Mount Expands Tumkur Facility with New Automated Panel, PEB Lines

Mount Roofing & Structures Private Limited, one of India's fastest-growing manufacturers in PUF and a leading solutions provider across pre-engineered building (PEB) and polycarbonate sheets, simultaneously inaugurated its second fully automated continuous sandwich panel manufacturing line and a new PEB manufacturing plant at its integrated campus in Tumkur.The milestone expansion, part of a total investment of Rs 250 crore, marks a significant advancement in the company's commitment to engineered performance, manufacturing scale, and industrial growth. The integrated facility spans approx..

India Becomes First to Produce Bio-Bitumen for Roads

India has become the first country in the world to commercially produce bio-bitumen for use in road construction, according to Road, Transport and Highways Minister Nitin Gadkari. Bitumen, a black and viscous hydrocarbon derived from crude oil, is a key binding material in road building, and the bio-based alternative is expected to significantly improve the sector’s environmental footprint.Addressing the CSIR Technology Transfer Ceremony in New Delhi, Mr Gadkari congratulated Council of Scientific and Industrial Research on achieving the milestone, noting that the initiative would help curb ..

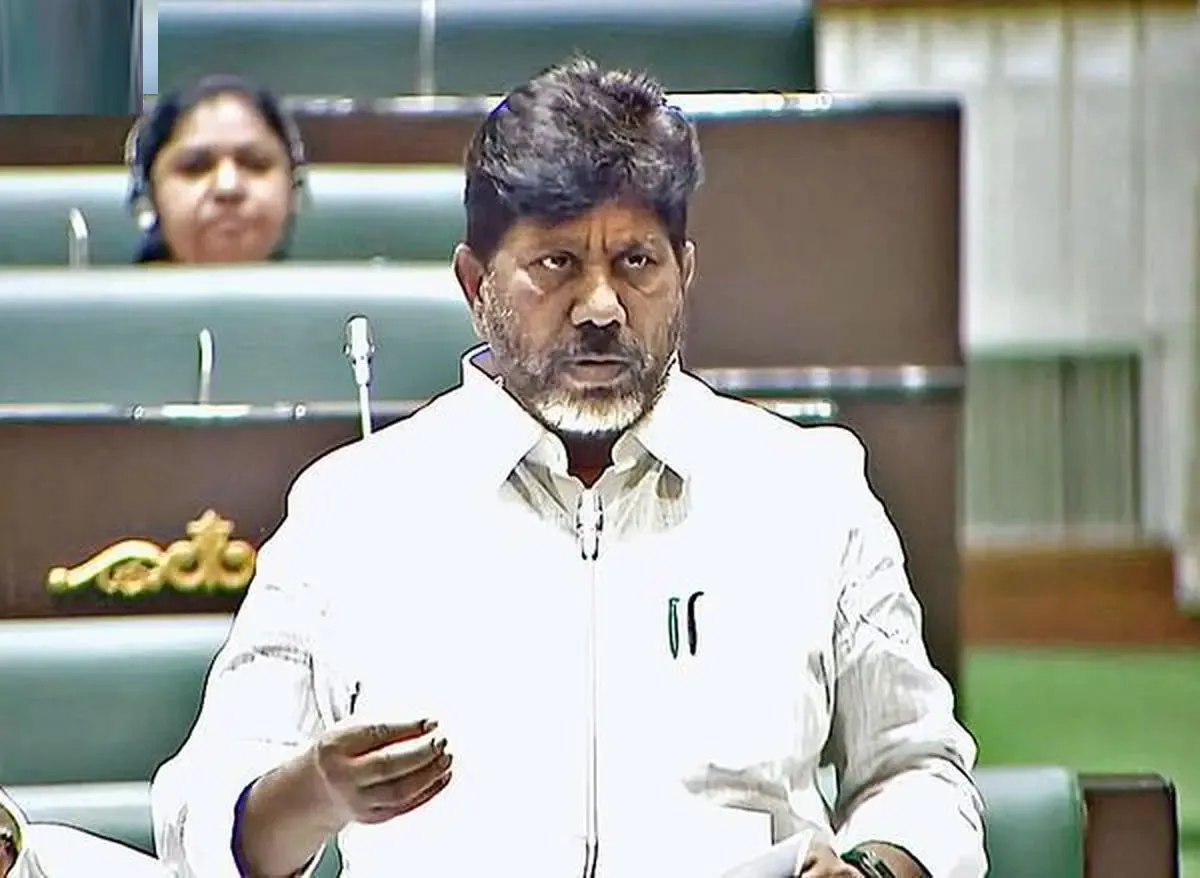

HILT Policy Seen Boosting Telangana Revenue Sharply

The Hyderabad Industrial Land Transformation (HILT) Policy is expected to generate around Rs 1.08 billion in revenue for the Telangana state exchequer, according to Deputy Chief Minister Bhatti Vikramarka Mallu. Speaking in the Telangana Legislative Assembly, he said the policy would be implemented within a six-month timeframe in a transparent manner, with uniform rules applicable to all stakeholders. Mr Vikramarka noted that without the HILT Policy, the state would have earned only about Rs 1.2 million per acre. Under the new framework, however, revenue is projected to rise sharply to Rs 70 ..