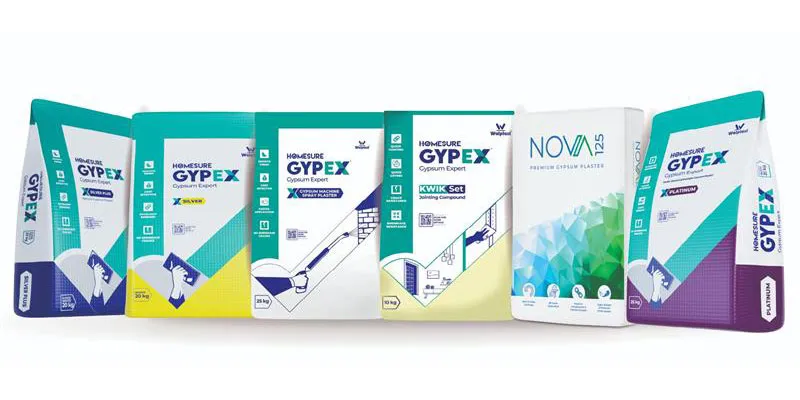

Walplast’s GypEx Range Secures GreenPro Certification

Walplast Products has received GreenPro Ecolabel certification from the CII-Green Products and Services Council for six products under its HomeSure GypEx gypsum plaster portfolio. The certification, valid until December 2027, recognises the products as Green Products in line with established sustainability standards.The certified products include HomeSure GypEx Machine Spray Plaster, HomeSure GypEx Silver Plus Plaster, HomeSure GypEx Silver Plaster, HomeSure GypEx Platinum Plaster, Nova 125 Premium Gypsum Plaster and HomeSure GypEx Kwik Set (Jointing Compound). All are manufactured at the comp..

Southco Launches N5 Lift-and-Turn Latch

Southco has introduced the N5 Lift-and-Turn Compression Latch, featuring a folding T-handle and integrated sealing performance within a compact hardware design.The N5 latch is engineered for ergonomic operation in demanding environments. Its folding T-handle allows for easy grip and actuation, including with gloved hands, and folds into the housing when not in use to maintain a low-profile appearance and reduce catch points. The overall design minimises panel footprint and enclosure intrusion, enabling efficient use of internal and surface space.Despite its compact configuration, the latch is ..

Adani Cement, NAREDCO Form Strategic Alliance

Adani Cement has entered into a strategic partnership with the National Real Estate Development Council (NAREDCO) to support India’s expanding housing and infrastructure requirements aligned with the vision of Viksit Bharat 2047.The collaboration brings together Adani Cement’s building materials portfolio, research capabilities and technical expertise with NAREDCO’s network of over 15,000 member organisations. The partnership will focus on skill development, knowledge exchange, technology adoption and sustainable construction practices across the real estate ecosystem.Joint initiatives w..