Signature Global reports 47% surge in Q3 sales, eyes Rs 45 bn for FY23

Tata, Airbus to Build India’s First Private Helicopter Line

In a landmark development for India’s aerospace sector, Tata Advanced Systems Limited (TASL) and Airbus will establish the country’s first private-sector helicopter assembly line in Vemagal, Karnataka. The facility will manufacture the Airbus H125 and H125M, marking a significant milestone in India’s push for self-reliance in aviation and defence manufacturing. The new Final Assembly Line (FAL) will produce the H125, the world’s best-selling single-engine helicopter, known for its versatility and performance in extreme environments. The first ‘Made in India’ H125 is expected to ro..

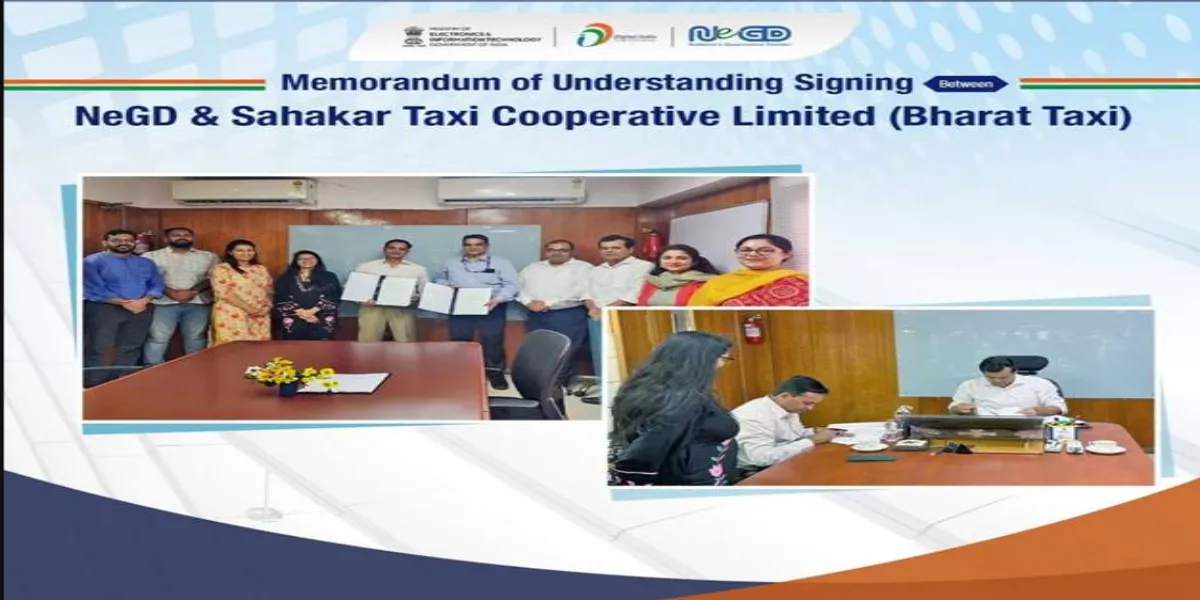

NeGD to Support Bharat Taxi in Building Cooperative Ride Platform

In a significant move for India’s digital and mobility transformation, the National e-Governance Division (NeGD) of the Digital India Corporation, under the Ministry of Electronics and Information Technology (MeitY), has entered into an advisory partnership with Sahakar Taxi Cooperative Limited, the company behind Bharat Taxi — a first-of-its-kind, cooperative-led national ride-hailing platform. A Memorandum of Understanding (MoU) has been signed between NeGD and Sahakar Taxi to provide strategic advisory and technical support covering key areas such as platform integration, cybersecurity..

MeitY Hosts Pre-Summit for India–AI Impact Summit 2026

The Ministry of Electronics and Information Technology (MeitY), Government of India, hosted a series of Pre-Summit events for the upcoming India–AI Impact Summit 2026 at the India Mobile Congress (IMC) 2025 in New Delhi. These sessions mark a key milestone ahead of the main summit, scheduled for 19–20 February 2026 at Bharat Mandapam, New Delhi. Delivering the inaugural address, S. Krishnan, Secretary, MeitY, highlighted India’s innovative and frugal approach to AI development. “We have adopted innovative means by learning from others’ experiences to build projects and products that..