Radiance Renewables Raises Rs 100 mn to Fuel Expansion

Hafele Begins Local Manufacturing in Maharashtra

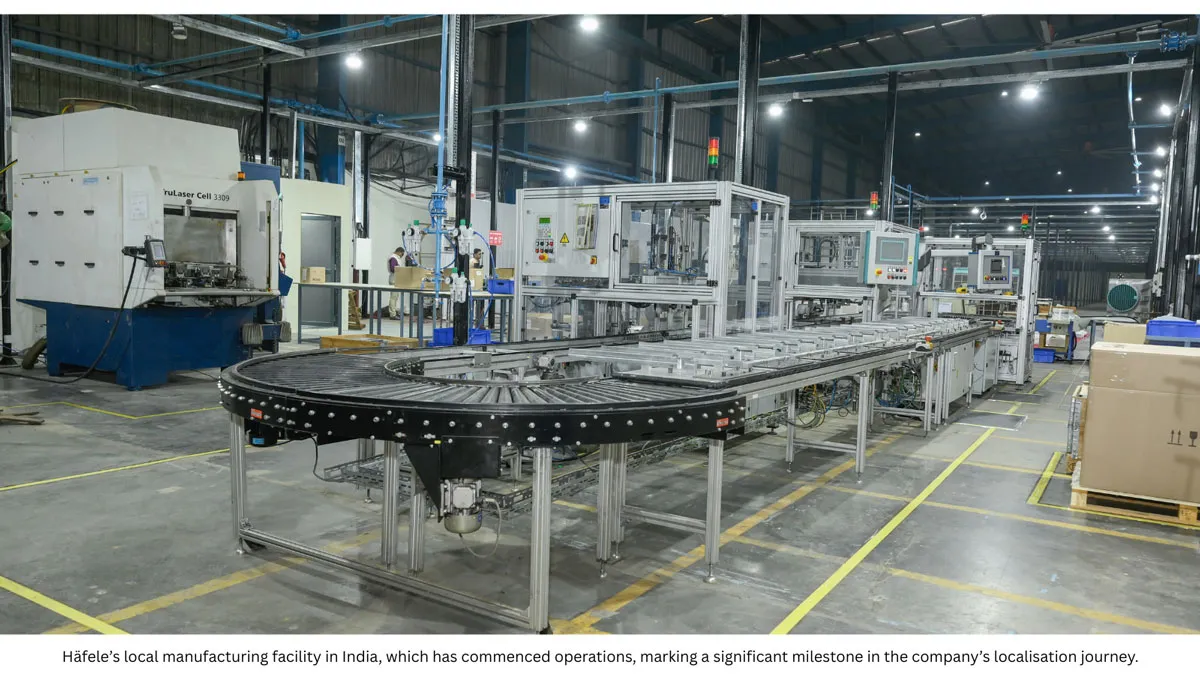

Hafele recently commenced operations at a new local production facility in Maharashtra, marking a significant step in the company’s long-term localisation strategy and reinforcing its commitment to the Government of India’s ‘Make in India’ initiative. The development is aimed at building a future-ready manufacturing ecosystem in the country while enabling local value creation and scalable operations.The India production initiative builds on Hafele’s established global manufacturing and supply chain network, which includes production facilities across Europe. By expanding manufacturin..

Jyoti Structures Commissions 400 kV Line in Karnataka

Jyoti Structures Limited (JSL), an engineering, procurement and construction company specialising in power transmission infrastructure, recently announced the commissioning of the 400 kV Gadag–II Transmission Line project for ReNew Power in Karnataka.The project comprises 100 circuit kilometres (CKM) of twin HTLS transmission lines connecting Gadag Power Station and Koppal Power Station. The line passes through the districts of Gadag and Koppal, where the project team addressed challenging terrain, right-of-way constraints and difficult soil conditions, including stretches of black cotton so..

Lingong Group Debuts Electric Equipment at CONEXPO 2026

Lingong Group recently presented its latest electric and intelligent equipment at CONEXPO-CON/AGG 2026, marking the company’s global debut as a consolidated brand. The event, held from March 3–7 at the Las Vegas Convention Center, featured core subsidiaries Shandong Lingong Construction Machinery (SDLG) and Lingong Heavy Machinery (LGMG), along with multiple product launches and the introduction of LGMG’s global service brand, LGMG ProCare.At the exhibition, Lingong Group showcased new product lines across loaders, aerial work platforms and industrial vehicles. Several models incorporate..