PE companies to raise Rs 20,000 cr for affordable residential projects

Railways Boosts Cyber Security And Fairness In Ticket Bookings

Indian Railways has said its reservation ticketing system is a robust and highly secure IT platform equipped with state-of-the-art cyber security measures. The national transporter has introduced several initiatives to enhance system performance and improve access to regular and tatkal tickets. A key step has been the large-scale revalidation and verification of user accounts. Since January 2025, around 30.2 million suspicious user IDs have been deactivated. Anti-bot tools such as Akamai have been deployed to filter non-genuine users, ensuring smoother booking for legitimate passengers. To c..

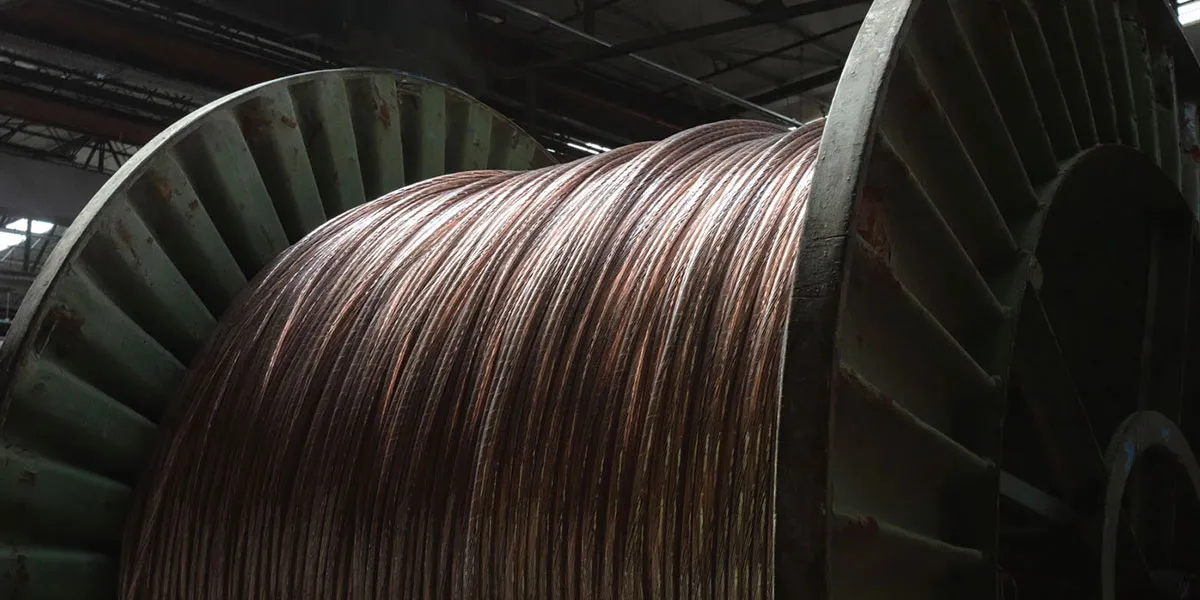

Indian Railways Speeds Up Green Transition With Wider Electrification

Indian Railways is accelerating its modernisation drive by upgrading infrastructure and rolling stock with advanced technologies aimed at enhancing safety, punctuality, reliability and passenger comfort. A major focus of this effort is the transition to cleaner traction systems, with a significant reduction in the use of coal-based and diesel engines. Electrification has been taken up in mission mode. As of now, 99.2 per cent of the Broad Gauge (BG) network has been electrified, with the remaining routes under execution. During 2014–25, Railways electrified 46,900 route kilometres, compared..

Centre Strengthens Cybersecurity Framework Across India’s Power Sector

The POWERGRID Centre of Excellence (CoE) in Cybersecurity has been established at the Indian Institute of Science (IISc), Bengaluru to advance research and development in cybersecurity for power grid operations and transmission systems. The initiative is part of India’s broader effort to build a resilient and secure power ecosystem. To strengthen cyber readiness across the sector, the Central Electricity Authority (CEA) issued the Cyber Security in Power Sector Guidelines, 2021, creating a comprehensive cyber assurance framework and governance structure for all power entities. Further, the ..