Certus Capital Pledges Rs.4 Bn Investment in Three Indian Real Estate Ventures

Hafele India marks second year of L.I.F.E initiative

Häfele India has entered the second year of its L.I.F.E – Ladies in Furniture Ecosystem initiative, reinforcing its commitment to empowering women professionals across India’s furniture, design and manufacturing sectors.Launched as a first-of-its-kind industry platform, L.I.F.E was conceived to build a supportive community for women in a traditionally male-dominated ecosystem. In its second year, the initiative is expanding its scope through deeper learning opportunities, stronger professional networks and increased collaboration among women entrepreneurs, designers, architects and manufa..

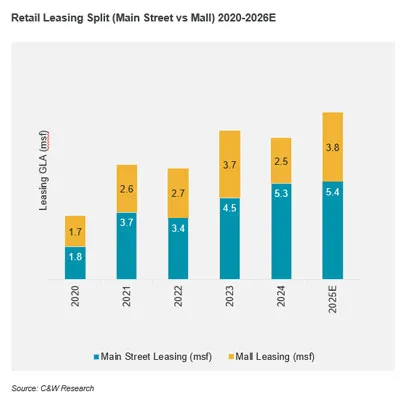

Retail leasing set to hit record ~9 MSF in 2025: Cushman & Wakefield

India’s retail real estate market is expected to close 2025 with a record ~9 million sq ft (MSF) of leasing—the highest annual absorption since the pandemic—up from ~7.8 MSF in 2024, as per news reports citing Cushman & Wakefield’s India Outlook 2026.The sharp year-end surge reflects a decisive return of mall-led absorption as new Grade A supply becomes operational in key markets during Q4. While high streets continue to record healthy traction, leasing that was earlier delayed due to limited availability of quality mall space is now being executed in newly completed assets. Fashio..

MIC Electronics gets Rs 10.5 million variation order from Central Railway

MIC Electronics has received a variation order worth approximately Rs 10.5 million from the Nagpur Division of Central Railway, expanding the scope of its ongoing passenger information and telecom infrastructure project under the Amrit Bharat Scheme. With this addition, the total contract value has been revised to Rs 94.2 million, up from the original Rs 83.7 million.The variation forms part of an existing contract awarded to MIC Electronics for the supply, installation, testing and commissioning of telecom assets and passenger amenities across seven stations in the Nagpur Division. The projec..