Chinese cities lift home buying restrictions to boost economy

Centre Boosts FPO Growth With New Credit And Market Support

The Government is implementing the Central Sector Scheme on the formation and promotion of 10,000 Farmer Producer Organisations (FPOs), under which all 10,000 FPOs have now been registered. The scheme provides Rs 1.8 million per FPO for three years as management support, a matching equity grant of up to Rs 1.5 million, and a credit guarantee of up to Rs 0.02 billion through eligible lending institutions. It also offers assistance for training, market linkages and alignment with other schemes. FPOs receive support to obtain input licences for seed, fertiliser and pesticide supplies, as well as..

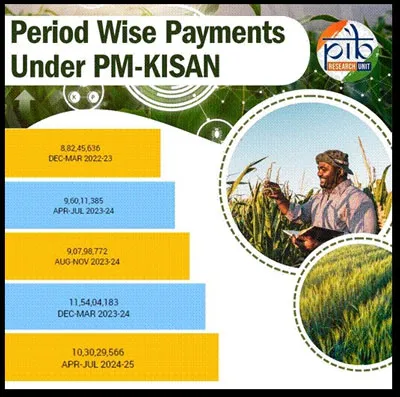

PM-KISAN Drives Farm Income Gains And Rural Stability

The PM-KISAN scheme, a central sector initiative launched in February 2019, aims to support the financial needs of farmers holding cultivable land. Under the scheme, Rs 6,000 per year is transferred in three equal instalments to Aadhaar-seeded bank accounts through Direct Benefit Transfer. Eligibility is based primarily on cultivable landholding, with certain exclusions for individuals of higher economic status. A farmer-centric digital infrastructure ensures scheme benefits reach farmers across India without intermediaries. With full transparency in registration and verification, the Governm..

Govt Extends Pro Tem Security Certificate To Two Years

In a further push to improve ease of doing business and ensure continuity for the telecom industry, the National Centre for Communication Security (NCCS) under the Department of Telecommunications has extended the validity of the Pro Tem Security Certification from six months to two years. The Pro Tem Certification, initially launched in October 2024 with a six-month validity, was designed to prevent business disruption for IP Router and Wi-Fi CPE products, which became subject to mandatory security certification from 1 October 2024. Under this certification, OEMs submit a declaration confirm..