordable housing buyers has been impacted by the pandemic due to loss of jobs and many MSMEs being shut down - resulting in significantly lower sales in this category.

Source: ANAROCK Research